Investment markets continued to grind higher last week, with a weak Pound helping to flatter overseas’ returns. This helped to build on the excellent returns that we saw in November. Following much recent speculation of impending interest rate cuts, this week will provide substance to the speculation as we have Central Bank meetings in both the US, the Eurozone and the UK, along with inflation readings for the US. Inflation and interest rates (and speculation around them) has been the key driver for investment markets this year, so we’d expect these events to be closely followed and impactful for near-term direction.

Last week / Last month

- Stocks pushed higher last week

- Weakness in the Pound helped to boost overseas’ returns

- Domestic UK shares did better than the larger, more international names in the UK market

- Bond markets continued their bounce as interest rate cuts for next year continued to be priced into markets

- Economic data was mixed in the US and China, with Chinese data showing some (much needed!) signs of light

This week

- It’s a key week ahead for markets.

- Central Bank meetings in the US, the Eurozone and the UK will be very keenly watched for any signs of when interest rate cuts might be coming.

- The US Federal Reserve conclude their meeting on Wednesday night at 7pm (our time). This follows inflation readings for the US which are also out on Wednesday.

- The Bank of England meet on Thursday, following UK jobs data on Tuesday.

- US Retail Sales (always a key watchpoint) are released on Thursday too.

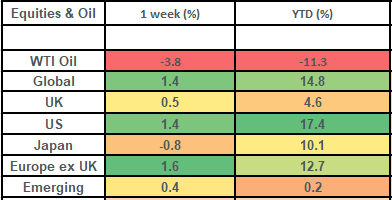

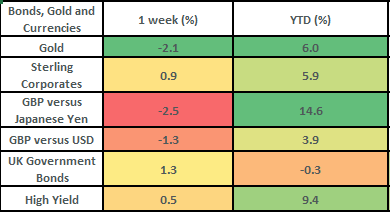

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Last week saw stock markets push higher, with European and US markets leading the way. Much of the gain in US and Global markets came from the weakening of the Pound over the week (undoing some of its gains in November), which meant that the overseas’ currency returns translated back favourably.

- UK stock markets were up by about 0.5% last week, but the smaller, more domestic shares did particularly well; rising by about 1.7%. This is due to the fact that these investments are more sensitive to interest rates and there was a continued mood in markets that interest rates would begin to get cut next year. This helped funds such as Gresham House UK Multi Cap Income Fund and Liontrust Special Situations Fund which are both held within the Magnus portfolios. They were both up by 3.1% and 1.5% respectively on the week which helps add to the gains posted last month (where Gresham House was up by 7%).

- Japanese stock markets were the laggard last week. This came on the back of comments from Bank of Japan (BoJ) officials which led investors to think that they might abandon their negative interest rate policy (interest rates in Japan are minus 0.1%). This prompted a sharp rally in the Japanese Yen (it rose by 2.5% vs the Pound on the week). The M&G Japan Fund (which is held in the Magnus portfolios) responded well to this change in direction, rising by 0.7% on the week. Key holdings such as Mitsubishi Financial rose on the week as they will be beneficiaries of a higher interest rate regime.

- Bond markets continued to rise as yields fell on the week. UK Government bonds were up by about 1.3% and Sterling Corporate bonds were up by about 0.9%. Within the Magnus portfolios, it was the Fixed Interest funds with the most interest rate exposure which did best. The Blackrock Corporate bond fund was up by 1% on the week, with the Invesco Tactical Bond fund up by 0.9%. The key driver in bond yields over the week was further speculation that there would be interest rate cuts coming next year.

- Economic data was mixed last week, with investment markets taking the view that interest rate cuts next year would be warranted to support growth. This week will give a clearer picture on this as we have Central Bank meetings from both the US Federal Reserve, the European Central Bank and the Bank of England, combined with inflation numbers from the US.

- The bulk of the data last week came from the US and China. In the US, Friday’s monthly jobs numbers (payrolls) came in a touch better than expected (199k vs 185k expected) and unemployment ticked down to 3.7% (from 3.9%). This stronger data was countered by some other jobs data earlier in the week which showed that job openings dropped from 9.5m to 8.7m: the lowest level since March 2021. The job openings number prompted a sharp move lower in bond yields as interest rate cuts were priced in as early as March next year.

- Chinese data was a mixed bag last week and Chinese sovereign debt also suffered a credit downgrade by Moody’s (a big ratings agency). This came on the back of some mixed trade data (seeing imports fall more than expected whilst exports rose) and a negative inflation reading. There were signs of light for China however, as the PMI Services data (key business survey data) came in better than forecast and actually in “expansionary” territory. We remain underweight China within the Magnus portfolios.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.