Global stock markets rose last week, with UK domestic stocks putting in a good showing on the back of inflation getting down to 2%. Despite the Bank of England making no changes to interest rates (holding them at 5.25%), UK markets were encouraged by the 2% inflation reading and positive tone from the Bank’s statement. It’s a quiet week ahead to round off the month, with most of the scheduled data coming towards the end of the week.

Last week

- Global stock markets rose for a 3rd consecutive week.

- UK inflation dropped down to 2%.

- The Bank of England held rates at 5.25% and the bond market is now pricing a first interest rate cut in August.

- US economic data showed further signs of slowing (albeit from a very high base)

- Bond markets were fairly flat on the week.

This week

- It’s a pretty quiet week in terms of scheduled data.

- US consumer confidence data is out on Tuesday and US PCE inflation (the Fed’s preferred measure) is out on Friday.

- In the UK we have our finalized Q1 growth number being released on Friday and there’s also a smattering of company reports, with Thursday seeing full year earnings from Currys and Halfords and a trading update from Lloyds.

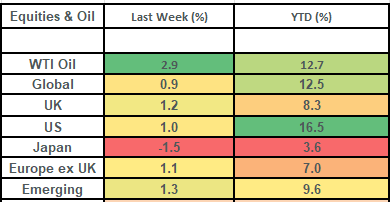

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

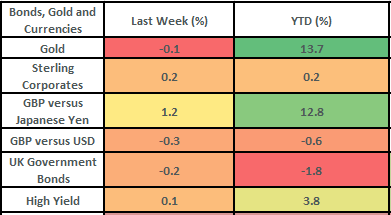

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

More detail:

- Global stock markets rose for a 3rd consecutive week to take returns for the month of June to 2.8% and to 12.5% for the year-to-date. All major markets rose by about 1% on the week with the exception of Japan which fell back by 1.5%, mainly due to currency weakness.

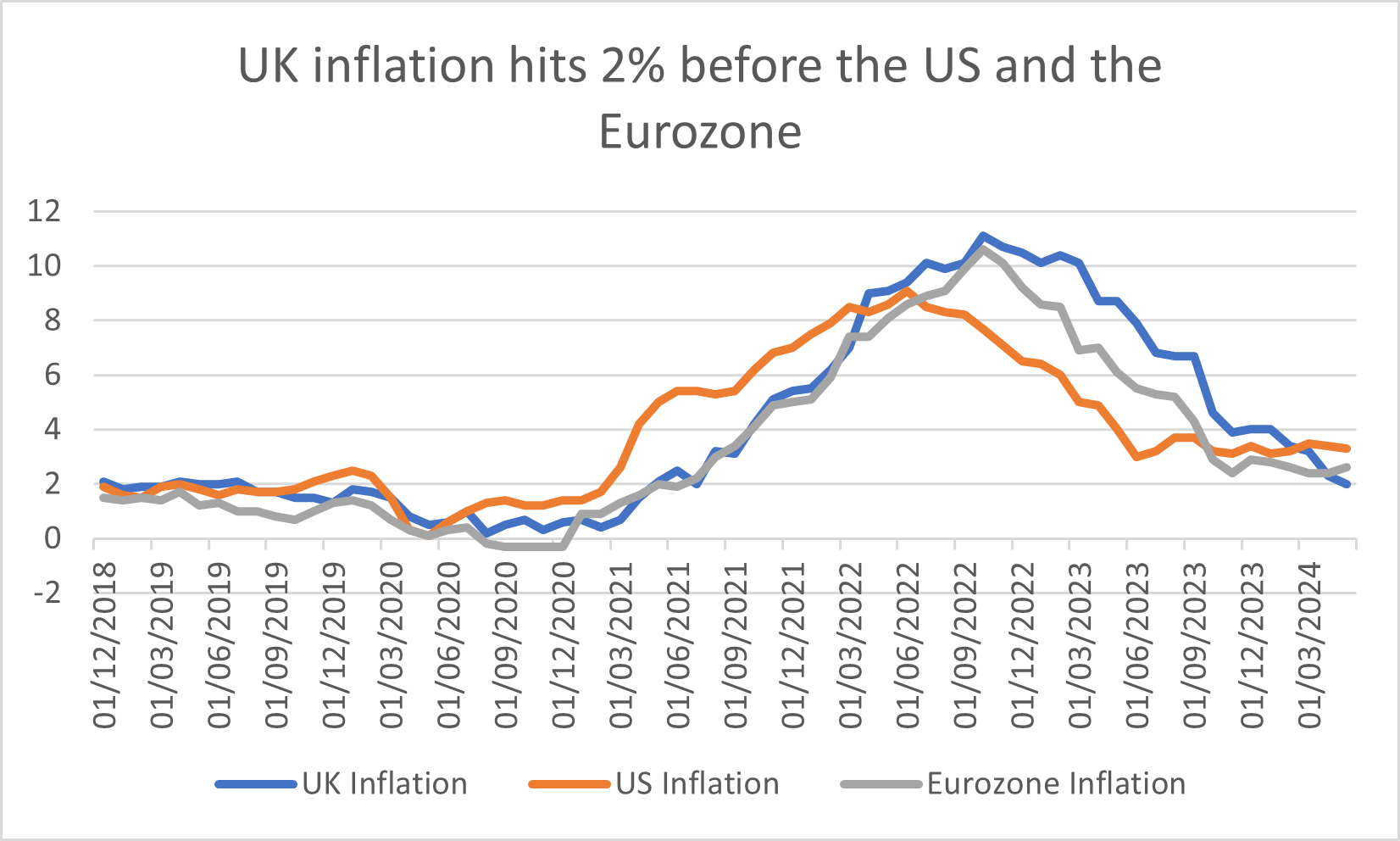

- UK stocks rose by about 1.2%, with domestic stocks (i.e. the FTSE 250) performing best, rising by about 1.7%. The key driver for the stronger domestic performance was the 2% inflation reading (CPI) which came out on Wednesday. This is the lowest inflation reading we’ve seen since July 2021. Furthermore, it means that inflation has now got back to the Bank of England’s target of 2% (having been up at 11.1% in October 2022) and means that the UK is the first out of the US and the Eurozone to get inflation back down to 2% (see chart).

- This good news on UK inflation came the day before the Bank of England’s meeting where they voted (7-2) in favour of maintaining interest rates at 5.25%. The Committee’s statement noted that the risks were “finely balanced” and that, combined with the fact that 2 of the nine members had voted to cut rates at this meeting, led the bond markets to price in a first rate cut in August. This helped boost the stock market.

- US economic data was a bit weaker than expected last week, with retail sales coming in lower than expected. There was also some housing data (housing starts and building permits) which pointed to a slowdown along with a higher-than-expected number of people filing for jobless claims. This slight weakness in US data helped certain parts of the stock market, i.e. the areas that benefit from slightly lower interest rates. Consumer discretionary stocks performed particularly well (with Amazon up over 3.3% on the week for example) as lower interest rates will mean that consumers have more money to spend.

- Bond markets were fairly flat on the week, with credit (investment grade and high yield) holding up pretty well as spreads narrowed and government bonds selling off a touch (amidst heavy issuance). Government bonds are having a pretty strong month, with UK gilts up by 1.9% so far in June with the UK 10-year bond closing the week at 4.08%.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.