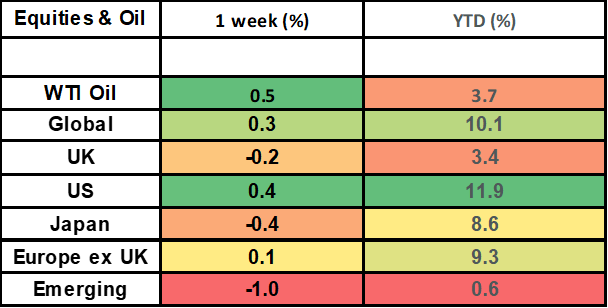

Global stock markets made modest gains last week thanks to the US market getting a boost from some a-than-expected inflation number. The other big news (in the context of a very low summer news week!) was a surprise up-tick in UK growth; on the back of increased consumer spending in June. This week is also pretty quiet, but there’s UK inflation data out on Wednesday and also US retail sales out tomorrow.

Last week

- Global stock markets made modest gains (thanks to the US market)

- US inflation ticked up to 3.2% (which was a lower number than expected)

- UK economic growth came in better than expected

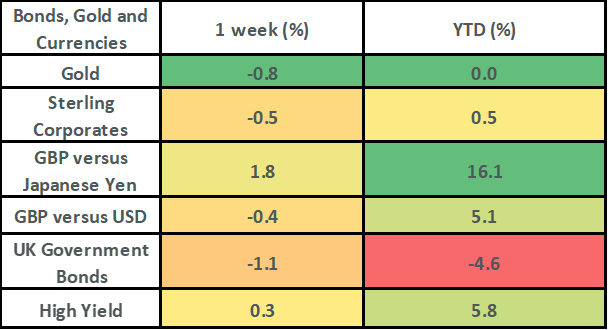

- UK bond markets sold off, with Gilts falling by 1.1%.

This week

- UK inflation numbers are out on Wednesday: survey data (as per Bloomberg) expects the number to drop to 6.8%

- UK retail sales data is out on Friday

- US retail sales data is due out tomorrow

- US housing data plus the most recent Fed meeting minutes are out on Wednesday

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets made modest gains of 0.3% last week. This was driven by the US market (which makes up nearly 70% of the index) which itself got a boost following an inflation number which came in lower than expected. Sector wise it was energy and healthcare (an overweight position in the Magnus portfolios) which performed best; both up over 3% for the week. Healthcare rallied on the back of the earnings report from Novo-Nordisk who lifted their guidance following strong demand for one of their weight loss drug (Wegovy) which can help patients shift upto 15% of their weight (alongside diet and exercise changes).

- The UK stock market was fairly flat for the week, with the FTSE All Share dropping by 0.2%. Insurance companies were the best performers within the FTSE 100, with Beazley up 6% on the week following increased price targets being issued by stock analysts (from Barclays and Berenberg).

- The big news (in the context of a pretty low news week!) was the US inflation number which came in at 3.2% (CPI) as compared to expectations for a reading of 3.3%. Falling airfares (coming down from the post-pandemic re-opening spike) were one of the big drivers in the lower-than-expected print.

- UK economic growth was the other economic news of note, with a growth number of 0.5% being posted for June. This was bigger than the 0.2% that economists had been expecting. Much of the uptick in growth came from better-than-expected weather which meant people got out and about a bit more; increasing their spend in pubs and restaurants.

- Bond markets sold off last week on the back of rising bond yields. UK government bonds fell by 1.1% whilst UK corporate bonds fell by 0.5%. Most of this fall came on Friday following the better-than-expected UK growth number (due to the fact that higher growth means less risk of a recession which means that the Bank of England can maintain interest rates at a high level).

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.