Weekly Round-Up, 29th July 2024

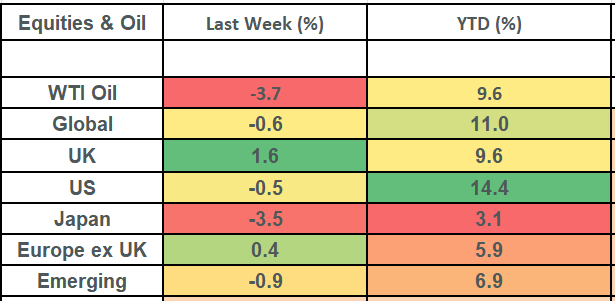

- Global equities recorded mixed returns for the second consecutive week, with small-cap and value shares continuing to outpace the large-cap growth stocks that have led the market over much of the year. It was a tough week for US markets, with the S&P 500 Index selling off on Wednesday by 2.39%. Company news outweighed positive macroeconomic data over the week in the US. In particular, Tesla and Alphabet (Google) earnings reports were perceived as disappointing by the market. On the other hand, UK equities gained 1.6%. Positive developments included the announcement by Reckitt Plc that it will focus on a core portfolio of “power brands” selling its homecare brands and the underperforming Mead Johnson business.

Last week

- US stock markets fell -0.5% last week, with the US technology sector once again weighing on returns.

- US economic data was broadly positive, with the Commerce Department releasing an initial estimate for second quarter growth of 2.8% and inflation figures excluding food and energy prices of 2.6%. The latter development raised hopes among market participants for a Federal Reserve rate cut in the third quarter, perhaps as early as September, although this cannot be guaranteed.

- The UK market bucked the trend with a return of 1.6%. And data suggests the relatively attractive valuations of the UK market are enticing institutional investors back in. According to flow data from Bank of America (cited by the Financial Times), since May institutional customers have become net buyers of UK stock — reversing a long-standing industry trend sparked By Brexit. Additionally, figures from Morningstar show three consecutive months of inflows into mid-sized UK stocks, a sector closely tied to the fortunes of the UK economy, the first inflows since November 2022.

This week

- A week of central bank announcements lies ahead with the US Fed, Bank of Japan and Bank of England all delivering highly anticipated news on monetary policy on Wednesday and Thursday.

- Friday sees the release of non-farm payroll data in the US, the most widely used employment figure and a bell weather for economic health.

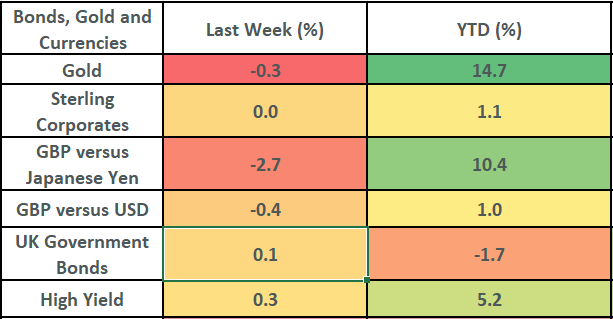

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

More detail:

- Why were the disappointing reports from Tesla and Google so significant? Because large AI and technology companies have pushed global markets to all-time highs several times this year their valuations have become increasingly stretched compared to fundamentals such as book value, therefore any perceived negative news can cause a sell-off.

- We are in the middle of the US second-quarter earnings season. 41% of S&P 500 companies have reported so far and earnings are on track to grow 9.7% year-over-year, above expectations for 9% growth at the end of the first quarter, according to US stockbroker Edward Jones, citing data from FactSet. The largest upside earnings surprises have come from sectors like financials, energy, and health care, more so than technology and growth sectors indicating the potential for a welcome broadening out of US market participation and performance away for the narrowly focused “Magnificent 7”.

- Last week was tough for Japanese equities with market wobbles and currency moves ahead of the widely discussed and anticipated Bank of Japan meeting on Wednesday 31st The consensus is that Japan won’t increase interest rates but will begin to slow its large-scale purchases of government bonds and this will be confirmed or disproved at the meeting. Given the size of its balance sheet and large influence in the market, any change creates various factors for policymakers to consider.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.