Global stock markets rose modestly last week, with most of the gains coming at the end of the week following some strong corporate results coming from Apple (the 2nd biggest stock in the US share market) as well as some weaker-than-expected US jobs data. Although weak jobs data might not seem like good news, it prompted the bond markets to alter their pricing of US interest rate cuts, with 2 now being priced for this year (which helps support asset prices). Closer to home, the UK stock market continued its rally, following strong numbers from HSBC and more excitement about another takeover bid in the UK market. The focus remains on the UK this week, with the Bank of England’s meeting on Thursday as well as first quarter growth data on Friday.

Last week

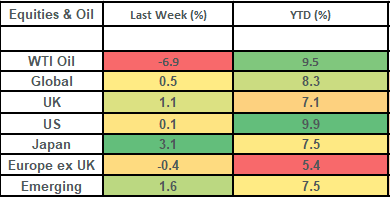

- Global stock markets rose modestly, with Japanese equities leading the way

- UK stocks put in another good showing, on the back of some good corporate earnings (from the Banks) and also news of another take-over bid

- Apple shares helped shore up the US stock market, with Apple announcing the biggest share buyback in history

- US jobs data came in weaker than expected which helped boost the bond market as more interest rate cuts were priced back into bond futures’ markets.

This week

- The Bank of England have their rate setting meeting this Thursday. We expect them to keep interest rates at 5.25% but the shape of votes will be informative for the next move.

- UK Q1 growth numbers (GDP) are released on Friday

- Chinese trade data is released on Thursday and inflation data is released on Friday

- It’s a quieter week for corporate earnings, with BP and Disney reporting today and trading updates from ITV (Thursday) and IAG (Friday) to name a couple.

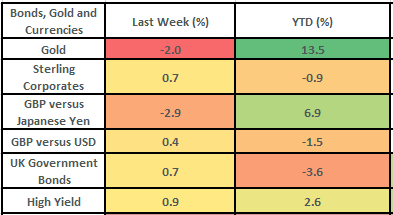

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

More detail

- Global stock markets put in another good week, rising by 0.5%, with the Japanese share market (due largely to the strength in the Japanese Yen) leading the way. Emerging markets continued to do well, with Chinese stocks driving gains and the UK share-market also put in another good showing, up 1.1% on the week.

- Within the UK stock market, the Banking sector posted the best returns, thanks to some strong returns from HSBC which was up 6.3% on the week. HSBC had a decent set of corporate results which they released last week, which included the announcement of a special dividend as well as a new share buyback of $3 billion. Standard Chartered also posted their numbers last week and surpassed analysts’ expectations for earnings and revenue, which led to gains of 10% in the stock on the week. There was also continued bid activity in the UK market last week, with Alpha Financial Markets Consulting rising by 27.4% on the back of takeover talks from 2 possible bidders (both private equity houses).

- The US stock market was a bit more muted last week (due partly to currency effects) but did show some positive earnings growth and got a boost from Friday’s jobs numbers. Apple (the 2nd biggest stock in the US share market), rose by 7.8% last week following some better-than-expected earnings numbers and the announcement of a $110 billion share buyback (the largest buyback ever!). This came despite a drop in iPhone sales (biggest drop in iPhone sales since Covid). Tesla was also up strongly last week (up 7.2%) on the back of Elon Musk making a surprise visit to China following news of the Chinese government’s tentative approval of Tesla’s self-driving technology.

- US corporate earnings season is now 80% of the way through (as of the end of last week) and the blended growth (year-over-year) rate is 5%. This is better than the 3.4% growth rate that was expected (by analysts at Factset) at the start of the reporting period. This would mark the 3rd consecutive quarter of positive earnings growth for the US stock market and be further confirmation of the stock market having come out of an earnings recession (following 3 consecutive quarters of earnings’ contraction in 2022/23).

- Interest rates and inflation continue to feature front and centre for investment markets this year. As such, Friday’s jobs numbers in the US were key. The numbers came in weaker than expected which led the bond futures market to adjust downwards; pricing more rate cuts and easing into the market in order to support the economy. 175,000 new jobs were shown to have been created by the US economy in April (following Friday’s data release), which was less than the 240,000 that economists surveyed by Bloomberg had been expecting. Furthermore, the unemployment rate ticked up more than expected (to 3.9% from 3.8%) and wages (as per average hourly earnings) came in a touch weaker than expected. This prompted the bond futures market to price in 2 interest rate cuts in the US this year, which is the same number as is currently being priced into the UK bond market.

- The US Federal Reserve met last week and kept interest rates on hold at 5.5% as expected. Fed Chair Powell said that current policy (on interest rates) was “sufficiently restrictive” but did say that the Fed needed “greater confidence” that inflation was falling back towards the 2% target; US CPI has come in higher than expected for the last 4 inflation prints.

- Bond markets rose last week, due largely to the drop in yields (bond prices move inversely to bond yields) at the end of the week following the US jobs data. The UK gilt market rose by 0.69% on the week and the US treasury market rose by 1% on the week. Credit (both investment grade and high yield) continued to perform well, with UK sterling corporate bonds rising by 0.7% on the week and global high yield bonds rising by 0.9% on the week. UK 10-year gilts closed out the week with a yield of 4.22%, with 10-year US treasuries yielding 4.51%.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

This content is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.

Magnus Financial Discretionary Management Limited is authorised and regulated by the Financial Conduct Authority.