Global stock markets rose by about 1%, with Chinese equities driving returns. China has very much been a sleeping giant for much of this year, and last week saw the Chinese authorities unleash the biggest amount of stimulus since the pandemic. This saw Chinese stocks rise by almost 17% on the week, with emerging market stocks rising in sympathy. This week we’d expect attention to remain on China but to switch to the all-important US jobs data – due out on Friday lunchtime.

Last week

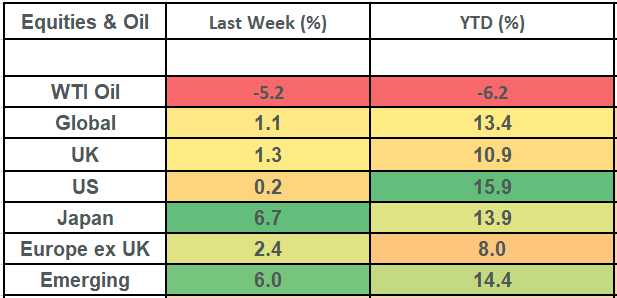

- Global stock markets rose by about 1%, with the focus very much on China

- The Chinese authorities unveiled a wide raft of stimulus measures, which saw Chinese stock markets rise by nearly 17% and Emerging market stocks rise by just over 6%

- UK equities held up well, with some decent economic data helping to further boost the Pound

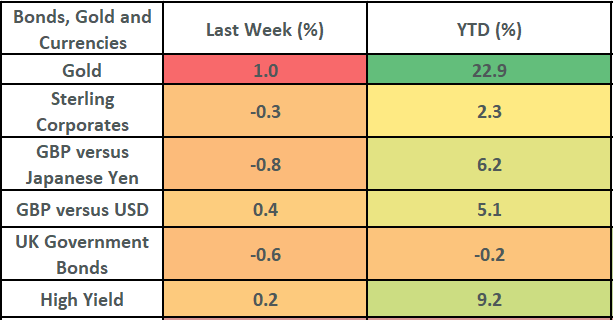

- Bond markets sold off modestly in the UK

This week

- The big scheduled event for this week is US Payrolls data which is due out on Friday lunchtime. The last 3 readings for this measure have been weak and have been a key driver in the bond market pricing in interest rate cuts from the US Federal Reserve.

- Eurozone inflation (September flash) is due out tomorrow.

- UK PMI (business survey) data is due out on Thursday.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

More detail:

- Global stock markets rose by just over 1% last week, with emerging markets (and in particular China) driving the gains. Chinese shares enjoyed their best week since the Global Financial Crisis in 2008, rising by about 16.7% on the week! This meant for gains of c6% for Emerging Market stocks (where China comprises roughly 25% of the index) and gains of 6.7% for Japanese equities, with Japan being a big beneficiary of Chinese imports.

- Why did Chinese assets rise so heavily? Last week saw the biggest amount of stimulus from the Chinese authorities since the pandemic! In particular, they cut a series of interest rates for banks, they cut mortgage rates by 0.5% (as well as slashing the downpayment ratio for second home purchases), they pledged to provide 100% loans at a 1.75% interest rate to support social housing and they issued lending facilities for companies which could be used for share buybacks. Strictly speaking this is not direct intervention in the stock market, but it is not far off and goes a long way to explaining the huge rally we saw last week.

- Why did the Chinese authorities step in in such size? Our view is that these measures were taken in an attempt to boost consumer confidence and to help China hit its 5% growth target for this year. 5% is already a very low growth target by China’s standards and the 2nd quarter number had them on track for 4.7% growth (which prompted economists to revise down their year-end forecasts).

- Will it work? Clearly it has had a big and very positive impact on the stock market! The litmus test will be if it feeds through to consumer confidence. Consumer confidence is at a multi-year low due largely to the house price crash in China (property accounts for c70% of total household assets in China). This has prompted the Chinese consumer to become a nervous saver! Savings rates in China are about 44% as compared to about 11% in the UK and about 5% in the US. Hence our view that this is very much a demand problem on the part of the Chinese consumer, rather than a supply one. That said, this move should help, and the global economy needs its 2nd biggest economy to be firing; especially when it (China) contributes c30% to world economic growth!

- The UK stock market (per the FTSE 100) was up by about 1.3% last week, with the China exposed names driving the gains. Miners such as Anglo American, Antofagasta and Glencore were all up between 12.8% (Glencore) to 14.5% (Anglo). There were also some big gains for China exposed financials such as Prudential (+11.6%) and Standard Chartered (+6.3%). The Oil majors (Shell and BP) weighed on the index owing to the drop in the oil price. UK domestic stocks put in a good showing, with the FTSE 250 up by 2% on the week.

- Clearly China stole the headlines when it came to macro news, but there was also some decent economic data out of the UK and the US. In the UK, the business survey data (PMIs) all came in positive (although to a lesser degree than expected) and in the US PCE inflation (the measure that the Fed look most closely at) came in at 2.2% (which was below the 2.3% that was expected).

- UK government bonds gave up some ground last week, with UK gilts falling by about 0.6%. This left the 10-year gilt yield at 3.97%. Elsewhere, credit markets generally fared well on the back of improving sentiment and good take up of new bond issuance.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.