Last week was very quiet. Markets ticked up a touch, which helped round off an excellent month of November. November saw global stock markets rise by 5.4% (their best month since July last year) and global bond markets rise by 3.3% – which was their best month since December 2008! Bond markets had a really big bounce in November, with US bonds (which are held in the Magnus portfolios) rising by 3.5% on the month, which made for their best month since 1985! This week is quiet as regards scheduled data, but there is some survey data (PMIs) being released early in the week and then the week finishes with the monthly US jobs numbers which are always closely watched.

Last week / Last month

- A quiet week to round off an excellent month

- November saw stocks have their best month since July last year

- November saw bonds have their best month since 2008 and US bonds have their best month since 1985!

- Inflation continued to moderate last week (Eurozone inflation came in at 2.4%)

- Sterling rose by 0.9% vs the US Dollar last week and by 3.9% in the month of November

This week

- It’s a quiet week, with the key data point scheduled for 1.30pm on Friday when the US monthly jobs report is released

- There is also some key Chinese data – especially given the recent weakness in the stock market there. Tuesday sees the release of some survey data (services PMI) and Thursday sees the release of monthly trade numbers

- UK survey data (PMIs) is released on Tuesday. Tuesday also sees earnings reports from Ashtead and Ferguson, with Frasers group reporting on Thursday.

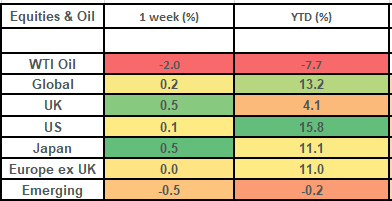

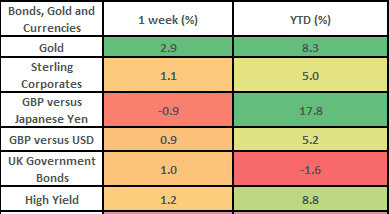

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Last week rounded off an excellent month for investment markets. Global stock markets had their best month since July last year, whilst Global bond markets enjoyed their best month since December 2008. US bonds (which we have a decent amount of in the Magnus Portfolios) had their best month since May 1985!

- Although global stock markets were fairly muted last week, they rose by 5.4% over the month, with UK stocks rising by 3%.

- The Magnus Portfolios also had an excellent month, rising by between 3% for a Cautious Portfolio to 3.7% for an Adventurous Portfolio. All of the underlying investments pulled their weight, but there was some really impressive performance from our recently added UK equity manager (Gresham House) who rose by 6.9% on the month, along with our infrastructure and European managers who both rose by over 6.3%. On the fixed interest side, our US bond allocation was up over 3%, our UK corporate bond manager (Blackrock) was up 3.9% and our tactical bond manager (Invesco) was up by 3.5%.

- The Magnus Portfolios are now up between 5.2% and 6.7% for the year-to-date

- Strength in the Pound has been the other key trend of the last month. The Pound rose by 3.9% vs the US Dollar over the month of November, by 1.5% vs the Japanese Yen and by 0.9% vs the Euro. This is positive in so far as it constitutes the UK economy getting a “thumbs up” from the global currency markets, but it does have the impact of crimping overseas’ returns – something to bear in mind if your Clients are seeing headlines in the press which are quoted in local currency or US Dollars…

- Markets were propelled higher over the month by a combination of:

- Moderating inflation:

- US inflation came in at 3.2% vs 3.3% expected

- UK inflation came in at 4.6% (from 6.7%), which was 0.1% lower-than-expected

- Last week saw Eurozone inflation slow to 2.4% (down from 2.9%), which was 0.3% lower than expected

- Central Banks indicating that no further interest rate hikes are necessary (which caused bond yields to fall which means that borrowing costs go down for companies: this gives companies more “breathing space”)

- Strong US Corporate earnings:

- Q3 earnings growth for US companies came in at 4.8% vs expectations for a decline in earnings of -0.3%

- This represents the first quarter of earnings growth since Q3 2022

- This is key since the US makes up 70% of the Global stock market!

- Stronger than expected Economic growth

- US 3rd quarter economic growth was revised up to 5.2% from 4.9%

- This is the strongest reading we’ve seen since Q4 2021 – when the economy was “re-opening” from Covid lockdowns

- This is further evidence that the US consumer is feeling confident and is out spending

- The US consumer makes up about 70% of US growth

- The US is the World’s largest economy

- Black Friday sales in the US were 7.5% up on last year’s numbers and Cyber Monday spending reached $12.4bn: this represents the biggest online shopping day of all time!!

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.