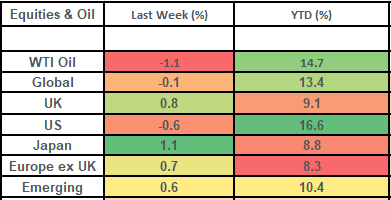

Global stock markets fell modestly last week. This was due to Pound strength which meant that modest gains in US stocks actually translated back to losses (when converted back to Sterling). Away from the US markets, gains were pretty decent across the board, with Japanese shares leading the way. This week markets will be focused on what the increased probability of a Trump Presidency might mean as well as comments from Fed Chairman Powell who’s speaking today. Alongside this, there’s a slew of UK economic data and a smattering of companies reporting their Q2 results.

Last week

- Global stock markets fell last week, although this was due to the strength in the Pound.

- UK share markets had a good week on the back of a very strong economic growth number.

- There was a big rotation trade in the US on Thursday last week (following a lower-than-expected inflation number), with smaller companies strongly beating the mega cap tech companies

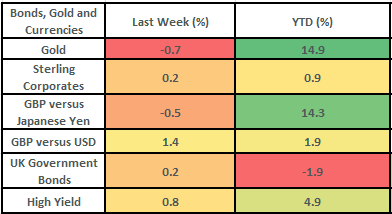

- Bond markets made modest gains, with US bonds doing better than UK bonds.

This week

- UK inflation is due out on Wednesday. It is expected to drop to 1.9% according to economists surveyed by Bloomberg. UK employment data is out on Thursday and UK retail sales data is published on Friday.

- The European Central Bank meet on Thursday. They are expected to maintain interest rates at 3.75%.

- Earnings season continues apace. Goldman Sachs reports today, Bank of America reports tomorrow, Wednesday sees ASML, Alcoa and Johnson and Johnson reporting, and we have Novartis and Netflix reporting on Thursday.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

More detail:

- Global stock markets fell by about 0.1% last week. This modest fall was due to the strength in the Pound which rose by about 1.4% vs the US Dollar, meaning that US equity returns faced a headwind when being translated back into Sterling. Most other markets enjoyed decent gains last week, but these were drowned out by the modest losses of US equities given that the US market comprises c70% of the global share index.

- UK share markets had a good week, rising by about 0.8%. Within this, it was the smaller companies which did best, with the FTSE 250 index of shares rising by about 2%, whilst the FTSE 100 rose by just 0.6%. This disparity is not unusual when Sterling is strong since the larger companies in the 100 index source a much greater portion of their earnings in US Dollars.

- Stronger economic growth was one of the key reasons for UK shares doing well last week. Growth data on a rolling 3-month basis came in at 0.9% which was better than expected and also made for the best reading since January 2022. Furthermore, the previous reading got revised upwards and the monthly reading for May (of 0.4%) was twice as high as expected.

- Although the US share market posted modest losses, there were lots of interesting movements beneath the surface! Gains in the US share market this year have been dominated by large technology companies. Last week saw a reversal of this, with the release of Thursday’s inflation data being the catalyst. US CPI came in at 3% from its prior level of 3.3%, with “core” inflation also dropping. The 3% reading made for the lowest print since June last year and the 2nd print in a row that had come in less than expected. Off the back of this, US small cap shares posted their biggest daily gain since December and an equal weighted index of US companies posted its biggest daily outperformance of the market cap weighted index since 2020!

- Bond markets posted modest gains last week but it’s worth noting that US Treasuries out-performed UK gilts. The lower US inflation number meant for the timing of interest rate cuts being brought forward by the bond markets, with the bond futures markets closing the week pricing in a 95% likelihood of the first interest rate cut coming at the Federal Reserve’s September meeting. UK government bonds did post small gains on the week, but these were tempered by the better growth data which had the impact of the delaying the timing of the first interest rate cut, with the bond futures market now split as to whether this comes at the August or September meeting.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.