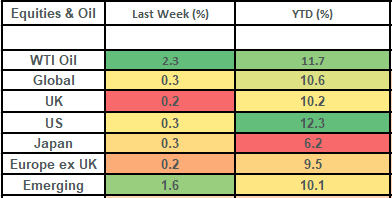

Global stock markets notched up their 4th consecutive weekly gain, with a modest rise of just 0.3%. Emerging market shares (led by China) were the star performer last week, with the UK stock market taking a breather (although not without clocking up another all-time-high!), due largely to strength in the Pound. This week is all about Wednesday, with UK inflation data and also the earnings report of Nvidia which has been such a strong performer this year and its earnings numbers will likely set the tone for market direction.

Last week

- Global stock markets rose modestly, with overseas’ gains crimped by strength in the Pound.

- Emerging market shares took the yellow jersey last week: boosted by a continued bounce-back in Chinese shares.

- UK stocks had a quieter week, but the FTSE 100 did notch up its 12th all-time-high in the space of a month.

- US inflation dropped back to a rate of 3.4%. Importantly, this broke a sequence of 4 prints where the number had come in higher-than-expected!

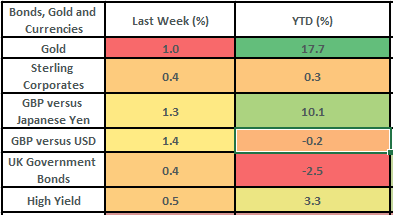

- Bond markets had a good week and are having a strong month: UK gilts are up c2% so far in May.

This week

- Wednesday is the big day for markets this week, with UK inflation data and Nvidia’s earnings.

- UK CPI is currently 3.2%. We expect it to drop to 2.1% on Wednesday due to a large number dropping out of the series.

- Nvidia’s earnings are released on Wednesday. This is key since Nvidia is the 3rd biggest stock in the US stock market and is already up over 85% this year: hence there is a lot of good news already baked in and very little room for disappointment!

- Wednesday also sees the release of the most recent minutes from the Federal Reserve’s policy setting meeting.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

More detail

- Global stock markets moved up modestly last week, making for their 4th consecutive week of gains. Returns in Global (and notably US) markets were crimped last week by the strength in the Pound, which rose by 1.4% vs the US Dollar and 1.3% vs the Japanese Yen. This Pound strength took a bit of the shine off US stock market returns, with the US market reaching fresh all-time highs last week as technology shares and banks drove gains.

- Emerging market shares were the strongest performer last week, rising by 1.6%. Much of the gain here was driven by the Chinese share market (which constitutes about 29% of the Emerging market share index) which rose by nearly 3% on the week and is up just over 9% so far this month. Chinese shares have bounced off very low levels (they were trading at valuation levels not seen since 2015) and have also been helped by increased stimuli from the People’s Bank of China (PBOC). The PBOC lowered the minimum down payment for first time buyers last week (by 5% to 15%) and also said it would extend lending of low-cost funds to state-owned banks to aid the purchase of unsold homes. This renewed stimulus came alongside some patchy economic data which showed continued weakness in the housing market but did also show an uptick in industrial production.

- UK stocks had a quieter week, rising by just 0.2%, but that didn’t stop the FTSE 100 from posting another all-time high: its 12th in the last month! This tied the record of all-time highs since the index was launched in January 1984. Domestic shares (i.e. FTSE 250) did better last week, up by 0.6%, as is often the way when the currency is strong (the FTSE 100 derives c70% of its earnings from overseas and often struggles when the Pound is strong).

- UK economic data was thin on the ground last week, but we did see wage data come in a touch higher than expected (with weekly earnings ex-bonus numbers running at 6% annualized) and the unemployment rate tick up to 4.3%. The unemployment number helped push bond yields down on the week as markets increased their pricing of interest rate cuts by the Bank of England (with 3 cuts expected in the next 12 months, with the first one coming in August).

- US Consumer Price Inflation (CPI) broke its streak of upside surprises and came in as expected last week: this was welcomed by the bond markets! CPI came in at 3.4% (down from 3.5%) which was bang on what was expected. This came as some relief to the bond markets as the last 4 US CPI prints have all come in higher than expected and driven the narrative that US interest rates need to stay higher for longer. Retail sales numbers also came out a touch weaker than expected, which was well received by the stock market and the bond market, again supporting the view that interest rate cuts would be on the way sooner than previously thought.

- Bond markets had a good week. UK gilts and UK investment grade bonds rose by about 0.4%, whilst Global high yield bonds rose by about 0.5%. Yields on 10-year gilts closed out the week at 4.13% and high yield spreads finished the week about 0.05% tighter. Gilts are now up about 2% in the month of May, with yields having come down to reflect the change in the perceived timing (by the bond market) of the interest rate cuts by the Bank of England.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.