Stock markets rallied hard last week, with the US (and in particular technology stocks) leading the way. This week the focus will be on the US Federal Reserve meeting, which concludes on Wednesday night. We are expecting to see an interest rate cut from the Fed, but the key focus for markets will be on the direction of travel for future rate cuts. The Bank of England also meet this week (on Thursday), but we’d expect events in the US to set the tone for markets.

Last week

- Global stock markets bounced strongly, with the US technology sector driving the gains.

- US inflation fell back to 2.5%: which helps strengthen the case for interest rate cuts this week.

- Bond markets performed strongly as yields fell.

- The European Central Bank cut interest rates.

- UK economic data was mixed, but wage growth remains strong.

This week

- The key focus this week is the US Federal Reserve meeting which concludes on Wednesday night. An interest rate cut is widely expected. What will be more instructive for markets is the signal that we’ll get around the future direction of interest rate cuts that will be packaged up in the “dot plot” which will be released as part of the meeting.

- The Bank of England meet on Thursday, with no action expected. We expect the next rate cut to come at the November meeting.

- UK inflation data is released on Wednesday.

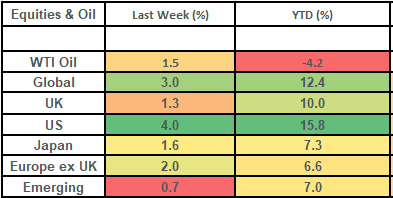

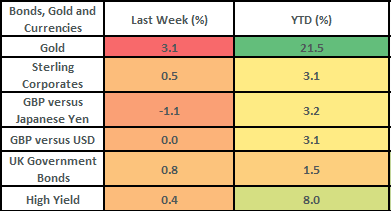

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

More detail:

- Global stock markets bounced back last week, posting their best weekly return of the year! Markets are likely to remain choppy as we head towards the US election on November 5th, hence part of the reason for the rally was likely a reaction to the prior week where markets had sold off. However, there was also some positive news from the US technology sector which helped to drive gains as well as a US inflation number (which was in line with expectations), which helped boost the chances of a US interest rate cut this week.

- The US technology sector was the clear market driver last week. Information Technology (“tech”) makes up about 31% of the US stock market, hence it is a critical driver of market direction. As a sector, it was up over 6% last week, which much of these gains being driven by Nvidia (up 15.7% on the week), which bounced back sharply off the back of some comments from Nvidia CEO Jensen Huang. Huang was speaking at a Goldman Sachs tech conference in San Francico and spoke about demand (for their Blackwell chips) being “so great”.

- US inflation was the other key driver for markets last week. US CPI (Consumer Price Inflation) came in at 2.5% last week. This was a marked drop down from the prior level of 2.9%, was bang-in-line with expectations and meaningfully lower than the high of 9.1% which it reached in June 2022. Last week’s inflation number coming in at 2.5% helped the bond market rally as yields fell to price in lower interest rates. In fact, by the close of last week, bond futures markets were pricing in a 100% chance of an interest rate cut at the Federal Reserve meeting this Wednesday, with a 50% chance of them cutting by 0.5% (as opposed to the more normal increment of 0.25%).

- Housing costs, or “shelter” (to give it its correct term!), continued to be the biggest driver in US inflation numbers. These numbers constitute roughly 35% of the inflation basket by weighting and are heavily driven by “Owners Equivalent Rent” (“OER”), which makes up about 26% of the overall inflation basket. OER is survey data and is based on asking homeowners to say how much they’d be able to rent their home for if they didn’t own it. Hence there is a high degree of subjectivity to it. Other components, such as energy, showed a marked decrease on the prior month and gave the markets confidence that interest rate cuts are coming.

- UK stock markets posted decent numbers last week, with the more domestically focused FTSE 250 doing best. The FTSE 250 rose by 2% on the week, whilst the larger stocks in the FTSE 100 index were up by 1.1%, making for gains of 1.25% in the FTSE All Share.

- Bond markets performed strongly last week, with UK government bonds rising by 0.8% in the week. Bond yields fell due to interest rate cuts being priced into markets. Bond yields fell across all maturities of the bond curves, although the biggest falls were at the front ends of the curve and particularly within the US markets here, since this was where interest rate cuts got most aggressively priced in.

- The European Central Bank met last week and made their 2nd interest rate cut of this year. They cut interest rates from 3.75% to 3.5%.

- Economic data for the UK was mixed last week. Growth data came in flat, showing 0% growth in July. This was a touch lower than expected. However, wage growth data still remains robust, with average earnings (excluding bonuses) seen to be growing at 5.1%; this is more than double the rate of inflation and clearly a healthy growth in real (i.e. after adjusting for inflation) incomes.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.