Global stock markets rose nicely last week, with the market rallying on some positive economic data; lower US inflation being the key driver. This better data combined with news of more stimulus from the Chinese authorities which helped push up stock markets and particularly those with exposure to China. UK data last week continued to show signs of lingering inflation and this in turn caused a re-pricing up of interest rates. This saw the Pound strengthen significantly and the bond market sell off (in anticipation of higher rates). These higher rates will likely be confirmed this week when the Bank of England meet on Thursday where we expect to see rates rise to 4.75% from 4.5%.

Last week

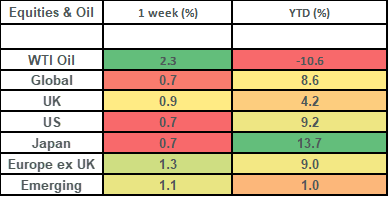

- Global stock markets rose, although gains were crimped by the strong pound

- UK stocks did well: helped by the materials sector

- Emerging market stocks bounced as China eased policy

- The US Federal Reserve held interest rates steady as inflation eased

This week

- The key event this week is likely the Bank of England’s meeting on Thursday. We expect them to hike rates to 4.75%.

- UK inflation is out on Wednesday, it is expected (as per Bloomberg survey data) to fall to 8.4%.

- Friday sees the publication of key survey data (flash PMIs) for all of the major economies.

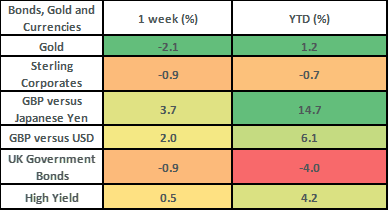

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets rose by about 0.7% as US inflation came in at its lowest level since March 2021 and the US Federal Reserve kept interest rates on hold (after having increased rates at its previous 10 meetings). Returns would have been a lot better had it not been for the strength of the Pound. The Pound rose by 2% on the week vs the US Dollar and 3.7% vs the Japanese Yen. This meant that overseas’ returns didn’t translate back quite so positively once one allowed for currency movements.

- The UK stock market (FTSE All Share) rose by 0.9% on the week, which was driven by returns in the FTSE 100. The FTSE 100 rose by 1.1% on the week, whilst the domestically focussed FTSE 250 fell by 0.2%. Within the FTSE 100, it was the big mining stocks, such as Glencore (+7.4%) and Antofagasta (+5.6%) which drove gains on the back of positive developments from China (more on that below). Ocado was the best performing stock in the FTSE 100, up 19.5% on the week; it still remains heavily down for the year though (down by 25%).

- Emerging market stocks rose by 1.1% on the week, with much of that gain being driven by Asian markets and Chinese related gains. This came on the back of the People’s Bank of China injecting more stimulus into markets. Specifically, they cut their medium-term lending facility by 0.1% to 2.65%, they lowered their 7-day reverse repurchase by 0.1% and also injected more money into the banking system. This followed economic data for Retail Sales, Fixed Asset investment and Industrial Production which all came in lower than expected.

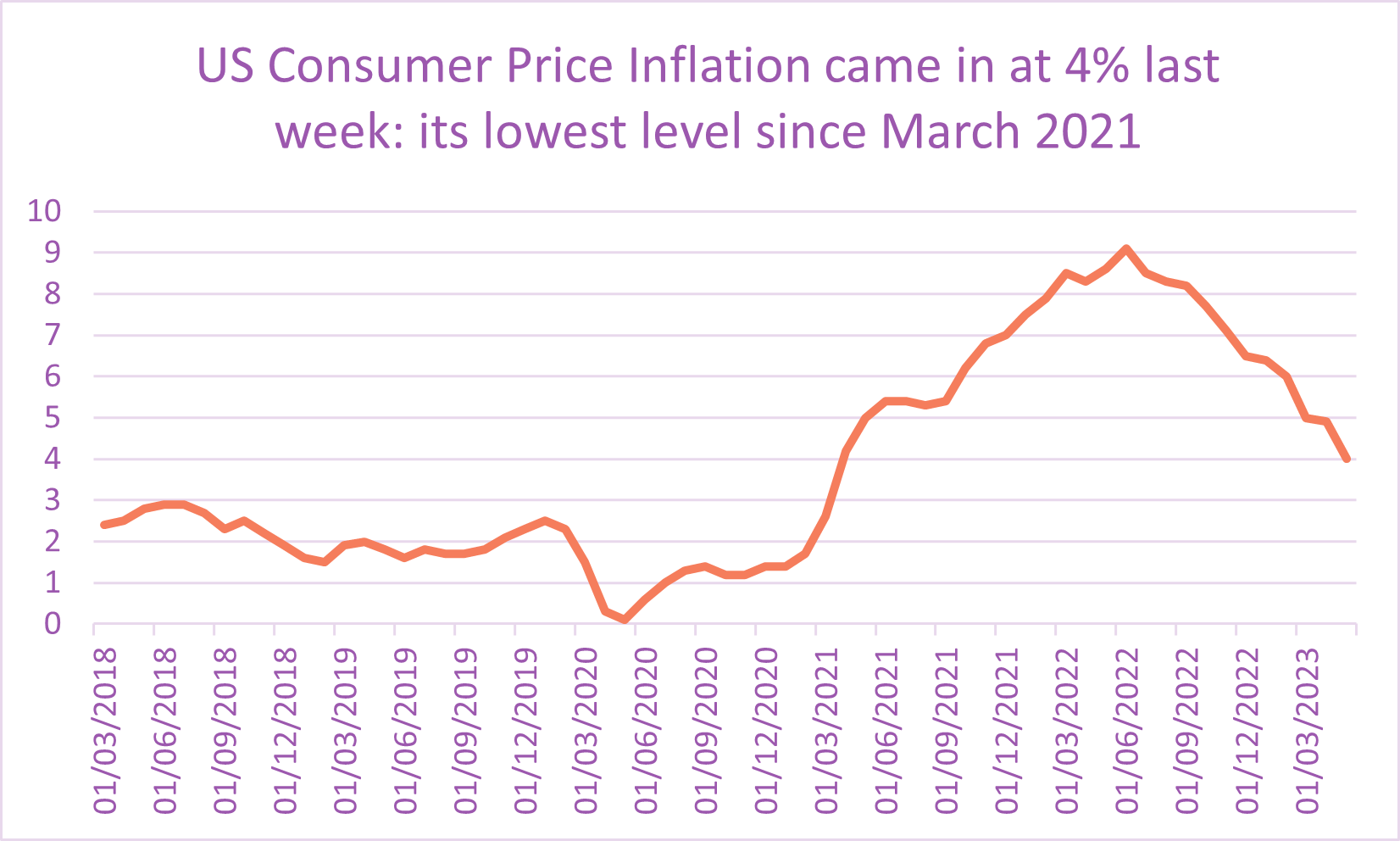

- Lower than expected US inflation was the big good news story of the week. US CPI came in at 4%, which marked the slowest pace since March 2021. This was significantly lower than the previous month’s reading of 4.9%, less than the expected reading of 4% and much lower than the peak last June of 9.1%. There was then some US jobs data later on in the week, which showed more people had claimed unemployment benefits than expected, which was taken as a positive indicator that the higher interest rates were doing their job and that the labour market is cooling (i.e. putting downward pressure on inflation).

- The US Federal Reserve met last week and maintained interest rates at 5.25%. This was the first time they had not hiked rates in the last 15 months. Bond futures markets are pricing in just 1 more hike now from the US Federal Reserve and then rate cuts 1 year out from now.

- The European Central Bank (“ECB”) raised interest rates last week to 3.5%. This is the highest-level European rates have been in 22 years. Bond markets are expecting a couple more hikes yet to come from the ECB, with President Christine Lagarde noting that they “still have ground to cover”. Inflation has been higher than expected in the Eurozone, largely because the region has avoided a widely anticipated recession and energy prices were less punitive than feared (owing in no small part to a warmer than expected winter).

- Government bond markets continued to be under pressure, with UK gilts falling by 0.9% on the week and UK corporate bonds falling by 0.9% also on the week. This fall was driven by rising bond yields in the UK, with the UK 10-year gilt yield closing out the week at 4.4%. This is pretty much back at the same levels that it was in the “mini” budget of September last year. A big driver in the higher UK bond yield has been the stronger-than-expected jobs market. Unemployment came out last week at 3.8% (which was lower than expected) and UK wage growth came in at 7.2% (which was higher than expected). This all argues for more interest rate hikes and we expect to see another one coming this week.

US inflation came in at its lowest level since March 2021 which helped to boost the stock market last week (it showed signs that the rate hikes were working and doing their job!)

Source: Bloomberg

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the particular investment objectives, financial situation or needs of any specific client, person, or entity.