This is the current question we’re receiving most regularly, so we thought we’d put pen to paper and share our thoughts!

Our view is fairly nuanced and quite detailed, but the quick of it is that there’s a lot to be positive about what we’ve seen of Labour’s policies towards UK investment markets and we think this has been a contributing factor to strong recent returns.

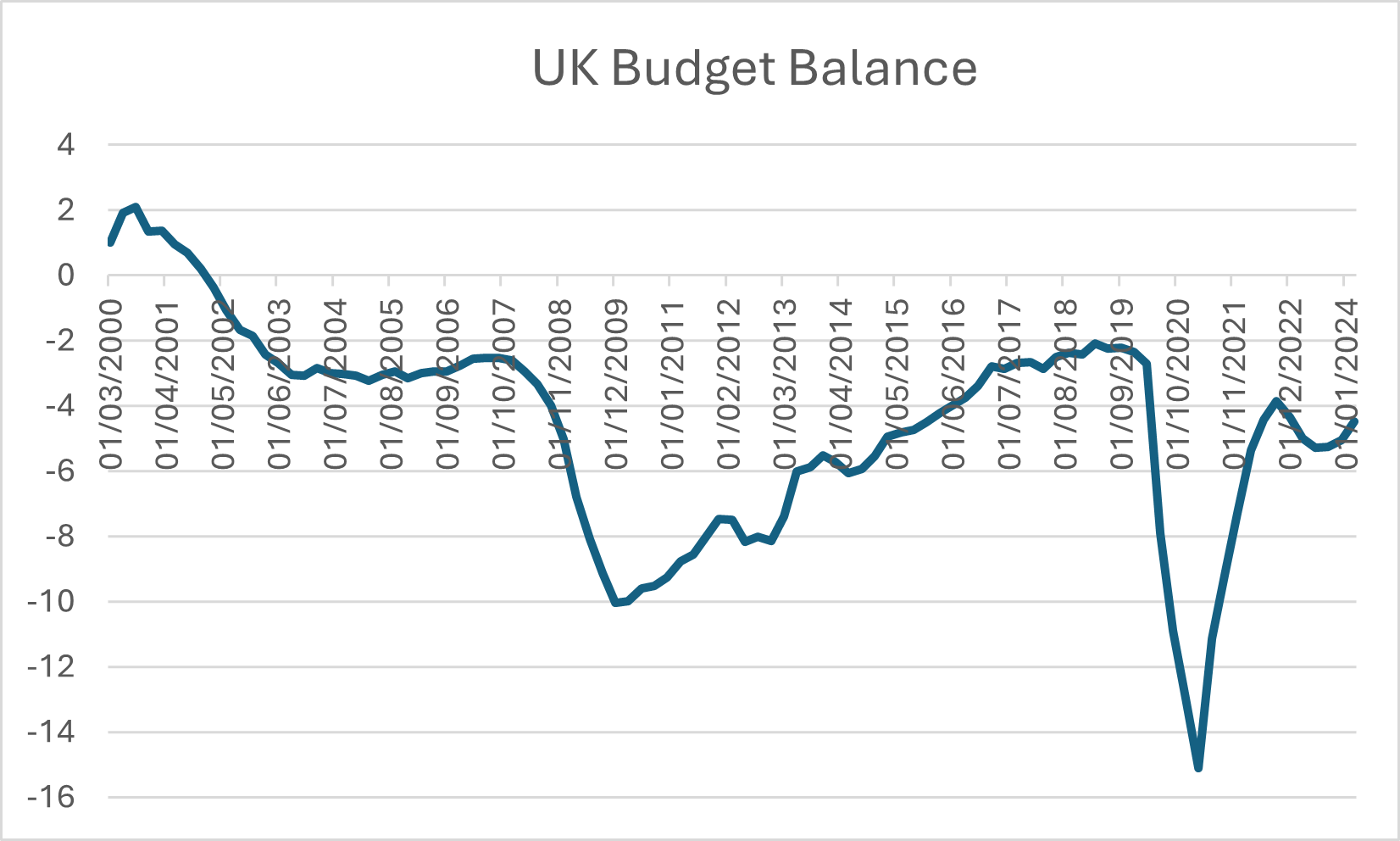

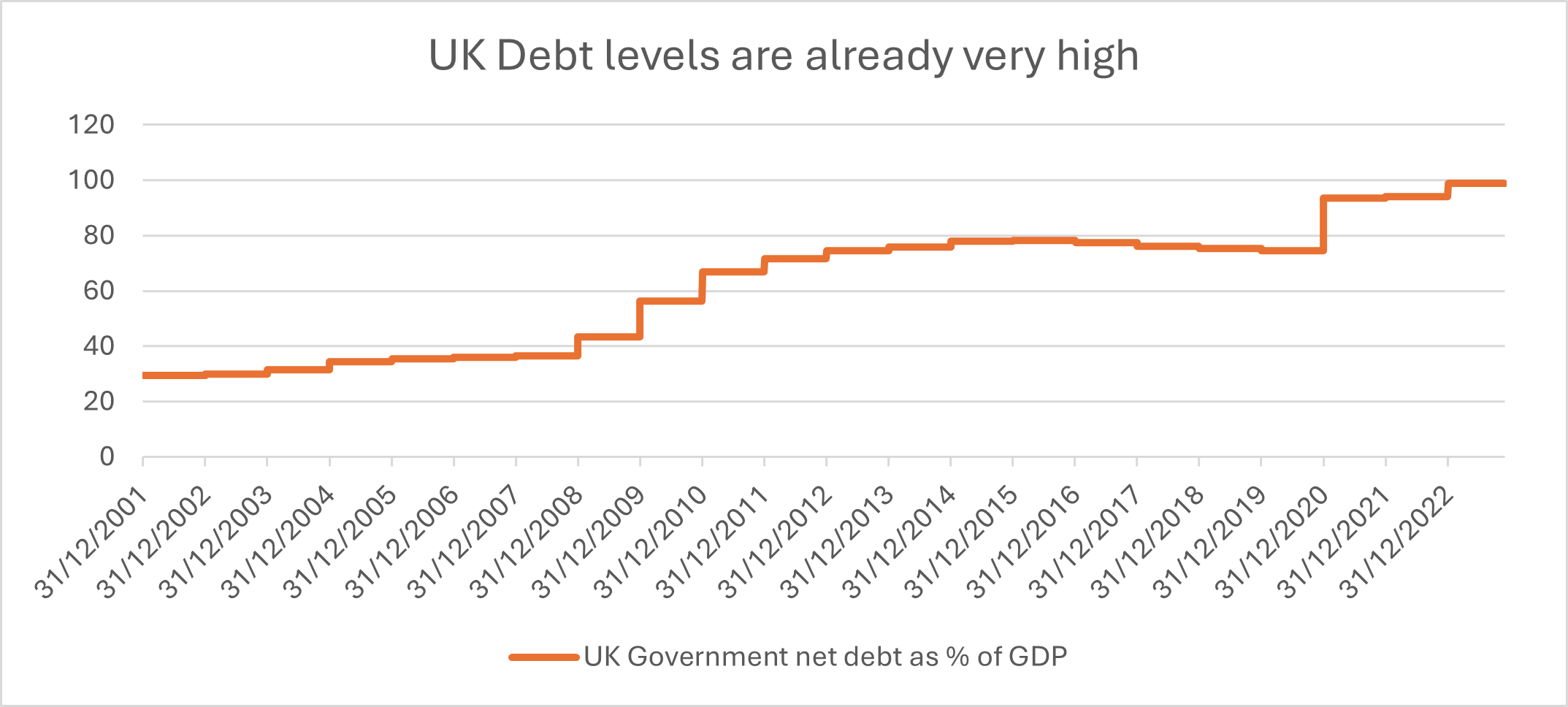

Regardless of the result come July 5th, the occupant of Number 10 Downing street will wake up to the same economic backdrop. Namely, a large budget deficit and very high debt costs: which will inhibit the room for maneuver. Furthermore, memories of the somewhat unfortunately named “mini-budget” from September 2022 (where the UK bond market fell by 10% in 10 days), will put a handbrake on any shock and awe policies.

The economic reality of breakfast time on July 5th 2024: A large budget deficit with a side-serving of high debt servicing costs!

Source: Bloomberg

Source: Bloomberg

High debt levels, mean high debt interest (it’s currently at the highest its been in 50 years) hence any plan that prompts a spike in bond yields (and therefore debt servicing costs) might make that first breakfast in number 10 hard to digest.

Comfortingly, Shadow Chancellor Rachel Reeves, with her background at the Bank of England and fondness for “securonomics” is abundantly aware of this. Whilst we’ve not yet had a manifesto, we have had the “Financing Growth” paper published by Rachel Reeves and Tulip Siddiq which opens by saying they will “unashamedly champion our financial services sector as one of the UK’s greatest assets”.

Whilst “Financing Growth” might not make everyone’s first choice on the summer reading list, it chimes well with UK investment markets and is perhaps one of the contributing factors to strong recent UK investment returns in the face of dominant Labour polling.

Specifically, this paper outlines a plan to “reinvigorate our capital markets”. In outlining this plan, much of what has held back UK investment markets in recent years is highlighted. Namely, the de-listing of companies from the UK stock market and the lack of both institutional and retail investment in the UK market. The paper notes that the UK lags its European and US counterparts in these areas and cites measures to overcome the issues. These measures include things such as a modern “Tell Sid” campaign for retail investors and the establishment of a British “Tibi” scheme to encourage UK pension funds to invest a proportion of their assets in UK growth companies.

Investment markets tend to vote with their feet and the fact that UK assets have done very well of late (with new “all-time-highs” being reached by the larger companies in the UK stock market) suggests that UK stock markets are fairly sanguine on the prospect of a Labour government.

At Magnus we like to remind our investors that the UK forms a relatively small part of their investment portfolios with an allocation to UK funds in the range of 8%-16% depending on risk appetite. and very importantly (!), investment markets are much more interested in trends in corporate earnings than they are in speculating about politics, especially UK politics! To that end, we’d note that US corporates (which dominate the global stock index) have just posted a 3rd consecutive season of positive earnings growth and are now firmly out of the earnings’ recession of 2022.

Time will tell if Labour do indeed get into Number 10 Downing Street and, if so, if they’re able to deliver on their promises. One thing we do know, is that that UK market likes what it’s seen so far and won’t hesitate in sugar coating its feedback to any policies it doesn’t like the look of – as Kwasi Kwarteng and Liz Truss found out to their detriment!

IMPORTANT: Past performance is not a guide to the future and may not be repeated. The value of investments and the income from them can go down as well as up, you could get back less than you invested.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.