Global stock markets were flat last week but this didn’t take the shine off in what was a very strong month of returns (for June), with the global share index up by 2.9%. UK stock markets have been treading water over the last few weeks and will look forward to this week’s General Election for some certainty to build on and for a return to fundamentals. Whilst the General Election likely grabs most of the press attention this week, global markets will be more focused on the Eurozone inflation print (out tomorrow) and on the US monthly jobs number (out on Friday).

Last week

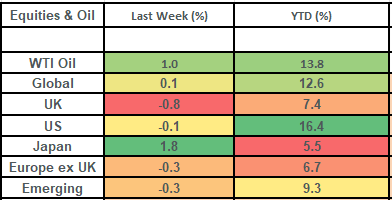

- Global stock markets tracked sideways in a quiet and uneventful week

- June was a positive month for global stock markets, with US technology stocks driving returns

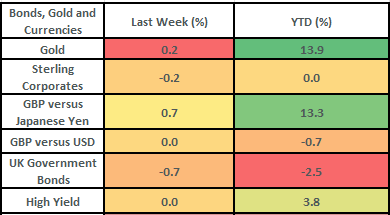

- Bond markets gave up ground last week but posted decent gains in the month of June

- UK growth data for the first quarter was finalised and came in better than expected

This week

- There’s a lot going on this week!

- Thursday’s UK election will be closely watched by local market participants (global markets will likely not pay it much mind unless there’s a large upset)

- Friday sees the release of the monthly jobs data from the US (Nonfarm Payrolls)

- Eurozone inflation is released on Tuesday

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

More detail:

- Global stock markets were little changed on the week in what was a quiet week for newsflow. The key data points for the week were Friday’s US core PCE (inflation) numbers, which showed a 0.1% rise in May (lower than the upwardly revised 0.3% increase in April) and the UK’s finalized Q1 growth (GDP) number which came in at 0.7% (0.1% higher than the 0.6% initial reading). This is the best quarter of growth we have had since Q4 2021 and is confirmation of the UK’s emergence from recession.

- Global stock markets had a good June, rising by about 2.9%, but there was much dispersion beneath the surface, with most of the gains being driven by the large US technology companies whilst many other sectors paused for breath. The technology sector was up by 9.9% in June, which continues the theme of 2024, with the technology sector up by 26% in the first half of the year. Although they’re not all strictly tech companies, much of the gain in the index this year has come from the so called “Magnificent 7” (Nvidia, Microsoft, Apple, Google, Meta, Amazon and Tesla), with an average gain of 39% (in spite of Tesla being down by 20%). Within this cohort, Nvidia has very much led the way, up by c150% in the first 6 months of the year.

- UK stocks gave up ground last week, falling by 0.8%. This has been the case over the last month, where they’ve fallen by 1.1%, with most sectors treading water ahead of the election following a strong run in April and May. DS Smith was a notable outperformer in the FTSE 100 index, up by 16.5% on the week on expectations that International Paper’s planned acquisition (of DS Smith) would move ahead.

- Japanese stocks posted a decent week, rising by 1.8%, with much of the gains being driven by exporters enjoying the benefits of the weak Yen (which has now fallen by 13% vs the Pound this year).

- Bond markets gave up a bit of ground last week (with UK gilts selling off by 0.7%) but still posted a decent month (up by 1.3%). Government bonds have tended to perform better than corporate bonds over the course of the last month as yields have fallen on the anticipation that interest rate cuts are on the way: with the first cuts being priced by bond futures markets for August in the UK and September in the US. The UK 10-year gilt yield closed out the week at 4.17%.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.