The US share market was the shining light last week for global stock markets, with the US S&P 500 closing the week at a fresh all-time high. This was largely thanks to the big technology stocks within the index and helped global share markets eek out a positive return on the week. This helped the Magnus portfolios as these have a fairly high allocation to global managers and we recently (at the 12th January rebalance) trimmed back our exposure to UK equities which struggled last week on the back of a higher than expected inflation number. This week the focus will shift to the US earnings season, with several big companies reporting this week.

Last week

- Global stock markets rose (thanks to the US share market)

- UK assets struggled on the back of the higher-than-expected UK inflation number

- US economic data continued to be very strong: which is key as the US is the World’s biggest economy and helps drive global share markets.

This week

- There’s a fair bit to look out for this week, both on the corporate and economic side.

- There’s lots of companies reporting earnings this week, with Netflix on Tuesday, Tesla and IBM on Wednesday, Intel and Visa on Thursday and American Express on Friday.

- US 4th quarter growth numbers are released on Thursday and PCE inflation numbers are released on Friday (this is key as PCE is the inflation number that the Fed look at the most closely).

- It is a quiet week as regards UK economic data, apart from some key survey data (PMIs) which is released on Tuesday.

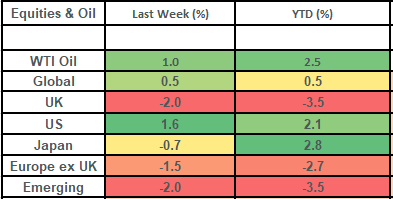

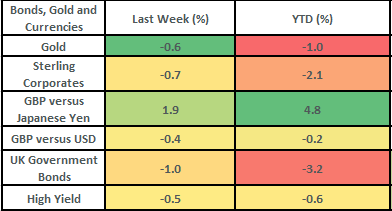

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

More detail

- Global stock markets rose by 0.5% last week. All gains were entirely driven by the US market (c70% of the global index), which rose by about 1.6% on the week. The week ended with the US S&P 500 index chalking up a fresh all-time-high. The S&P 500 closed the week at a level of 4839.81 which takes it past the previous high that it posted in January of 2022. It was the big technology names which drove the gains in the US index (tech accounts for nearly 30% of the index), with Nvidia up over 9% on the week and Microsoft and Apple both up over 3%.

- UK assets struggled last week. This was largely due to the 4% inflation number which came out on Wednesday. The 4% CPI number was higher than the previous level of 3.9%, but the key disappointment for markets was that it was higher than had been expected (a 3.8% level had been penciled in by Bloomberg economists). This chimes with the view that we hold that inflation will take longer-than-expected to get back to 2% due to the fact it has become entrenched in wages and also services. This was evident in last week’s inflation print, with services inflation ticking up to 6.4% (from 6.3%) and food inflation running at 8%. To compound the picture for the UK last week there was also a disappointing retail sales number for December which came out on Friday and showed a contraction in spending.

- This higher-than-expected inflation number caused the FTSE All Share to fall by 2% on the week. Within the FTSE 100 (the index of the UK’s largest companies), it was the mining sector which fared worst (which account for about 9% of the index), with names like Fresnillo down by 10.6% on the week and Glencore down by 8% on the week. Although it has been a tough start to the year all round, we would note that the Magnus portfolios trimmed their UK equity exposure significantly (in favour of global managers) in the rebalance that occurred on 12th

- UK bond markets also gave up ground last week, on the back of the higher inflation print. UK Government bonds fell by 1% on the week, with the 10 year government bond yield closing out the week at 3.9%. This increase in yields was driven by markets pricing in less interest rate cuts for 2024 (due for the need for interest rates to stay high to combat the higher inflation). Interest rates are now priced to finish the year at 4% in the UK, whereas just 3 weeks ago they were priced to finish the year at 3.75%.

- US economic data continued to be strong last week, with Retail Sales coming in positive and better-than-expected. On top of this, housing data was also better-than-expected. This is really key. The US economy accounts for roughly 25% of global GDP (it is the world’s largest economy) and it continues to tick along very nicely!

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.