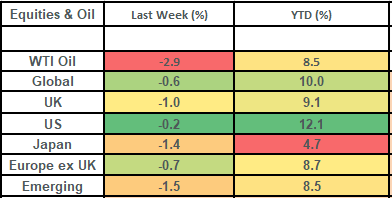

Global stock markets fell back last week after having posted positive returns for the 4 consecutive prior weeks. There was an element of pausing for breath (given the strong recent gains), but sentiment was also hurt by expected delays to interest rate cuts. The Federal Reserve meeting minutes from last week noted the “lack of progress” on US inflation, which led to market to delay the timing (till later this year) for the first interest rate cut in the US. Added to this, we also had UK inflation coming in a bit higher than expected (but falling to its lowest level since July 2021) and of course the announcement of the UK election! We cover it below, but it’s worth mentioning the staggering earnings numbers from Nvidia (which generated $26.04 billion of sales in the first quarter) which helped support the strong earnings’ growth story in the US market.

Last week

- Global stock markets sold off after having had 4 consecutive weeks of positive returns.

- Delays around the timing of interest rate cuts were the key driver of the sell-off.

- Corporate results continued to be strong, with Nvidia’s results helping to round-off a positive US reporting season.

- UK inflation came in at 2.3%, but the fall was less than expected as services inflation remained high.

This week

- It’s a pretty quiet one in terms of scheduled data.

- In the UK, we’ve got a raft of housing data out on Friday as well as full year earnings reports from JD Sports (Thursday) and Dr. Martens (Friday)

- In the US, the focus will be on the revised estimate for Q1 growth (due out on Thursday) as well as the release of the PCE inflation number (due out on Friday)

- Friday also sees the release of the estimated (or “flash”) inflation number for the eurozone: which will give a good guide as to whether we’ll get the interest rate cut that the markets are currently expecting when the ECB meets on 6th

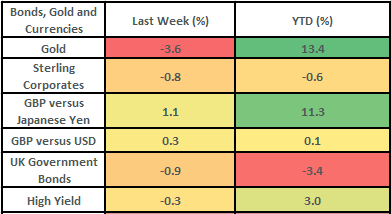

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

More detail:

- Global stock markets posted modest losses last week after 4 consecutive weeks of gains. There was an element of markets pausing for breath after a very strong recent run and this combined with a re-pricing of interest rate cuts by the bond markets; essentially with rate cuts being pushed out till later in the year.

- Despite being drowned out by the noise around UK inflation and the UK election, Nvidia’s first quarter corporate results came out last week and they were outstanding. This was key for the health of the market as Nvidia accounts for a large portion of the US stock market’s earnings (about 37% over the last 12 months according to Bank of America) and has been responsible for 25% of the gains in the US market for the year-to-date (Nvidia alone is up 115% ytd and is the 3rd largest stock in the US market). Nvidia reported profits (non-GAAP) that were 461% higher than the prior year and sales that were 262% higher than the previous year.

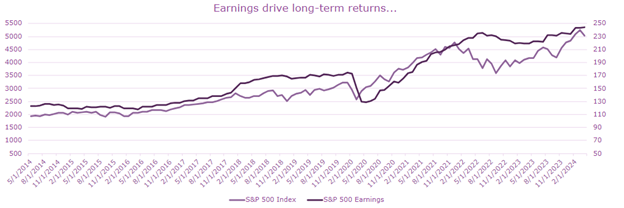

- The strong results from Nvidia helped close the door on a strong US corporate reporting season. I have included the chart below on earnings growth as this is the key driver of long-term stock returns and this quarter’s results mark 3 consecutive quarters of positive earnings growth having been in an earnings recession for the 3 quarters prior. 96% of US companies have now reported earnings and the Q1 growth rate is 6%. This is better than the 3.4% growth rate that was expected (by analysts at Factset) and analysts are now expecting overall earnings growth for 2024 of 11.4%. This is key for the continuation of market growth as the chart below shows. Corporate earnings and stock prices don’t move in lock-step fashion, but corporate earnings are the single biggest driver of stock prices over the long-term and the backdrop that we’re seeing is positive and encouraging.

Source: Bloomberg

- UK inflation came in at 2.3% last week, falling from 3.2%. This is a positive trajectory, but the number came in higher than the 2.1% that economists (as per Bloomberg) had been expecting. The key driver in the higher number is core services inflation, with “going out” costs still running at over 5% driven by things like restaurants and cinemas. This prompted the bond futures markets to delay the timing of the first UK interest rate cut, with the first cut now being priced in September this year and that being the only interest rate cut in the calendar year.

- Interest rate cuts in the US also got pushed back last week following the release of the Federal Reserve’s meeting minutes. These showed that officials noted that there was a “lack of progress” on inflation. This, combined with some stronger than forecast US economic data last week, prompted the bond futures markets to price in just one interest rate cut in the US this year: at either the November or December meeting.

- The upward pressure on bond yields (as pricing of interest rate cuts got delayed) led to returns of -0.9% for UK gilts, with UK corporate bonds down by about 0.8%.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.