The last 2 days have seen global stock markets fall by about 5%, with yesterday being their worst day since September 2022.

In this note, we unpack:

- What’s driven the market sell-off?

- What we’ve been doing within the Magnus Portfolios

- Why staying invested and not panicking, in our view remains the right approach for most of our investors. Lower interest rates make for a good opportunity to put capital to work.

What’s driven the market sell-off?

- Fears of a US recession

- Unwinding of the “carry trade.”

- Concentration amongst the big US technology stocks

- Fears of a US recession:

Fears around a US recession have been the key driver in the sell-off. In turn, this prompted an unwinding of the “carry trade” which led to heavy selling, particularly within Japanese equities.

We have written about the US economy before click here for article and believe that whilst it is showing clear signs of slowing, it is still in decent shape. Last week, the stock market reacted badly to 2 adverse data points: a disappointing manufacturing report on Thursday and a disappointing jobs report on Friday. These both followed Wednesday’s Federal Reserve meeting where the US Fed held interest rates at 5.5%. Yesterday saw the release of 2 much more positive US data points, with the Institute of Supply Managers’(ISM) purchasing managers’ index (PMI) services index pushing into expansionary territory along with the ISM employment component indicating increased appetite to invest in their businesses and to recruit.

- Unwinding of the “carry trade.”

Last week’s poor US data points coincided with the Japanese Central Bank hiking interest rates to 0.25%. This may not sound much but it is symbolic since it marks the highest level in Japanese interest rates since 2008. This rise in Japanese interest rates combined with the weak US data prompted an unwinding of the “carry trade” which then saw the Japanese stock market fall by 10.5% yesterday. The “carry trade” has been funded by borrowing cheap Yen and then selling those Yen to invest in riskier, higher returning assets. The slightly higher Japanese interest rate, combined with expectations of lower interest rates and lower returns elsewhere, prompted a fast unwind of this trade yesterday. Basically, higher than anticipated borrowing costs for these investors meant they had to sell quickly. This looks to have righted itself overnight, with the Japanese market closing up 10% this morning.

- Concentration amongst the big US technology stocks

The US stock market has been led up by a small number of large technology focused stocks. These stocks have been powered by the boom in Artificial Intelligence spending and are generally trading at high valuations. Their earnings have been fantastic, but the chances of them surprising markets in a positive way is now fairly slim. We blogged on this just a few weeks back Magnus’ blog on US market concentration and concentration risk is something we guard against within the Magnus portfolios.

As a cohort, these stocks have driven the market higher for much of this year, but in the last 3 weeks they have weighed on returns. Last week saw 4 of these big companies (Meta, Microsoft, Apple and Amazon) report their second quarter earnings. All of them beat their earnings’ expectations, but Amazon missed on its revenue expectations and guided downwards for its Q3 expectations. Given the high valuation (Amazon trades on about 28x forward earnings) and the shaken market mood, the stock was penalized with a 9% fall on Friday: this matters when the stock carries a near 4% weight in the US stock market.

The market was pulled further lower by a 4.65% fall in Apple (which makes up about 6.5% of the US share market) yesterday. This came on news that Warren Buffet’s Berkshire Hathaway was selling nearly half of its stake in the company.

What we’ve been doing within the Magnus Portfolios

The Magnus portfolios are extremely diversified; the combined weight of the biggest 6 stocks within our most equity heavy portfolio is just shy of 7%. This compares to a weighting of close to 30% within the US share market.

The Magnus portfolios are underweight in the technology sector (where much of the global selling has been) and trade on fair valuations.

Furthermore, we took the opportunity at our recent rebalance (end of July) to reduce our exposure to Japanese stocks. The highest exposure we have to dedicated Japanese equity managers is now just 1.7% (in the Magnus Adventurous model) having been as high as 5% prior to the rebalance. Our reason for wanting to decrease the allocation was driven by increased valuations within that market and wanting to increase our exposure to global high quality, cash generative companies, which we did with the introduction of the Evenlode Global Equity Fund.

Furthermore, the bond holdings within the Magnus portfolios have provided excellent ballast as bond yields have fallen over the last week.

Stay invested and don’t panic: Lower interest rates make for a good opportunity to put capital to work.

Although not pleasant, choppiness in markets is not unusual. Choppy times in markets are often where the best returns get made and it is super important to work with your planner and stick to the plan.

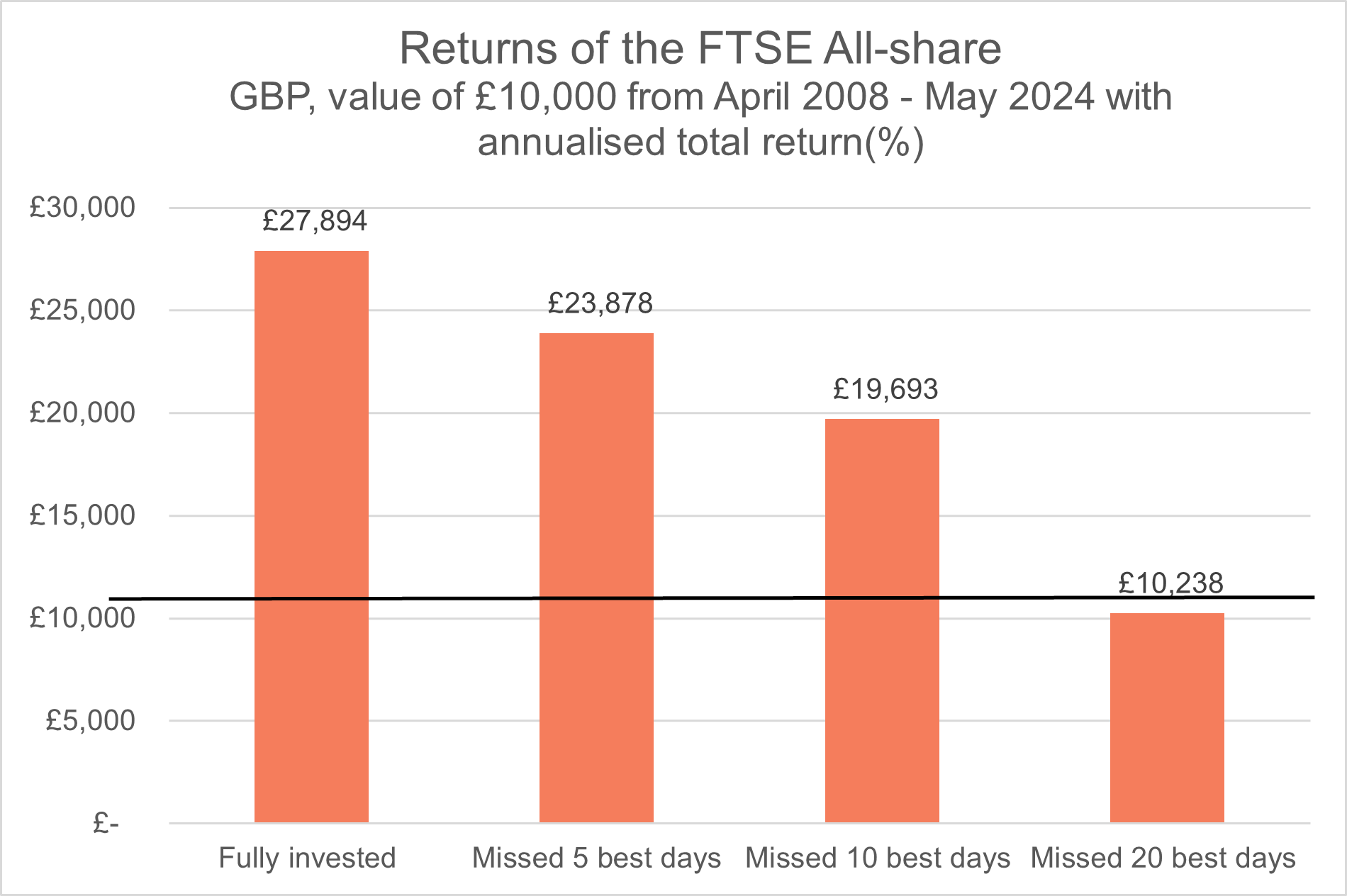

The chart below is taken from a recent blog The importance of being invested, where we showed that the old adage of “time in the market beats timing the market” is one we heartily agree with (and so does the empirical data!). This chart shows that (using the FTSE All Share as a proxy for equities), missing the 20 best days in a 16-year investment period (i.e. missing out on just 0.4% of the investable days) could mean giving up all of the investment return on offer!

Source: Bloomberg, FTSE, Magnus. Past performance is not guaranteed

For now, the market shakeout has not threatened financial stability. As such, emergency interest rate cuts are unlikely. However, both the Federal Reserve and the Bank of England have been consistent in signaling that interest rates are headed down; with the US Federal Reserve signaling interest rates being 2% lower over the next 2 years. Bond markets won’t wait in an orderly queue for interest rate cuts (as the last few days have shown us!) and this means that reinvestment rates on cash products will likely track downwards. Lower reinvestment rates decrease the attractiveness of cash and any short-term stress in markets could be a useful entry point as part of a phased re-investment plan.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.