Last week saw the stock market bounce back pause for breath. Global stocks gave up a bit of ground as Asian shares dragged. We’re now a couple of weeks into US earnings season and so far, so good. However, this week will be key for markets as lots of the big tech companies report their numbers. The reaction to these numbers will likely set the tone in a week that is fairly quiet on the economic data front save for US inflation numbers (out on Friday) which will be keenly watched.

Last week

- Global stocks gave up some ground last week, although UK stocks continued their bounce-back

- US earnings season was mixed last week. Banks continued to do well, but there were some high-profile misses

- US jobs data showed signs of weakness, whilst Chinese economic data was mixed

- Bond markets sold off as yields rose

This week

- This stands to be a big week for corporate reporting, with a lot of the big names reporting their quarterly numbers

- Tuesday sees earnings numbers out from UBS, Microsoft, Alphabet and Visa. Wednesday sees earnings numbers from Meta and Thursday sees earnings numbers from Barclays, Amazon, AstraZeneca, and Intel

- Alongside the corporate data, there is some key economic data this week in the US. Thursday sees the preliminary reading for the first quarter’s growth being released and Friday sees the release of inflation data (PCE numbers)

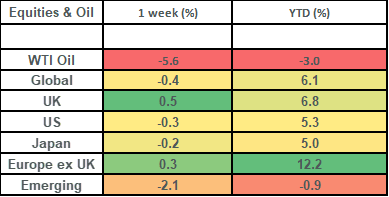

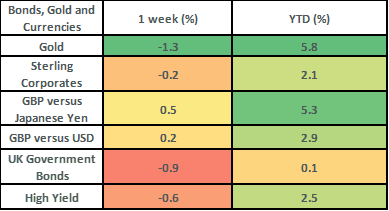

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets gave up some ground last week as some damp economic data caused the market’s recent bounce to pause for breath. The FTSE World index fell by 0.4% on the week, with Asian markets dragging the most (the FTSE Asia ex Japan index was down by about 2% on the week).

- UK stock markets continued their bounce back, with the FTSE All Share rising by 0.5% on the week which takes gains for the month of April to 3.6%. The FTSE 100 (i.e., the largest shares in the UK index) drove gains in the FTSE All Share last week, with Melrose Industries (+13.5%), Entain (+8.2%) and Flutter Entertainment (+6.9%) helping to drive gains. Gains in Melrose came as the company completed its demerger of certain parts of its business (GKN Automotive, GKN Powder Metallurgy and GKN Hydrogen) into Dowlais group (an engineering group focussed on the automotive sector).

- US earnings season continued to chug along last week, and we are now 18% of the way through. Results last week were a bit of a mixed bag, and the market is in something of a holding pattern awaiting the big releases this week, with just over 1/3rdof the companies reporting including many of the big tech heavyweights such as Amazon, Alphabet, Meta, and Microsoft. At a high level, US corporate earnings have been better than expected so far, but it is important to note that the bar is pretty low and has been lowered significantly throughout the course of the year! Companies that have reported are showing a blended earnings decline of -6.2% as compared to an estimated earnings decline (at the 31st March 2023) of -6.7%.

- One of the bright features of the US earnings season so far has been the performance of the banking sector. Last week saw Western Alliance Bancorporation (a US regional bank) rise by 28% on the week (and 24% on the day of its results) as it reported news that deposit withdrawals had stabilised and that deposits in April had started to increase. This followed on the back of strong earnings numbers the week prior from JP Morgan and Citigroup, with JP Morgan in particular having cited an increase in deposits. On the negative side, it is worth noting that Goldman Sachs missed their earnings estimates as did Tesla, with the latter falling by 11% on the week having had a super strong bounce-back this year (it is up just over 30% for the year). Netflix was another high-profile company that reported last week. Although they beat earnings estimates, the stock traded down on the week (by 3.3%) as they reported that they would be a delay in launching the implementation of their plan to crack down on password sharing.

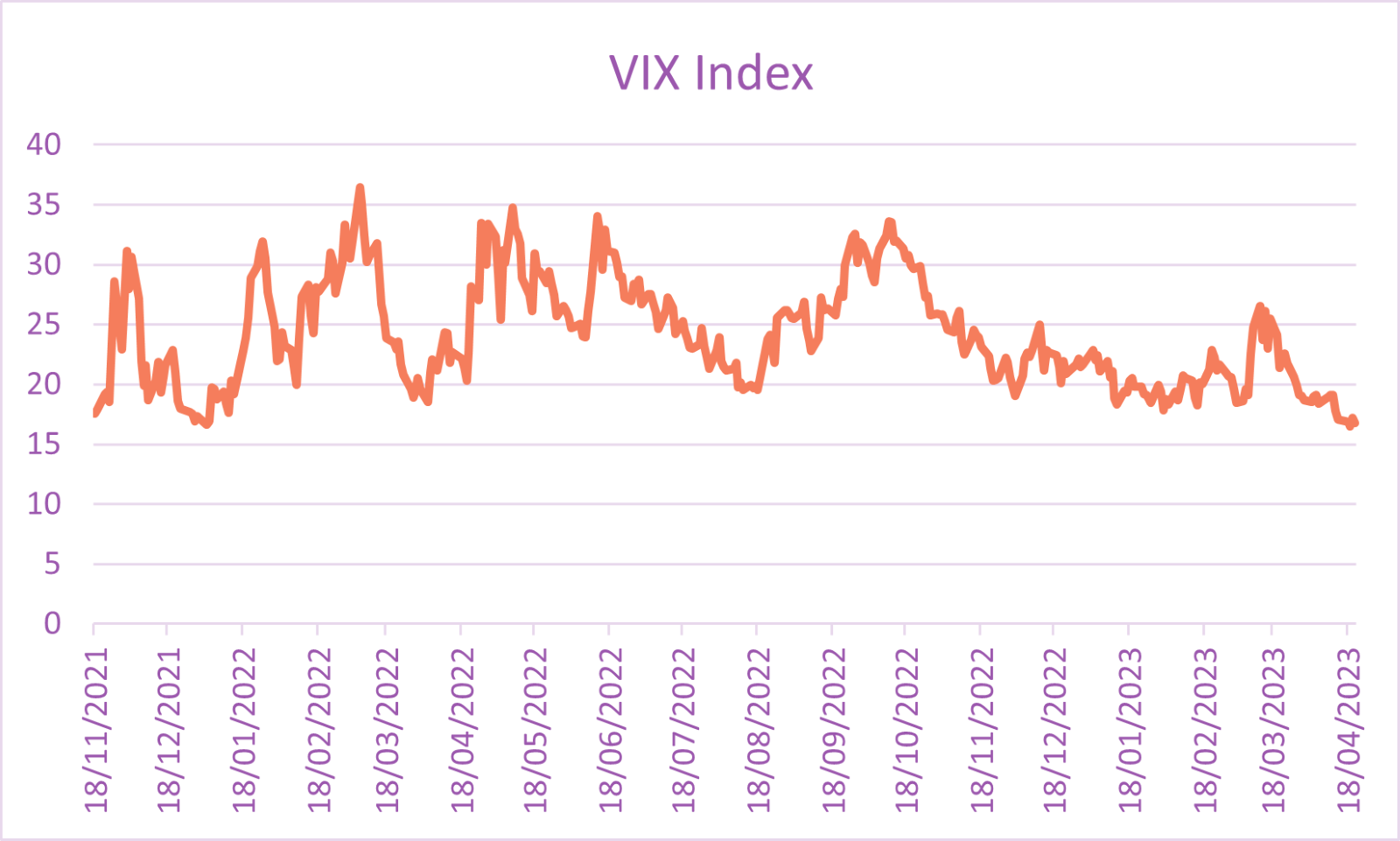

- The better performance of the banking sector has been evident in the performance of the VIX index. It closed at a level of 16.46 last Wednesday which was its lowest level since November 2021. It averaged 25.6 last year which was a very elevated reading as opposed to the prior decade where it has averaged 17.8.

- US economic data showed signs of some weakness in the jobs market as the weekly jobless claims markets ticked up a bit more than had been expected and continuing claims reached their highest level since November 2021. Chinese GDP came in at 4.5% vs expectations of 4%, but other data from China was more of a mixed bag. Property investment was lower than expected as were industrial production numbers although retail sales were higher.

- The bond markets sold off a bit last week, with yields rising. UK government bonds fell by about 0.9% on the week, with the UK 10-year bond yield closing the week at 3.76%. Credit markets performed better but they were still under-water for the week, with UK investment grade credit markets down by about 0.2% and global high yield markets down by about 0.6%.

The VIX index – often referred to as the “fear gauge” recorded its lowest reading last week since November 2021

Source: Bloomberg

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the particular investment objectives, financial situation or needs of any specific client, person, or entity.