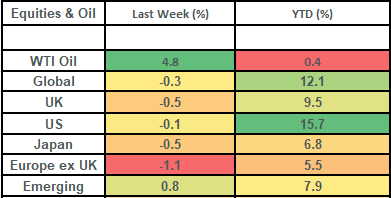

Stock markets sold off a touch last week, with a strong Pound taking the fizz out of overseas’ gains. The focus last week was on Central Banks and interest rates, with the US Federal Reserve cutting rates by 0.5%, whilst the Bank of England held steady. This week is quieter, although there is a smattering of US economic data, along with a scheduled speech from US Fed Chair Powell on Thursday.

Last week

- Global stock markets dropped modestly, due to Pound strength affecting overseas’ returns

- The US Federal Reserve cut interest rates by 0.5% (to take them to 5%)

- The Bank of England kept interest rates steady at 5%

- The Pound rose to its highest-level vs the US Dollar since March 2022

- Emerging market equities rallied on hopes of more stimulus from the Chinese authorities

This week

- It’s a much quieter week after the Central Bank meetings last week

- In the UK we have flash PMI readings for September – due out this morning

- In the US, we have PMI data today, Consumer Confidence data tomorrow and then PCE inflation (the measure that the Fed puts most weight on) out on Friday

- It is thin on the ground with respect to corporate earnings, with Micron reporting on Wednesday and Costco reporting on Thursday

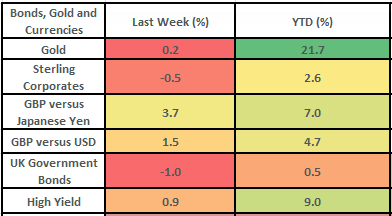

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

More detail:

- Global stock markets dropped back last week, but this was entirely due to currency translation effects and the strength of the Pound! The Pound rallied hard last week, rising by about 1.5% vs the US Dollar, 3.7% vs the Japanese Yen and 0.7% vs the Euro. This bounce higher (which saw the Pound get back to levels vs the US Dollar not seen since March 2022) was a nice tick in the box for the UK economy, but did mean that overseas’ equity returns (which were actually positive in their base currencies) translated back as being modestly negative when priced in GBP.

- Why was the Pound so strong? It was a combination of Pound strength and Dollar weakness. The Pound was strong on the back of good UK economic data and interest rates which remained high. UK retail sales came in much better than expected for the month of August (with data published last week) and inflation remained steady at 2.2% (as per CPI). The Bank of England held rates steady at 5% last week (widely expected), with Governor Bailey saying, “it is vital that inflation stays low, so we need to be careful not to cut too fast or by too much”. Market expectations are currently pricing in an interest rate cut at the November meeting, with a 60% chance of a further cut at the December meeting, with UK interest rates priced to be 3.5% one year from now.

- Why was the US Dollar weak? The US Federal Reserve cut interest rates by 0.5% last week. This was the first time that the Fed had cut interest rates in 4 years and was larger than the typical 0.25% increment in which they normally move rates. This cut took US interest rates to 5%. Furthermore, the Fed released an updated version of their “summary of economic projections” (or the “dot plot” as its more commonly known), which showed a faster pace of cutting than had been suggested by the previous (i.e., the one released in June) version. The “dot plot” showed that the Fed expect to cut interest rates by a further 0.5% this year, by 1% next year and 0.5% in 2026. This would take the Fed funds rate down to 2.9% by end 2026, which is lower than the Fed had previously forecast. A lower interest rate makes for a lower return on one’s money and can cause a currency to sell-off relative to another; this is likely what happened to the US Dollar last week.

- UK stock markets were down by about 0.5% last week, which took returns for the year-to-date to about 9.5%. Within the UK market, it was the Banks (which generally do better when interest rates are higher – in a healthy economy) which did best along with the mining companies. The best performing stock in the index was Kingfisher (a home improvement company) which rose by about 13.6% on the week following raised guidance (by the company) around earnings and cash flow for this year.

- Bond markets gave up ground last week as bond yields rose. This was most pronounced in the UK market (as the Bank of England held rates steady and economic data came in strong), with UK gilts falling by about 1% on the week. UK 10-year gilt yields closed out the week at 3.9%, with their counterparts in the US closing out the week at 3.74%.

- The Bank of Japan also met last week and kept interest rates unchanged at 0.25%. This was widely expected.

- Emerging market equities were the bright spot last week, with returns being driven by the performance of Chinese stocks (China accounts for about 24% of the emerging market share index). Continued slowing momentum in Chinese economic data looks to have caused the market to start pricing that the Chinese authorities will step up their stimulus measures to support growth, which would, in turn, support Chinese stocks.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.