Nobel Prize winner Harry Markowitz is reported to have said that “diversification is the only free lunch in investing”. We agree! Our goal at Magnus is to give our clients the best returns, while taking as little risk as possible. Our approach targets high “risk-adjusted” returns in finance speak, or put simply, the best possible bang for buck!

We achieve this by spreading our clients’ assets across a broad range of managers, asset classes, styles and sectors. The opposite of this is a concentrated approach; one that works handsomely if all goes well and hurts badly if it doesn’t. The US index (in particular) is the most concentrated it’s been since the early 1960s, so this is a very real problem investors face today.

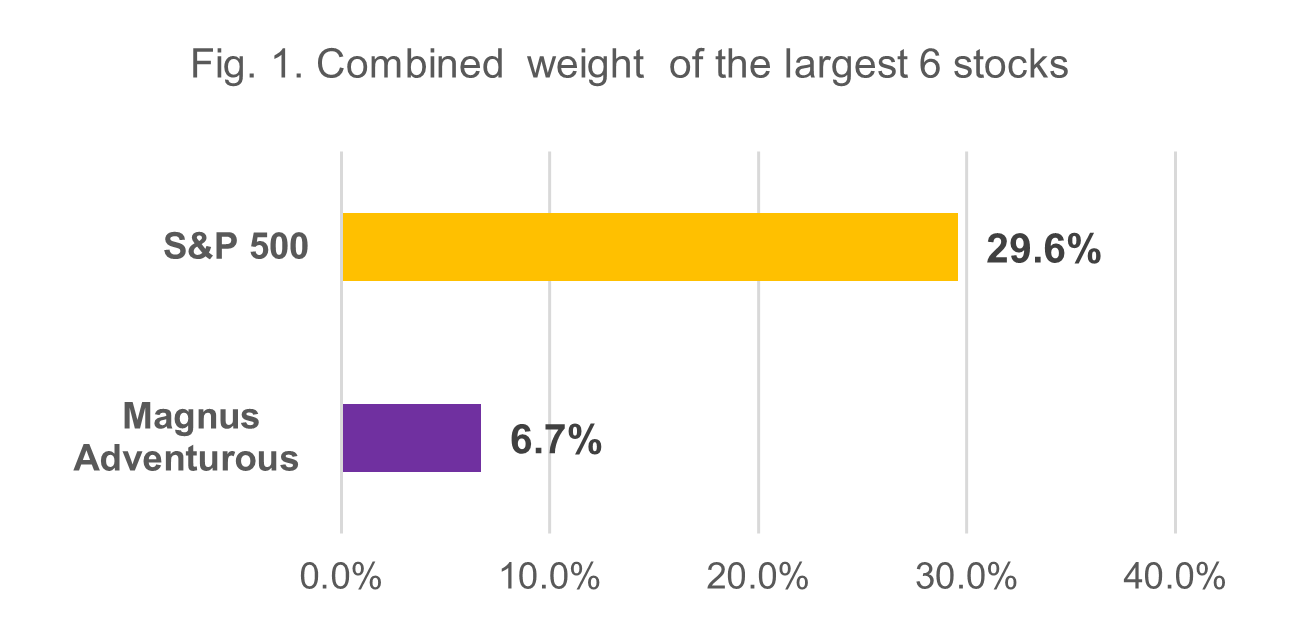

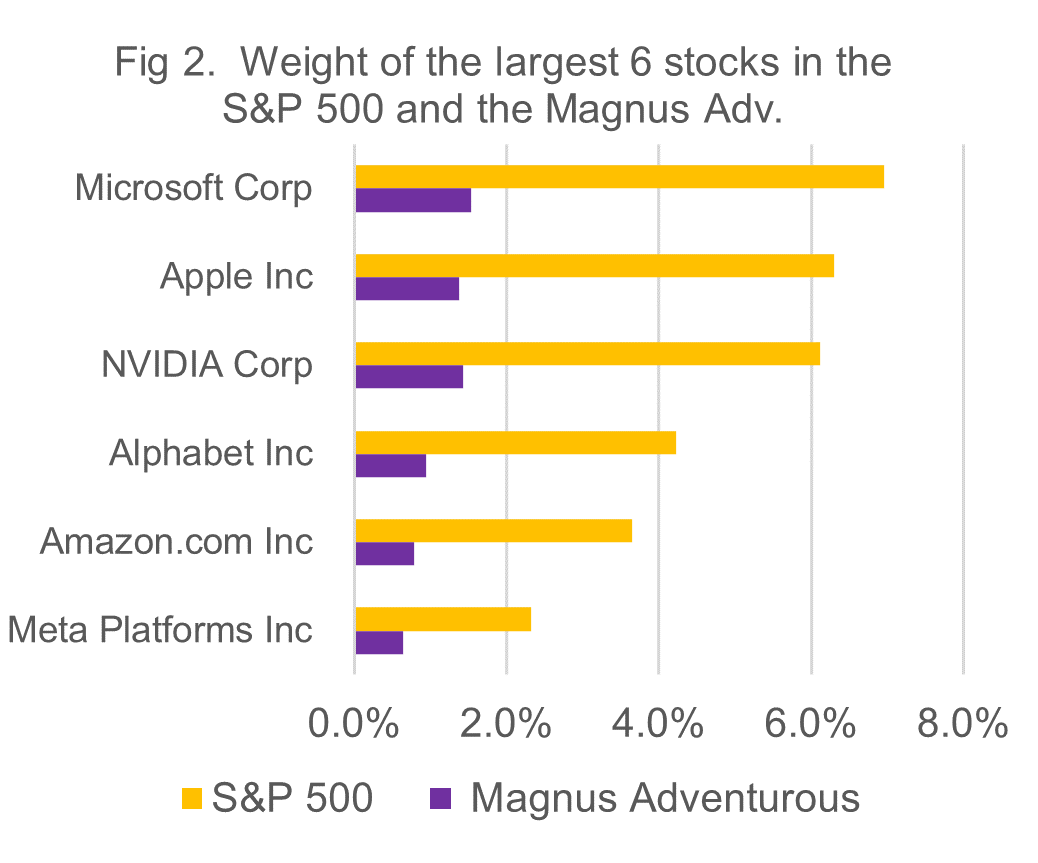

This is illustrated in the chart below, with the top 6 stocks in the US index (home to c500 companies) comprising close to 30% of the index’s weight! It’s little surprise they’re also known as the “super 6”. Furthermore, these companies are all tied up in the same trade and, to a large extent, are customers of each other via their spend on artificial intelligence and computing chips. Contrast this to the Magnus approach, where our Adventurous model portfolio has just shy of 7% within these companies.

To be clear, we think these “super 6” are fantastic companies. They generate enormous amounts of profit and have earned their positions in the index. Our cry is one of risk management. We have made strong returns for our clients by having some exposure to these names, but don’t believe a concentrated approach represents prudent risk management.

Not only do we cast our net wider, but we try to target cheaper valuations. This means having meaningful exposure to markets such as UK and Emerging market equities. Here, the managers we deploy find sectors like UK banks (which are broadly keeping pace with big US technology companies) but trade on a fraction of the valuation, which offers a higher protection cushion.

The “super” US companies are hugely cash generative (they are definitely ‘sausage with sizzle’ as opposed to the dot com cohort that were all sizzle and no sausage) but have also become victims of their own success. The market is now expecting ever higher sales numbers at each quarter’s results and any miss is likely to have a ripple effect across the group.

At Magnus, we steer away from a concentrated approach and instead prefer to have just 7% in these stocks as opposed to the circa 30% as comprised by the US share market. We continue to focus our concentration on staying diversified, as we believe this is the right way to navigate the peaks and avoid the troughs.

The information is correct as at 30/6/2024. Investments can go down as well as up and you may get back less than you invested.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.