Global stock markets rose last week, with US Dollar strength helping to boost overeas’ returns. It was a fairly full week, which saw the Bank of England put through their 12th consecutive interest rate rise and US inflation come in a touch lower than expected. Equity markets generally took all of this in their stride, whilst bond markets were fairly flat. This week we’d expect attention to remain on the US debt ceiling and also on China and Japan who both have lots of scheduled data.

Last week

- Stock markets rose last week thanks to strength in the US dollar.

- Big technology companies helped stabilise returns.

- The Bank of England hiked rates to 4.5%.

- US inflation came in at 4.9%; a touch lower than expected.

This week

- China is in the spotlight this week with its monthly data dump tomorrow. This includes retail sales, industrial production and fixed asset investment. Alongside this, we’ll get earnings reports from Alibaba, Baidu and Tencent over the course of the week too.

- In the UK, we have employment data out tomorrow, with unemployment expected to stay at 3.8%.

- Retail sales (tomorrow) is the key US data point of the week, with housing data (Thursday) also one that’ll be closely eyeballed.

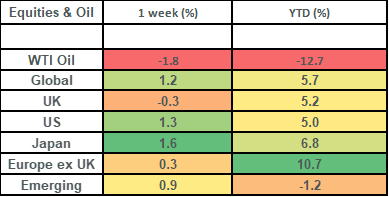

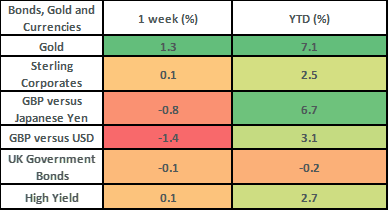

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global equity markets rose by about 1.2% last week, with the US market driving most of the gains. These gains came largely from strength in the US Dollar (up by 1.4% vs the Pound on the week) as opposed to strength in the underlying equity market. That said, the big technology and consumer discretionary shares in the index responded well to the lower inflation number (which supported the narrative that the Fed will pause on hiking interest rates). Amazon (a 2.9% in the US S&P 500 index) rose by 6% on the week, whilst Google parent Alphabet (a 3.75% weight in the index) rose by just shy of 13% on the week. This followed the unveiling of a new artificial intelligence-based search platform from Alphabet.

- UK shares (as per the FTSE All Share) were down by 0.3% on the week. Bigger shares in the index (i.e. the FTSE 100) did best (down by 0.15% on the week), whilst the smaller, more domestic shares (i.e. the FTSE 250) lagged; down by 1.25% on the week. This follows the pattern of the year-to-date for UK stocks, with the FTSE 100 up by 5.7% and the FTSE 250 up by 3%. Melrose (+11.2%), JD Sports (+8.4%) and IAG (+5.3%) were the best performers in the FTSE 100 index last week, with Ocado (-8.5%), Land Securities (-6.5%) and British Land (-5.6%) bringing up the rear.

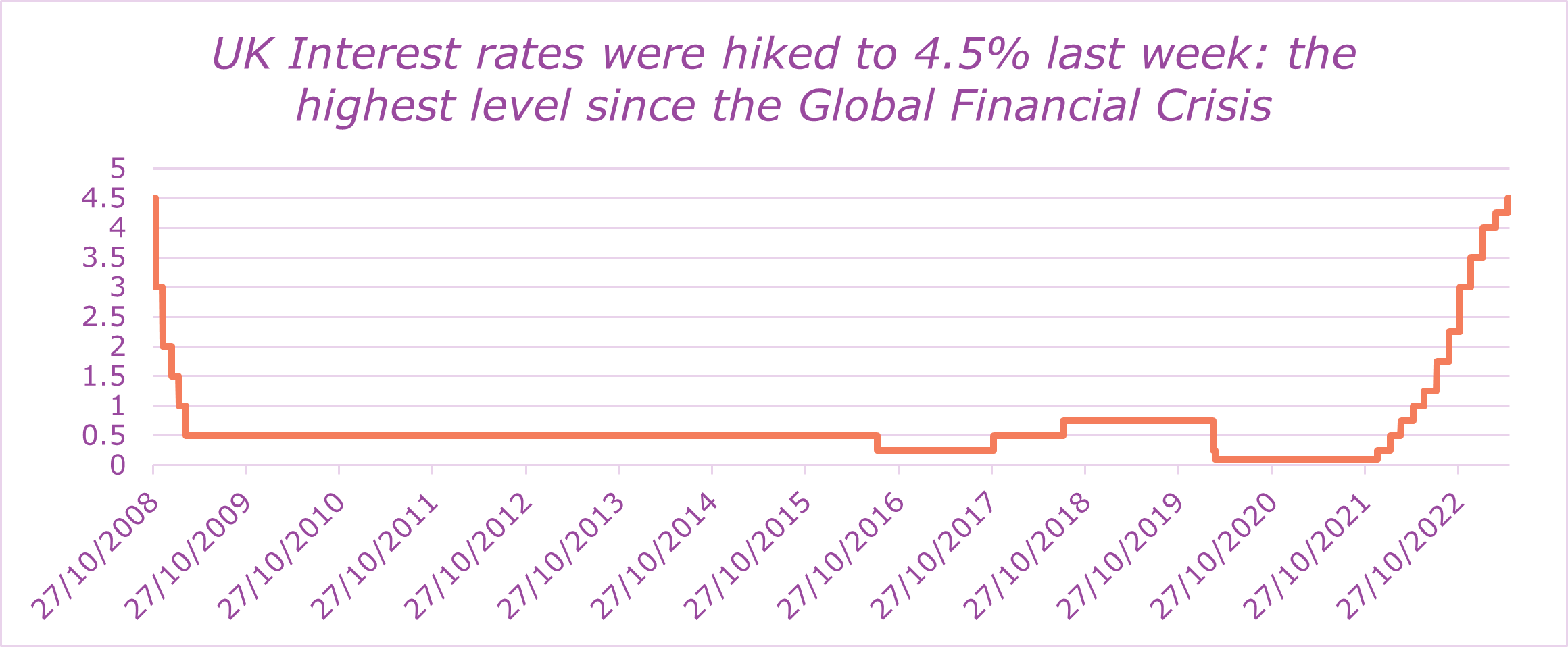

- The interest rate rise from the Bank of England was the big news story for UK markets last week. Interest rates rose to 4.5% which is the highest level that they’ve been at since 2008. This marked the 12th consecutive interest rate rise and comes on the back of inflation remaining much higher than target; it is currently running at 10.1%. The next inflation number comes out on 24th May, which sees a big number drop out of the 12-month series. However, inflation has been elevated for such a prolonged period now that it has become a bit stickier than the Bank of England had previously forecast. This (amongst other factors) has led them to revise up their inflation forecasts for the end of the year from 3.9% to 5.1%. Last week also saw the publication of the first quarter’s growth (GDP) number for the UK. It came in at 0.1% which meant that we narrowly avoided being in a technical recession!

- US inflation (CPI) came in at 4.9% last week which was a touch lower than the 5% that had been expected. Whilst still a pretty high number, this marked the slowest pace of growth in 2 years and the 10th straight month of improvement since the peak of 9.1% last June. There are some big numbers which are due to drop out of this series in the next few months which should see the US inflation number drop towards 3% by the end of this year.

- Bond markets were pretty quiet last week. UK government bonds lost about 0.1% in value whilst US Treasury bonds lost about 0.2% in value. Credit markets fared a little better (modest positive returns across the board) as spreads tightened over the course of the week. Bond yields remain fairly elevated (reflecting the higher interest rate environment), with UK 10-year yields closing out last week at 3.78% and UK investment grade yields closing out last week at 5.78%.

- Gold continues to do well as an asset class, rising by 1.3% last week to close out the week at $2010.77/ounce. This is close to the all-time-high of $2063/Oz it reached in August 2020.

- The upcoming deadline to increase the US debt ceiling was a continuing feature of markets last week. We expect this to continue to be the case (and cause choppiness in markets) until resolution. US Treasury Secretary Yellen has warned that the deadline could come as soon as 1st June.

The Bank of England hiked interest rates last week by 0.25%. This was the 12th consecutive interest rate hike.

Source: Bloomberg

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the particular investment objectives, financial situation or needs of any specific client, person, or entity.