Global stock markets rose last week, with US technology shares driving most of the gains. Although a small part of the global index, UK shares also posted a good week, with domestically focused shares doing best. The UK General Election result dominated the headlines, and the result now means that UK markets can get back to focusing on fundamentals (which have been improving). This week the focus will be on UK growth data, US inflation and also the big US banks that report their earnings on Friday.

Last week

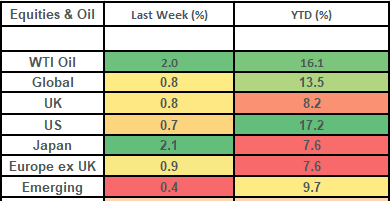

- Global stock markets rose last week (although the gains were narrowly focused)

- UK assets enjoyed an election boost.

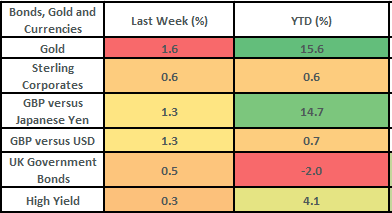

- Bond markets did well as yields fell.

- US economic data showed further signs of cooling, which in turn led to the timing of interest rate cuts being brought forward.

This week

- This week starts slowly but finishes with key economic data as well as the start of US earnings season.

- Wednesday sees the release of Chinese (CPI) inflation data.

- Thursday sees the release of UK growth (GDP) data (expected to come in at 0.2% for May) and also US inflation data (expected to come in at 3.1%)

- Friday sees US banks such as Citigroup, Wells Fargo and JP Morgan report earnings.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

More detail:

- Global stock markets rose by about 0.8% last week, with Japanese markets leading the way following a recent period of weak performance. Gains were spread fairly evenly across other regions, although from a US perspective (the most important region since it constitutes c70% of the global benchmark) the gains were focused on the large growth companies and technology in particular. Tesla was the standout stock performer within the US markets. It rose by c25% last week (and wiped out all its losses for the year) on the back of a better-than-expected deliveries report.

- Closure on the General Election saw UK assets put in a good showing, with the Pound rallying by about 1.3% vs the US Dollar, the bond market up 0.5% and the share market up by 0.8%. Domestic shares, in particular, enjoyed a good week, with the FTSE 250 rising by 2.5% on the week. Utilities were the other sector of note, and they bounced strongly on the election result, perhaps on hopes for more clarity and further investment. UK Utilities have struggled since the calling of the election, perhaps overreacting to potential increased costs of regulation in the run-up to the result.

- US economic data showed continued signs of cooling last week. Survey data (ISM) showed signs of moderation in the services sector as well as the manufacturing sector (which has been weak for some time). Jobs data presented a mixed picture but did show the unemployment rate ticking up (to 4.1%), wages coming down (less inflationary pressures) and numbers of longer-term unemployed workers creeping up too. This puts the US unemployment rate at its highest level in 26 months. This, combined with the downtick in wages, has seen inflation indicators start to nudge downwards as well and prompted Fed Chair Jay Powell to say last week that the Fed had “made quite a bit of progress” (in bringing inflation lower). This augers well for interest rate cuts later in the year.

- Bond markets had a good week, with both government bonds and investment grade bonds doing well. Government bonds rallied as yields fell, with the UK 10-year bond yield closing out the week at 4.12%. Investment grade credit spreads also tightened (notably within UK credit) which reflected increased expectation of interest rate cuts (lower borrowing costs) and a removal of uncertainty (in the case of UK credit) that came with the election UK election result.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.