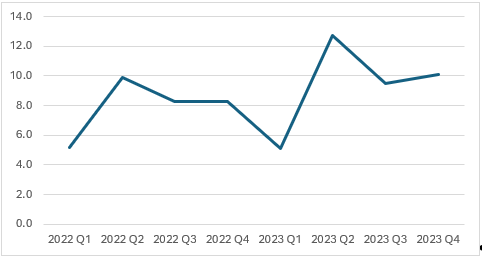

Now could be the time to cash in on your cash holdings; that’s the view from the team at Magnus. We gave the same message last year (see “don’t miss out”), but judging on the spike in UK domestic savings rates (chart below), it’s perhaps fair to say that our cries were ignored! Here goes with one more spirited effort. UK Household Savings rates have spiked in the last 2 years:

Source: ONS

Source: ONS

We generally remain very positive on the outlook for financial markets, which should come as welcome news for those of you who are rolling off 1-year cash products and thinking about the next move. Furthermore, we’d note that the bond markets appear to be pricing in 2 interest rate cuts over the course of the next 12 months, which will pressure cash rates lower.

Our message is two-fold and very simple:

- If you’ve got excess cash – consider getting it invested!

- Look to stay invested!

Why get invested?

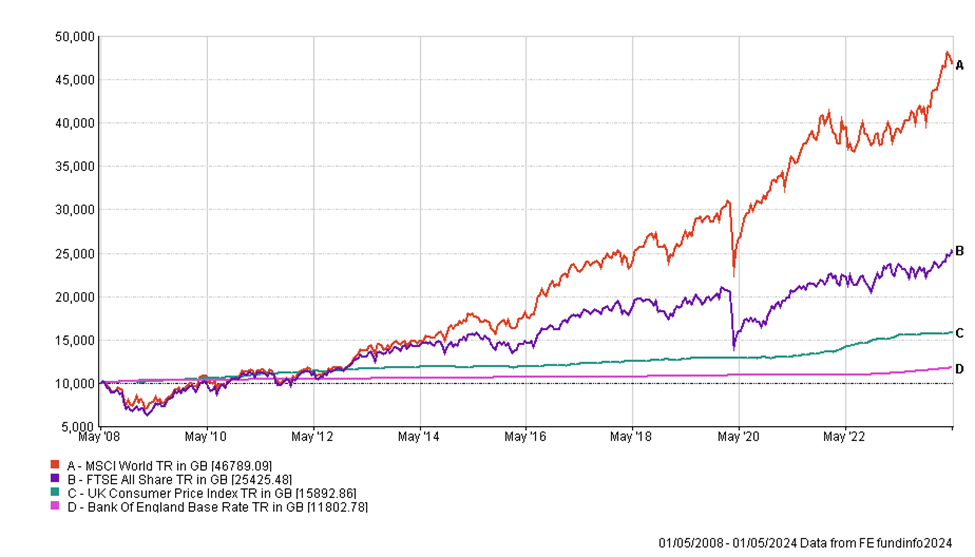

Cash is not always king! Despite the high(ish) rates on offer, financial assets tend to outperform cash over the longer-term. This was the case last year, but has also been the case over longer time periods: see chart below:

Past performance is not a guide to the future and may not be repeated. Source: FE Analytics

This chart shows the 15-year period from 2008 (when cash rates were 5%) and shows that cash returned less than inflation and a lot less than other financial assets: such as equities and bonds.

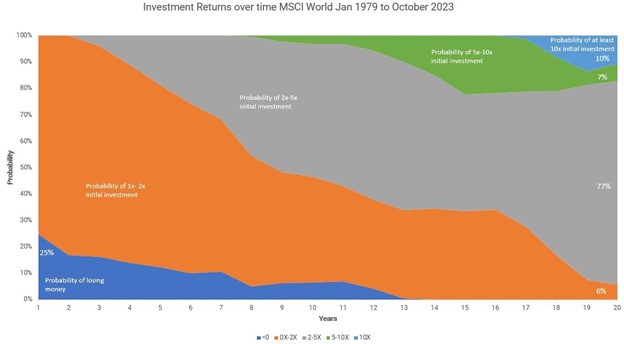

Sadly, investing is not always a smooth ride, especially when investing over a shorter period. However, the longer you remain invested the greater the chance of growing your money and the least chance you have of losing money. This brings us on to our next point: look to stay invested!

2 charts on this point. The first shows that the longer you’re invested, the greater the likelihood of growing your wealth (quite significantly over long time periods). The second highlights the fact that you shouldn’t look to make heroic jumps in and out of the market: doing so can be VERY costly!!

Source: MSCI, Magnus

Source: MSCI, Magnus

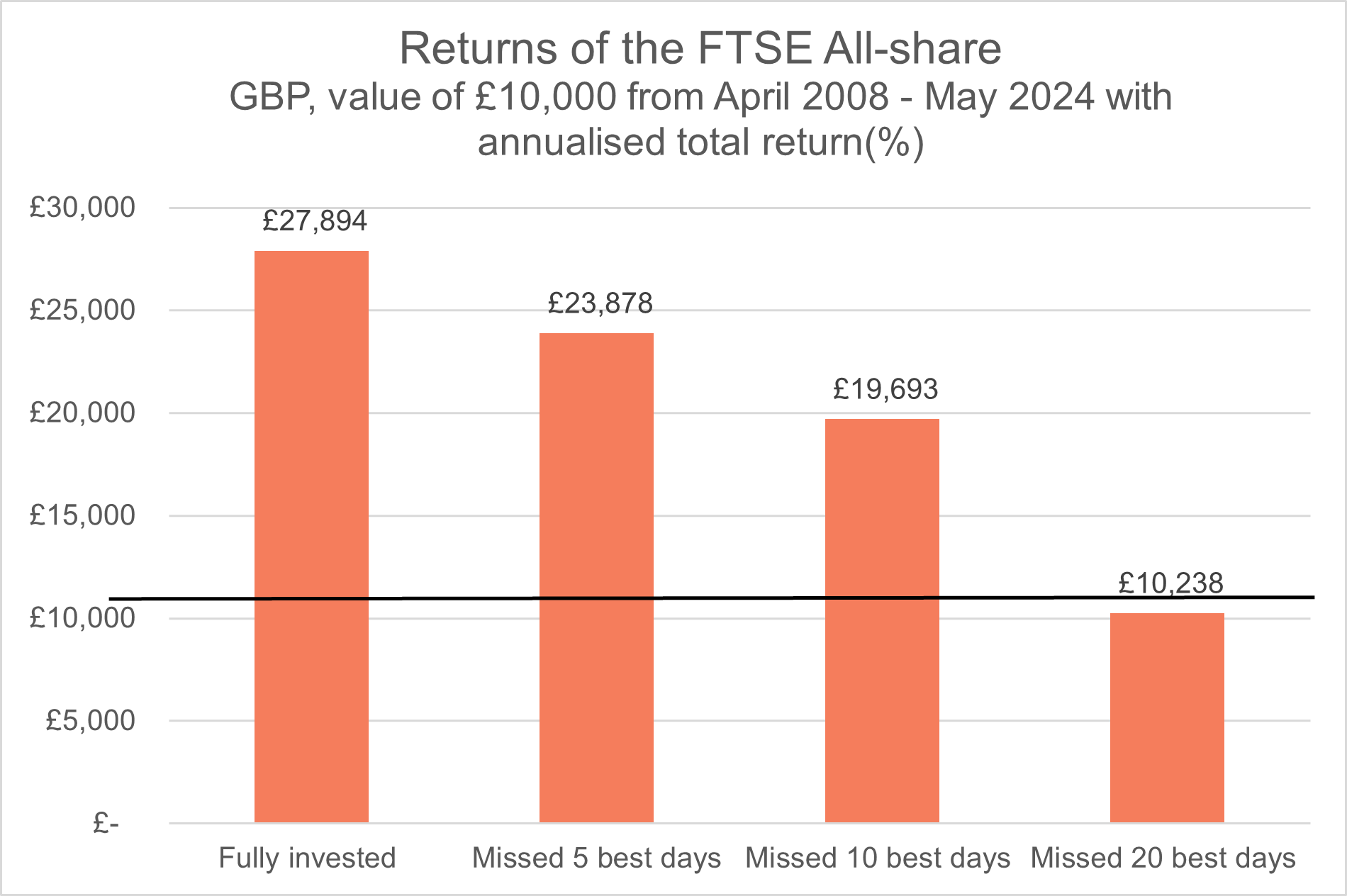

You might hear the words “time in the market beats timing the market” from your Financial Planner and we couldn’t agree more! The chart below shows that missing the best 20 days of investment returns in a 16-year period meant that you’d have given up almost £18k of gains based on a £10k initial investment: pretty much all of the investment returns!!

Source: Bloomberg, FTSE, Magnus.

Having some short-term cash for a rainy day fund normally makes sense, but having big pots of your wealth sat in cash is likely to decrease your level of wealth in the long term as inflation will eat into it.

The Magnus team remain excited about the opportunities in investment markets and if you’re looking for long-term investment growth to take advantage of some attractive valuations please speak to your financial planner.

The value of investments and the income from them can go down as well as up, you could get back less than you invested.