With the US stock market bobbing around at record high levels, it might seem a bit odd to cite the economy as showing signs of creaking! However, (much like the stock market itself!) there’s two clear strands to the US economy: one that’s reaping the rewards of record high prices and the other that’s bearing the brunt of higher interest rates. It’s this latter cohort that moves the dial on US growth and we expect support to come soon in the form of interest rate cuts.

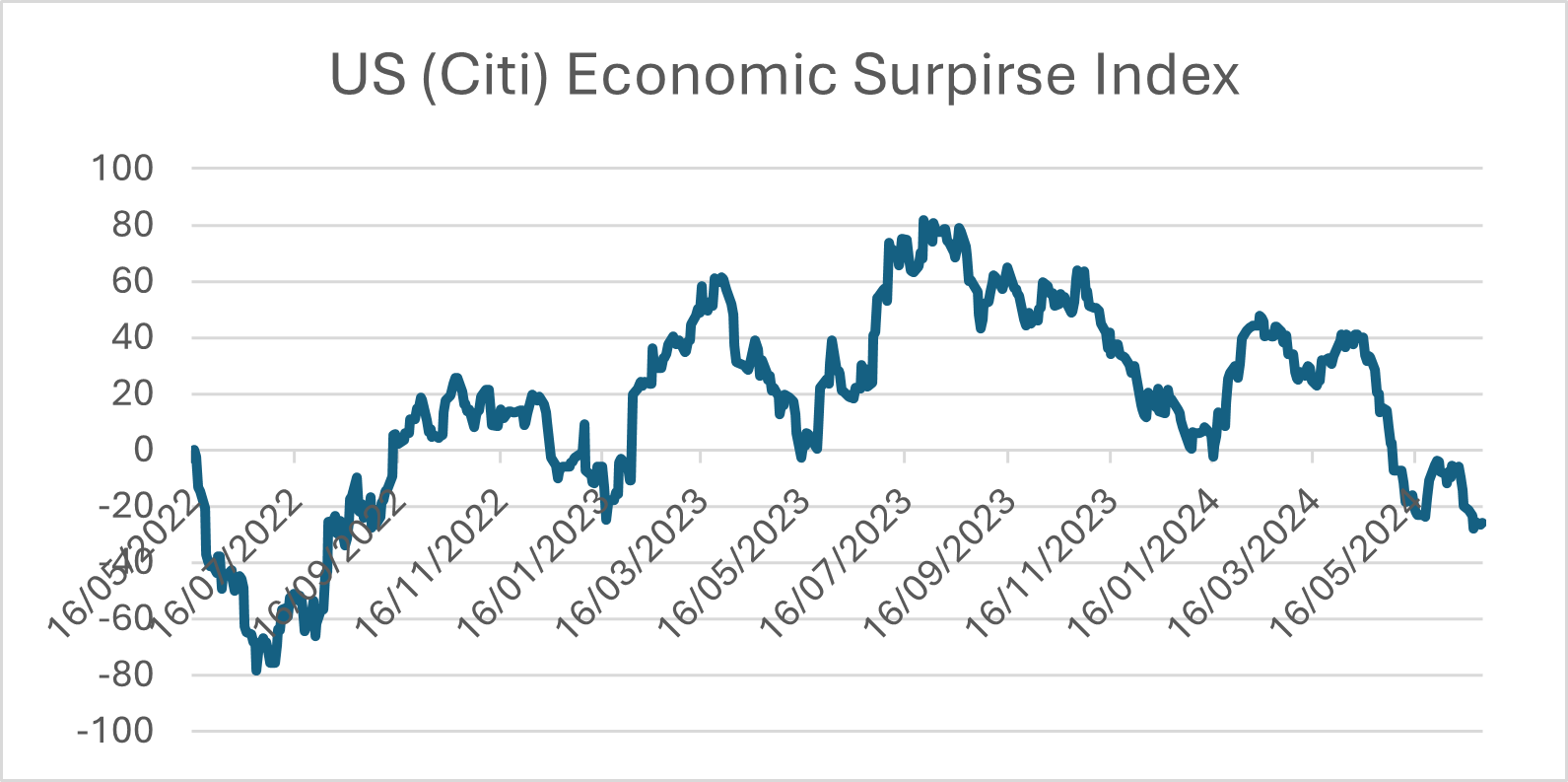

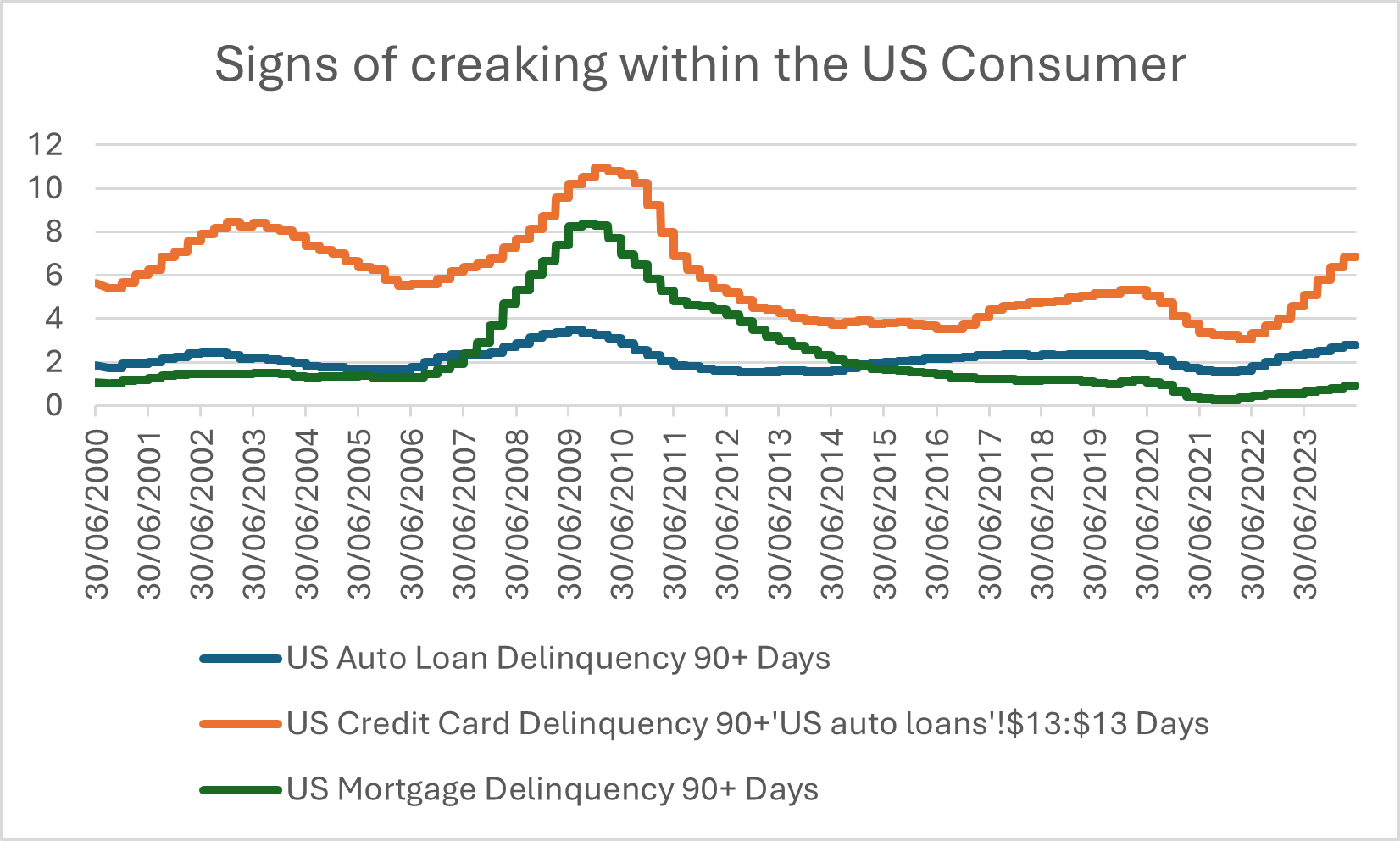

The last few months have seen a downward turn in US economic data following a period of super-charged growth (that saw the economy enjoy six consecutive quarters of plus 2% growth). Economic data has broadly underwhelmed, consumer confidence has taken a knock, savings rates have dropped, and we’ve seen a pick-up in delinquencies on auto-loans and credit card debt in general. Why does this matter to the US economy? The US consumer accounts for close to 70% of US growth. Recent data, such as the halving in the monthly growth rate of personal consumption, provides evidence that consumer led growth is under pressure. Cuts to interest rates are a great way to change this pattern and the US Federal Reserve have been very consistent in flagging this as the direction of travel.

US Economic Data has started to surprise to the downside: [1]

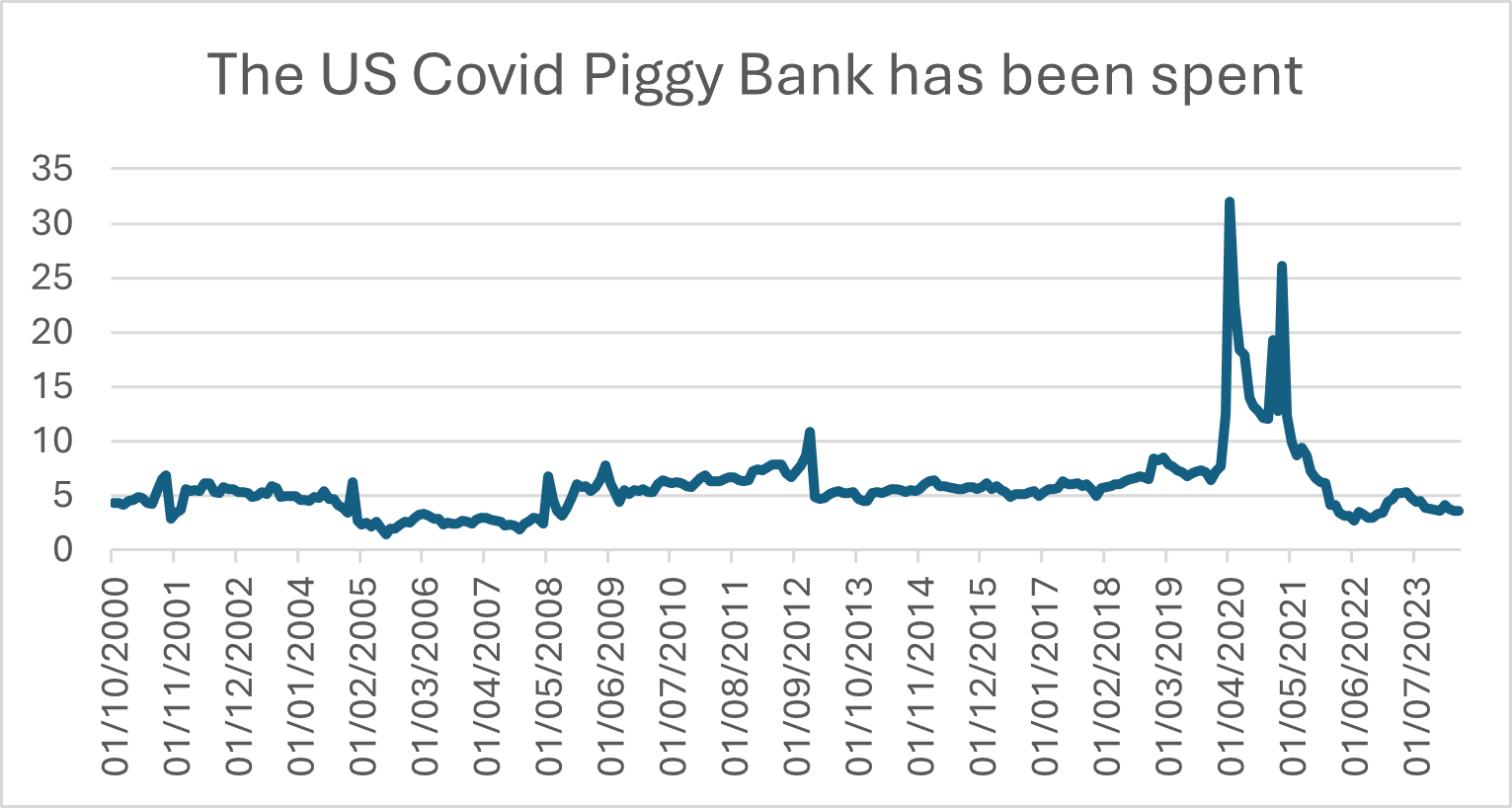

Savings’ rates have fallen below long-term averages (and are now running at 3.9%): [2]

The US Consumer is starting to miss payments on purchases made on credit: [3]

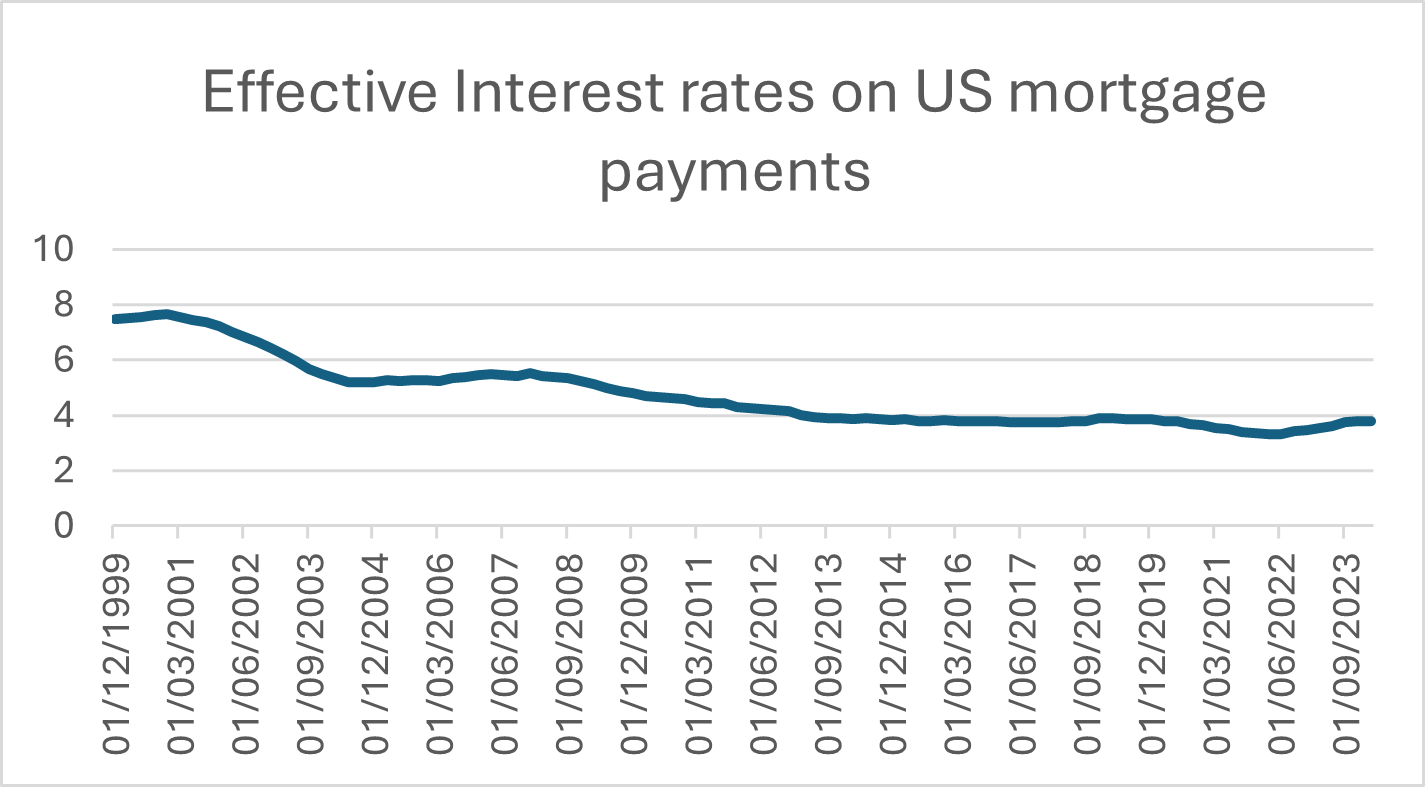

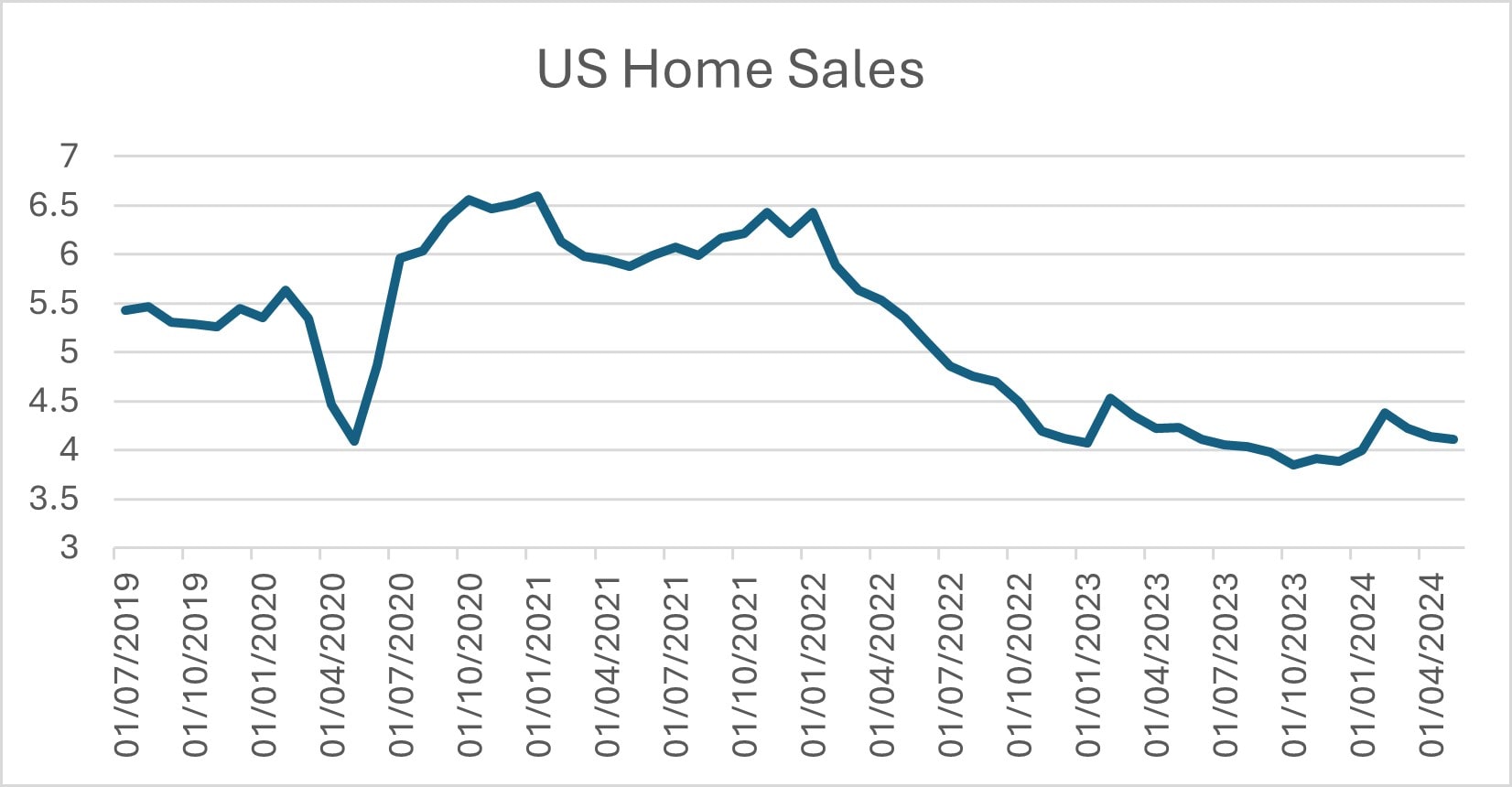

Speculating on exactly when the first interest rate cut comes is something of a spectator sport (I’m as guilty as anyone here), but the confidence that they do come is the key driver for the consumer and therefore stock markets. To this end, the Federal Reserve (despite changing the rhythm) has been consistent in its communication that we can expect policy rates at around 3.1% by 2026; i.e., about 2% lower than they are today. This will boost the cash strapped US consumer and also help free up the US housing market (which has been pretty stagnant for the last 2 years by virtue of homeowners being locked into low-rate mortgages: see charts below).

US homeowners have locked into low-rate mortgages (at an average effective rate of 3.8%): [4]

But, mortgages are (generally) not portable, so people aren’t moving! [5]

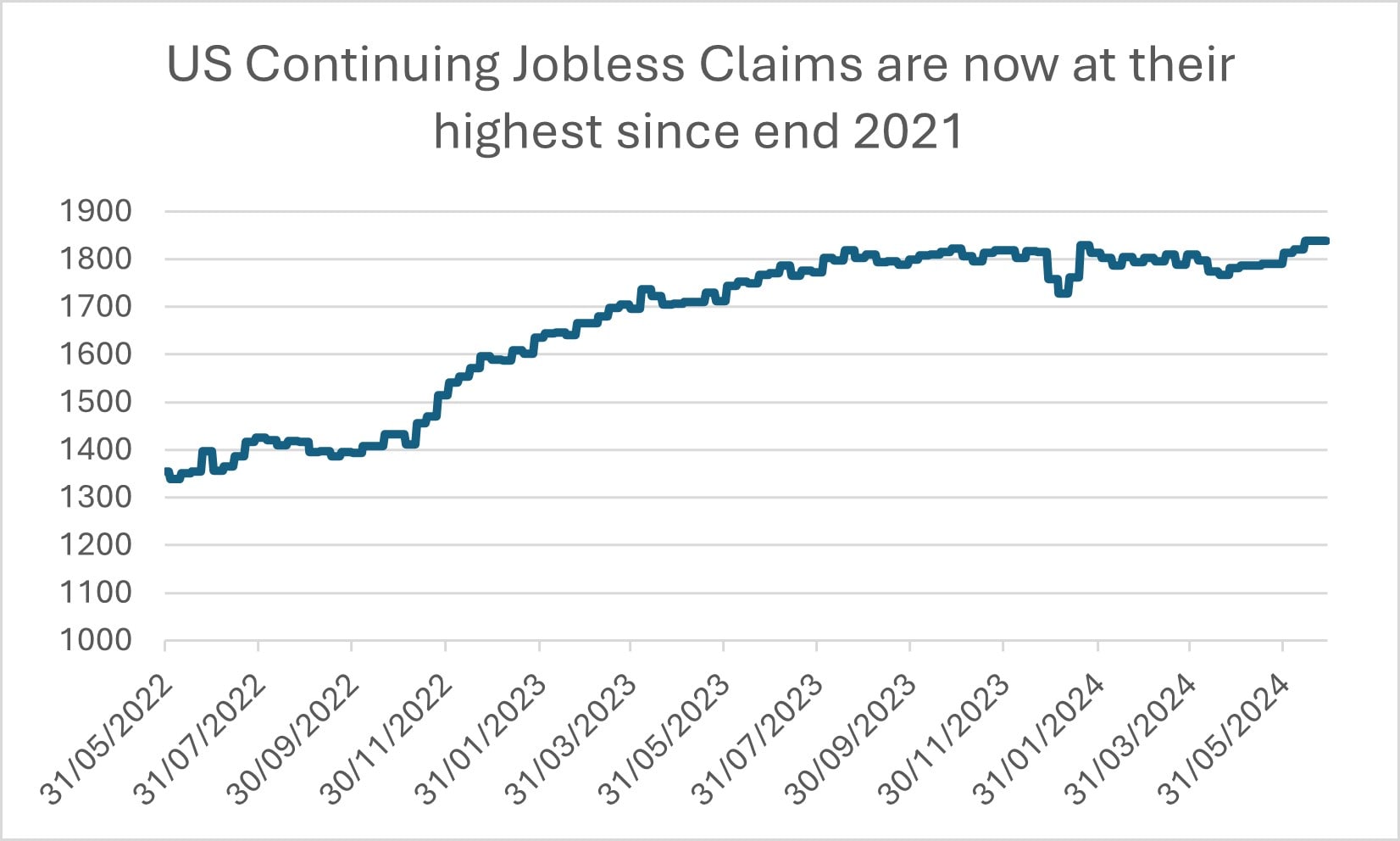

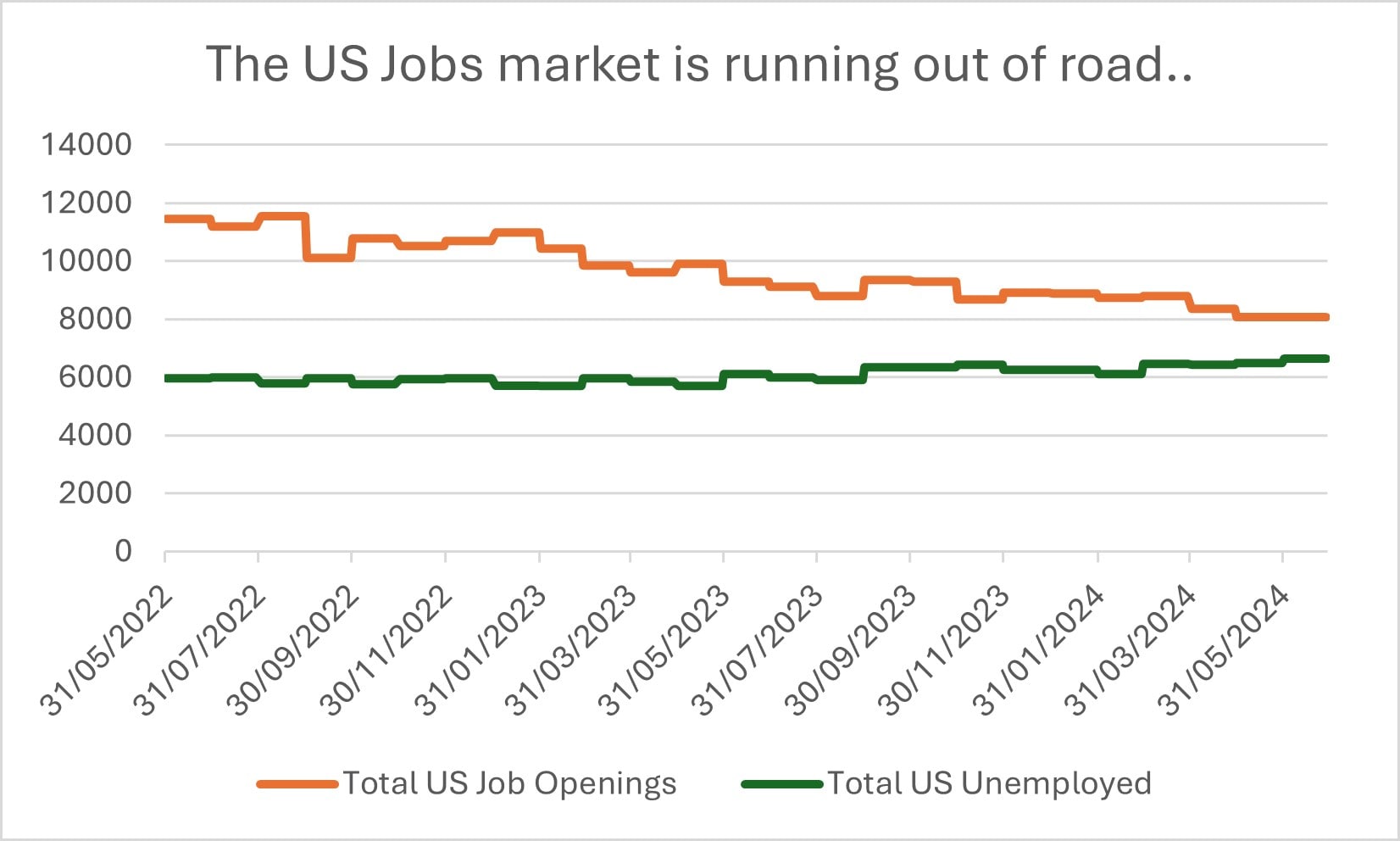

A stagnant US housing market has had two broad impacts: those with houses have got richer (less transactions have bid up prices) and those who rely on all the positive spillovers of housebuilding have got poorer. This dynamic is starting to be felt in the US jobs market, with unemployment ticking up and unemployed workers taking more time to find a new job (perhaps needing re-location, combined with a new, more expensive rental agreement). We can see this in the charts below looking at the pick-up in continuing claims data and also the decrease in number of available jobs evidenced in the last 2 years:

The US worker is finding it harder to find a new job: [6]

Because there are less jobs available, and they might not match to their skill set (or location!): [7]

These charts all point to some form of slowdown in the US, which argues for the circa 2% of interest rate cuts that the Federal Reserve has guided towards. On the face of it, this might seem a bit “glass half-empty,” which would be bad news for stock markets. We take a more “glass half-full” approach. We expect any slowdown to be short-lived and for interest rate cuts to breathe life into areas of the stock market that have are already priced for a slowdown (e.g., sectors such as Industrials, Staples and Financials which have seen positive earnings’ revisions but little expansion in their multiples). We’d also note that debt issuance from both consumers and corporates has been relatively low (i.e., they’ve been prudent) and there remains a wall of money sat in money market funds (generally accumulated by the richer cohort) that sits waiting to pounce on any pull-back.

“Creaking not cracking” is where we get back to when we look at the US and we expect synchronized global interest rate cuts to breathe new life into consumers’ wallets and broad reaches of the stock market. In turn, this should feed across to UK assets and help boost returns in the next phase of this equity growth cycle.

Investments can go down as well as up and you may get back less than you invested.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.

[1] Chart shows US economic surprise index. Source: Bloomberg.

[2] Chart shows US savings rates in % terms. Source: Bloomberg.

[3] Chart shows % of loans being defaulted on as per US NY Fed Equifax Transition data. Source: Bloomberg.

[4] Chart shows effective rate on US mortgages in %’s. Source: Bloomberg.

[5] Chart shows monthly US home sales in millions. Source: Bloomberg.

[6] Chart shows US Continuing Jobless Claims. Seasonally adjusted in Thousands. Source: Bloomberg.

[7] Source: Bloomberg. Units are in Thousands.