Last week was pretty quiet and investment markets lost a bit of ground. This follows a very strong recent run and does nothing to take the shine off excellent numbers so far in November. Strength in the Pound was the key driver for the modest losses last week, with the Pound strengthening on the back of better economic data and a fairly uneventful Autumn Statement. Pound strength meant that overseas’ returns (which were actually modestly positive in their own currencies) were translated back as modest losses. This week is also looking pretty quiet, but there’ll be eyes on the Eurozone inflation number (out on Thursday) and also any reports on the strength (or otherwise) of the recent Black Friday sales.

Last week

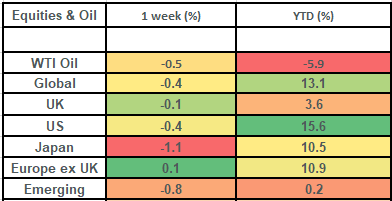

- Global stock markets fell by 0.4% but still remain up strongly (up 5.2%) for the month

- The Pound strengthened on the back of better UK economic data

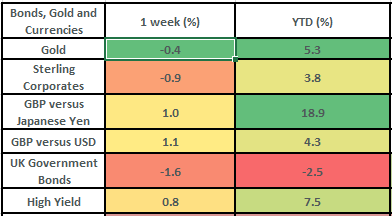

- Bond markets fell back after a very strong recent surge

- US markets were very quiet due to Thanksgiving and NVIDIAs earnings report passed without incident

This week

- It’s a pretty quiet week ahead to see out the month

- Eurozone inflation is released on Thursday

- UK economic data is very sparse, but we do have earnings reports from Easyjet, Halfords and Mulberry over the course of the week

- In the US, we have PCE inflation data released on Thursday (this is the main inflation measure that the Federal Reserve look at), home sales data and the updated reading of the Q3 GDP number (due out on Wednesday)

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets took a breather last week after a very strong recent run. The global stock market fell by 0.4% on the week. This followed 3 straight weeks of strong gains and the global market remains strongly up in November: by 5.2%. This puts it on track for its strongest monthly gain so far this year.

- The key driver of the pullback in stock markets last week was the strength in the Pound. The Pound rose by 1.1% vs the US Dollar, 1% vs the Japanese Yen and 0.9% vs the Euro. This meant that the returns in overseas markets (which were actually modestly positive) were negative once they were translated back into Sterling. The Pound rose on the back of better-than-expected UK economic data and an Autumn Statement that didn’t make big increases to fiscal spending. Key UK survey data (S&P Global Composite PMIs) moved into “expansionary” territory, with a reading of 50.1 vs the 48.7 level that had been expected, for the first time since July this year.

- Although the UK equity market remained subdued last week, it remains strongly ahead for the month (up 3.6%) and I’d highlight the continued strong performance of the UK managers within the Magnus portfolios. Gresham House has been the star of the show, posting another positive week (up by 0.4%), which takes their returns for the month to 7%. They have benefited from holdings such as XPS (pensions consultancy firm) and MoneySupermarket which are up 11.7% and 9.2% for the month-to-date respectively.

- Last week was always going to be a quiet one due to the US thanksgiving celebrations, with US markets being shut for Thursday and half of Friday. However, the 3rd quarter’s earnings report from NVIDIA (the artificial intelligence chipmaker and the world’s 6th largest company by market capitalization) was always going to be a key event for markets. The company comfortably beat earnings and revenue but gave cautious guidance – due to export restrictions to China. The stock fell by 4.4% on the week, but still remains up over 200% for the year, hence the risk for stock markets last week was a bad earnings result that upset the whole apple cart for the wider market. NVIDIA has been a key holding for the Royal London Global Diversified fund which is held across the Magnus Portfolios – Royal London are up 16% for the year-to-date and have been our best performing manager.

- Bond yields rose (making for losses in bond markets) last week after a strong recent rally. This came on the back of comments from Central Bankers indicating that rate cuts might not be coming as quickly as investors would like – the Central Banks want clear evidence that inflation is going back to the 2% targets. This caused UK gilts to fall by 1.6% on the week and US Treasuries to fall by 0.1% on the week; both still remain up strongly for the month-to-date; by 2% and 2.5% respectively.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.