The Global Equity market has now posted a “correction” of -10%.

These sorts of pullbacks are unsettling but not uncommon. In fact, in the last 21 years, global equities have seen such selloffs about once every 2 years.

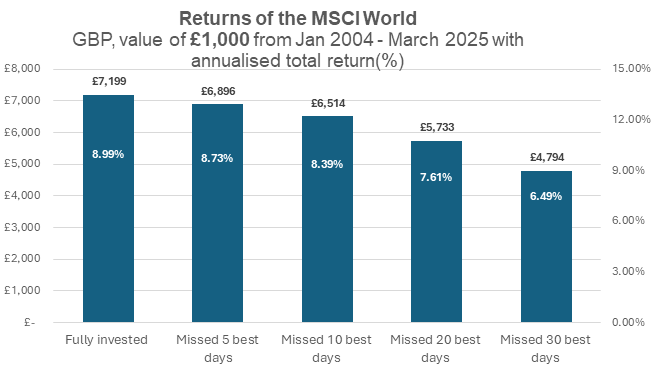

Historically, these opportunities have often created excellent entry points for markets and have penalised investors for jumping out and missing out on some of the best returns.

What does history tell us?

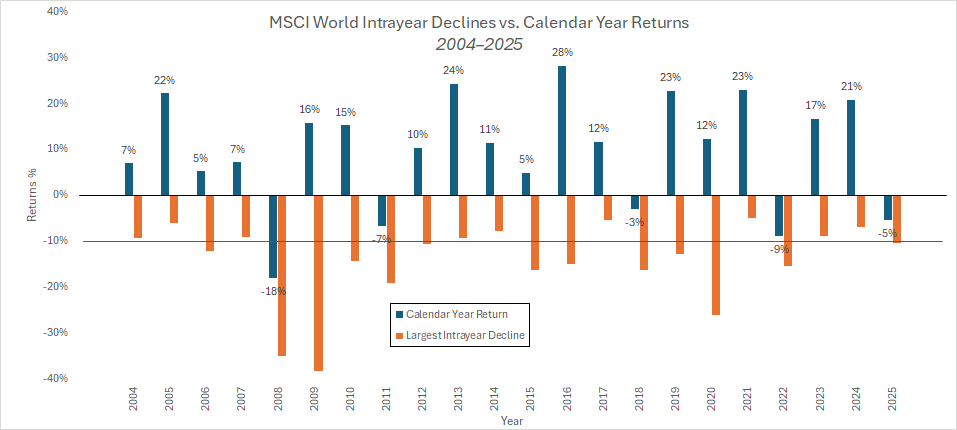

We looked back over 21 years’ worth of data for global equity markets and plotted the annual returns in the chart below:

History shows that in this 21-year period, we’ve had 12 calendar years where the intra-year sell off has been 10% or more: roughly once every 2 years. In fact, the average annual intra-year drawdown for the stock market is 14%.

Whilst not always a smooth ride, staying invested and riding out the lumps and bumps would have yielded an average annual return of almost 9%.

Don’t try and time the market

Using the same time data set, we looked at the opportunity loss associated with jumping out of the market. Missing just a handful of days could mean giving up on meaningful gains. The chart below shows that by missing just 30 of the best days (about 0.6% of the data set) in this time window would make for an investor giving up just over 25% of the return on offer.

Much of this recent sell-off has been concentrated in richly valued US technology stocks. These stocks constituted a high weight within broad passive indices. We have some exposure to these names within our clients’ portfolios but at a relatively low weighting and have diversified our clients’ equity exposure via relatively high exposure to the UK market (which we increased towards the back-end of last year), defensive assets such as infrastructure and defensive equity sectors such as consumer staples.

History tells us that being overly reactive in these environments can cause damage to long-run returns. We intend to use market volatility as a friend and to stay diversified and stay invested.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.