Global stock markets posted their 3rd consecutive week of gains, with European markets leading the way. Strong US earnings helped power gains in the global share market, whilst closer to home it was the hope of interest rate cuts from the Bank of England (as well as more bid activity) that helped to drive gains in domestic shares. The bond market (notably the UK bond market) responded well to the more accommodative stance taken by the Bank of England which prompted interest rate cuts getting priced in sooner rather than later. This week there’s key economic data from the UK, US and China as well as a smattering of earnings reports from the UK and US.

Last week

- Global stock markets rose for the 3rd consecutive week

- UK stocks continued their rally, buoyed by further bid activity, better economic data and the hopes of interest rate cuts

- US corporate results continued to be strong and helped support the US stock market rally

- The Bank of England held interest rates at 5.25%, but leaned towards cuts in the summer

- Bond markets had a decent week, with government bonds faring best.

This week

- UK employment data is out on Tuesday (the markets will be looking for a modest tick-down in wage growth to support the lower inflation narrative)

- US inflation and Retail Sales data is out on Wednesday. The last 4 US inflation prints have come in hotter-than-expected, hence the market will want to see signs of this cooling

- Chinese economic data (Industrial Production, Retail Sales and Fixed Asset Investment) is released on Friday

- On the corporate side, we’ve got earnings reports from Vodafone and Home Depot (Tuesday), Imperial Brands, Burberry and Cisco (Wednesday) and Walmart on Thursday.

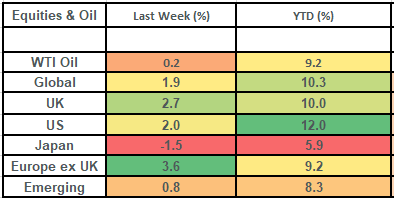

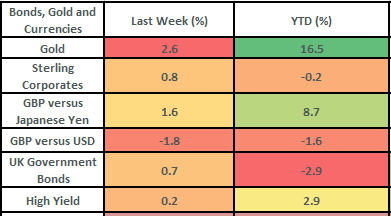

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

More detail

- Global stock markets put in their 3rd consecutive week of gains, rising by 1.9% last week. Gains were driven by further evidence of strong corporate earnings as well as weaker-than-expected US economic data which helped support the case for interest rate cuts (which in turn will support stock markets).

- US corporate earnings season is now 92% of the way through and results have been better-than-forecast. US companies have grown their earnings at a blended (year-over-year) rate of 5.4% which is more than the 3.4% growth rate that had been forecast (by analysts at Factset). The US is now on course for its 3rd consecutive quarter of positive earnings growth and its strongest quarter of earnings growth since Q2 2022. The key watchpoint will remain Nvidia’s earnings (Nvidia is already up c80% this year! and Nvidia is the 3rd biggest stock in the US index) which are out on 22nd

- Weaker-than-expected US economic data might not sound like the ideal tonic for strong equity markets, but it was welcomed last week as the US economy has been so strong of late and that strength has made for interest rate cuts getting priced out by the bond market. Last week this turned as we saw a consumer sentiment survey (University of Michigan) reach its lowest level in 6 months and weekly jobless claims hit their highest level since August. These weaker US data points (combined with the weaker US monthly jobs number we had on the first Friday of May) meant that more interest rate cuts got priced into bond markets (with the first US interest rate currently priced for September). Lower interest rates mean easier access to capital for companies and is hence good news for stock markets.

- UK stock markets (+2.7%) continued to bask in sunshine, as the stock market was spurred on by more bid activity, better economic data and a tilt towards interest rate cuts from the Bank of England. John Wood Group was the latest company to be bid for last week, which follows a recent spate of bids in the last month including names such as Anglo American, Tyman, Darktrace and Alpha Financial. Alongside this, data showed a much stronger return to economic growth than expected, with 1st quarter growth coming in at 0.6% (vs 0.4% expected) which marks the exit from a technical recession.

- The Bank of England held interest rates at 5.25% last week, but there was a shift in the voting pattern of the members and a shift to a more positive tone from Governor Bailey, which prompted interest rate cuts to be priced in sooner than they’d been prior to the meeting. Bond futures markets are now pricing in a full rate cut at the August meeting, with a 58% chance of a cut at the 20th June meeting, with 3 full cuts priced in over the course of the next 12 months. The Monetary Policy Committee (“MPC”) members voted 7-2 in favour of “no change” to interest rates at this meeting, but this marked a positive shift in so far as the prior vote had been 8-1. Furthermore, the BoE revised down their inflation forecasts and Andrew Bailey said that “it’s likely that we will need to cut the bank rate over the coming quarters and make monetary policy somewhat less restrictive”.

- Bond markets had a decent week, with UK gilts rising by 0.7% as yields fell (to reflect the lower interest rate environment). Credit spreads tightened a little (which helped support higher yielding bonds), but the main driver of the market over the course of the last week was the shift in interest rate expectations which dragged yields lower, with the UK 10-year gilt yield closing the week at 4.16%.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.