Fed Chair Jerome Powell took on the role of Santa Claus last week and gave the markets an early Christmas present! Chair Powell said it was “not likely” there’d be further hikes and that he and his colleagues were considering “dialling back the amount of policy restraint in place”. Although US interest rates were kept on hold (at 5.5%), US bond markets lapped up these comments to price in 6 interest rate cuts next year! This saw all investments do extremely well, but particularly those sensitive to interest rates: great news for some of the managers in the Magnus Portfolios! Last week also saw the Bank of England and the European Central Bank meet (both maintained rates as they were). Governor Bailey was a lot less optimistic on interest rates than his US counterpart, but markets were much more focused on the US and all assets rose strongly as lower interest rates were priced in. Although this week is much quieter, inflation numbers from both the UK and the US will likely drive momentum given that falling inflation has been a key ingredient in the move lower in bond yields (and future interest rate pricing) which has driven so much of this recent rally.

Last week

- Investment markets had a very strong week

- An indication of interest rates being cut in the US next year was the catalyst for the move higher in investment markets

- Bond markets did best along with assets that benefit from lower interest rates (like infrastructure equities)

- Equity markets rose for the 3rd consecutive week

- US inflation fell from 3.2% to 3.1%

- The Bank of England, the US Federal Reserve and the European Central Bank all met and made no changes to interest rates. However, the market started to price in cuts for next year, particularly due to the change in stance by the US Fed.

This week

- It’s a much quieter week than last!

- The focus will be on inflation numbers out of the UK (out Wednesday) and on retail sales numbers and finalized 3rd quarter growth numbers for the UK (out on Friday).

- In the US, home sales data and consumer confidence data is released on Tuesday and then there is a key inflation print (PCE) being released on Friday : this is the measure that the Fed look at the most and hence will be a key watchpoint as we round out the week.

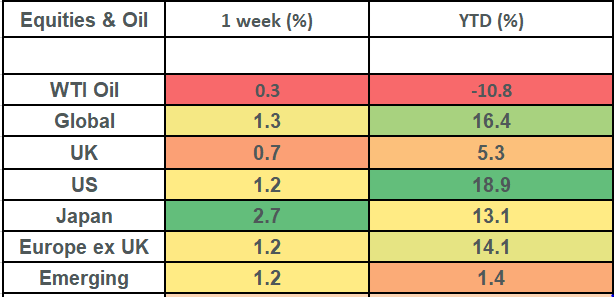

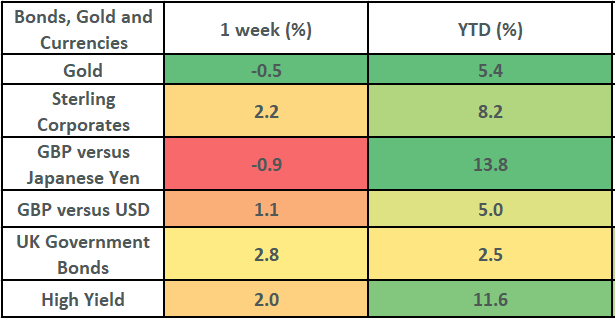

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets rose by 1.3% on the week. This takes returns for the month of December to 2.7% and returns for the year-to-date to 16.4%. The key driver for the push higher was the perceived pivot from the Federal Reserve in the US and its Chair Jerome Powell. The Fed kept rates constant at 5.5% but they changed their guidance for next year. Their “dot plot” now guides towards 3 interest rate cuts for next year. The bond futures market (which is often more accurate than the Fed’s dot plot!) is even more bullish and is pricing in 6 interest rate cuts for next year. This would take US interest rates from 5.5% to 4% and breathes more life into stock markets (as it makes it cheaper for companies to borrow money: interest rates being cut are a bit like an oxygen mask dropping from the ceiling!).

- The “Adventurous” Magnus 90% equity portfolio rose by about 1.6% on the week and the “Cautious” Magnus 35% equity portfolio rose by about 1.2%. This takes returns for the month-to-date to 3% and 2.1% respectively. Pleasingly, some of the key contributors this month have been some of the investments that have been “sleepers” for much of this year. The Infrastructure manager that we hold (FT Clearbridge Legg Mason) was up by 1.9% last week and is now up close to 11% so far this quarter (they have massively benefited from lower bond yields). Within our fixed interest exposure, managers such as Blackrock Corporate Bond fund and Invesco Tactical bond fund (which has been positioned for yields falling) both rose by about 2.3% on the week.

- The UK stock market was up 0.7% last week. A decent number, but returns were somewhat held back by the strength in the Pound – or rather, the weakness in the Dollar. The FTSE 100 market in the UK derives around 70% of its earnings from overseas and hence tends to struggle when the Pound is strong. Pleasingly, all of the active managers in the Magnus portfolios delivered decent gains. It is worth noting that Gresham House (of the UK managers) are up 4.6% for the month on the back of having 2 of their companies bid for this month: Ten Entertainment Group (a Ten Pin bowling company) and Smart Metering Systems (smart meter company for home installation) are both up 40% this month on take-over bids. Gresham House are only a small weight in portfolios, but have given some excellent return since their inclusion this summer.

- UK government bond markets were up by 2.8% last week, whilst US treasury bond markets were up by 2%. This came as bond yields moved down sharply to price in lower interest rates next year. UK 10-year bond yields closed the week at 3.67% and US 10 year bond yields closed the week at 3.91%: these numbers were about 1% higher in each case just a matter of a few weeks ago!

- The Bank of England (“BoE”) met on Thursday and kept interest rates at 5.25%. Governor Bailey was actually quite cautious in his comments, but the proverbial horse had already bolted after Fed Chair Powell opened the proverbial door the previous evening. UK bond markets are now pricing in 4 interest rate cuts for next year and for interest rates to finish the year at 4.25% (they are 5.25% today). The monetary policy committee (“MPC”) voted 6 to 3 in favour of keeping rates steady. It is worth noting that the 3 dissenters had voted for a rate hike. The BoE are still grappling with higher inflation than other countries (CPI is 4.6%) and our core inflation (often the stickier element of inflation) is running at 5.7%.

- The European Central Bank also met on Thursday (it was a very busy week!). They kept rates steady at 4% but did revise down their growth and inflation projections against the backdrop of some slowing business survey data. This caused the bond market to price in interest rate cuts for next year, with 6 rate cuts being priced into the market now. This would take European interest rates to 2.5% by the end of next year.

- China had some key data out last week too – which somewhat went under the radar given everything else going on! Retail sales, industrial production and fixed asset investment numbers were released. They weren’t bad, they showed signs of progress, but, on balance, they were worse than expected. This prompted further stimulus from the Chinese authorities into the banking system. It is worth noting that the credit impulse in China has now turned positive: this is generally a good sign that the economy is being stimulated in advance of a pick-up in growth.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.