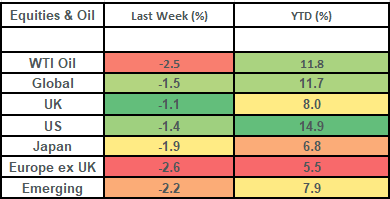

Global stock lost ground last week, with the US market losing ground and posting its worst week since April. On the face of it, last week was a soggy week for stocks after a strong recent run which has seen them rise by c9% since mid-April. However, beneath the surface there was a big rotation, notably within the US market. US smaller companies performed well, (having their best week relative to the big tech stocks in well over a year), but the larger companies within the index dragged the overall index level down. Bond markets were flat as inflation tracked sideways. This week sees some of the big US companies (e.g. Alphabet) report their Q2 earnings and we also see the release of PMI data globally.

Last week

- Global stock markets fell last week, with the US technology sector weighing on returns.

- US corporate earnings (which are the key driver for long-term returns) continued their positive trajectory.

- UK shares paused for breath after a strong recent run.

- UK inflation remained at 2% and the bond yield curve shifted to a more positive stance.

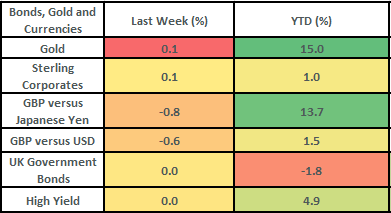

- Bond markets were flat on the week.

This week

- It’s a busy week for corporate earnings as well as economic sentiment indicators.

- In the UK we have earnings reports from Reckitt Benckiser (Wednesday), Lloyds, ITV, Astrazeneca and Anglo American (Thursday) and Natwest on Friday.

- In the US, Alphabet, Tesla, Visa and General Motors report on Tuesday and IBM, AT&T and Ford report on Wednesday.

- PMI (Purchasing Managers Index) data is released for the major economies over the week, with the US and UK data out on Wednesday.

- Q2 US growth data is released on Thursday. This will be closely watched for signs of slowing in the US economy and the readthrough to when the first interest rate cut will be coming.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

More detail:

- Global stock markets fell by about 1.5% last week, with the US technology sector weighing most heavily. The tech sector was hampered by news that the Biden administration was considering export curbs on chip manufacturers as well as the global outage to computer systems on Friday. Technology carries a 25% sector weight in the global index and hence has a big impact. Notwithstanding this, there was some decent performance for small-cap and value shares, with these styles having their best week relative to technology in well over a year.

- US corporate earnings season continued to move along pretty well last week. It is still early days (with only 14% of companies in the index having reported), but the broad picture is positive. Blended earnings growth (for Q2) is running at 9.7% year-over-year which is a bit better than expected and on track for being the highest rate of growth since Q4 2021. So far, financials have reported good numbers (banks and credit card companies) and there were also some decent numbers last week from Netflix. Netflix beat on earnings and revenue expectations and now has 277.65 total paid memberships. Despite this good backdrop, Netflix’s revenue guidance for the 3rd quarter was a bit less than analysts had been expecting and the stock fell back by about 1.7% on the week, with a lot of hope being baked in after a c28% rise so far already this year.

- UK stock markets gave up some ground last week after a strong recent run. The materials sector (c8% of the FTSE 100) weighed on returns within the large-cap index following some disappointing production numbers from Antofagasta, whilst the more domestically focused FTSE 250 held up a bit better. Furthermore, continued signs of strength in the economy meant that the market’s pricing of when the first interest rate would be got delayed to later in the year.

- UK inflation came in at 2% last week for the 2nd month in a row. This good number also came alongside a drop in wages, with average earnings (excluding bonuses) coming in at 5.7% which is their lowest level since mid-2022. However, services inflation continued to be sticky, staying at 5.7%, with restaurants and hotels making a big contribution to the overall number. Inflation at 2% for the 2nd month in a row is clearly a good thing (and a marked difference from the 11.1% reading we had in October 2022!). However, it was a touch higher than economists (surveyed by Bloomberg) had been expecting and as such, the pricing for a first interest rate cut by the Bank of England got moved from the August meeting to the September meeting.

- Bond markets were flat on the week, with the 10-year UK government bond yield closing out the week at 4.12%. We’d note that there have been some improvements in the shape of the UK bond yield curve this year and that 10-year bonds are now yielding more than 2-year bonds for the first time in over a year. This is important as it is generally viewed as a sign of a healthy economy (i.e. that investors get rewarded for investing for longer periods of time due to there actually being some long-run growth!).

- The European Central Bank met last week and held their interest rates at 3.75%, having recently made a 0.25% cut at their June meeting.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.