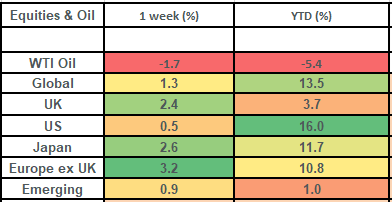

Investment markets continued their strong run in November, with global stock markets up 1.3% last week and UK bond markets up 1.9%. These gains came on the back of lower-than-expected inflation numbers and are good proof points that the stock market is forward-looking and doesn’t equal today’s economy! Stocks and bonds both pushed higher on the basis that we’d get cuts to interest rates next year. Last week also saw continued better than expected data from corporates and further evidence that the US consumer (who matters a lot more than the UK consumer) is still spending. Whilst we’re 94% of the way through US earnings season, this week sees one very notable company report- in the form of Nvidia! Nvidia is up over 200% this year (being the poster child for AI) and carries a 3.2% weight in the US stock index (S&P 500) – hence its earnings numbers could well move the market!

Last week

- Global stock markets rose by 1.3% on the week

- UK stocks rose by 2.4%, with UK domestic shares (FTSE 250) rising by 4%

- Bond markets benefited from lower-than-expected inflation numbers. UK government bonds rose by 1.9% on the week

- UK inflation came in at 4.6% and US inflation came in at 3.2%

- Bond yields fell significantly as interest rate cuts were priced into the market for next year

- Chinese economic data was mixed which prompted stronger intervention from the PBoC (People’s Bank of China)

This week

- Scheduled events this week are thin on the ground, but all eyes will be on be on Nvidia’s earnings which get released on Tuesday night (after the US market closes). The bar has been set high, with analysts expecting revenue of $16bn in Q3 after Nvidia smashed expectations in Q2 by reporting revenue of $13.5bn (90% more than they’d done in the prior quarter).

- The US stock market is closed on Thursday and half of Friday for thanksgiving.

- Chancellor Hunt’s Autumn Statement is out at lunchtime on Wednesday. This is likely the key event for the UK this week, although there is some survey data (PMIs) and Consumer Confidence data; both due to be released on Thursday.

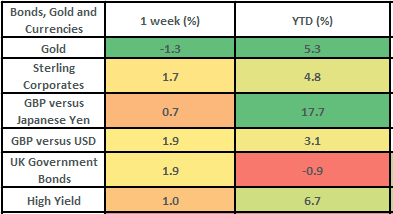

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Last week was another excellent week for stock markets. Global stocks rose by 1.3% on the week and UK stocks (as per the FTSE All Share) rose by 2.4%. This takes gains for the month of November to 5.6% for global stock markets and 3.7% for UK equity markets.

- The key catalyst for the push higher was inflation numbers from both the UK and US which came in lower than expected. This benefited all asset classes as it led the market to price in interest rate cuts sooner than had been previously priced. Key beneficiaries in the Magnus portfolios were holdings such as Gresham House (one of our UK equity managers) and Franklin Templeton Infrastructure (our infrastructure manager), which both rose by over 3% on the week. Gresham house has had a fantastic move up in November and is now up over 6.5% in the month alone, with the infrastructure manager up over 5%.

- Inflation was where the market was focused last week (like much of the last 2 years!). UK inflation came in at 4.6% (having been 6.7% previously) and US inflation came in at 3.2% (having been 3.7% previously). These numbers are still much higher than the 2% targets, but (and this is really key), they were both lower than expected (by just 0.1% in each case)!

- These lower-than-expected inflation numbers support our view that the stock market does not equal the economy! Inflation at 4.6% is still way too high (more than double the Bank of England’s target), but it is a better reading than expected and this meant that the bond markets started to price in interest rate cuts. The prospect of lower interest rates helps breathe air into stock markets (as it means companies can get cheaper access to fresh capital that they can use for growth) and explains why UK domestic stocks rose by a massive 3.5% on the day of the US inflation data release (their best day since February!).

- Yields fell sharply in the bond markets on the back of the inflation prints as rate cuts were priced in. UK 10-year bond yields closed out the week at 4.1% and US 10-year yields closed out the week at 4.44%. This saw the UK government bond market rise by 1.9% on the week and US Treasuries rise by 1% on the week. Certain managers in the Magnus portfolios have really benefited from this move, with the Invesco Tactical Bond Fund up 3.3% so far this month and the Blackrock corporate bond fund up 3.9% so far this month. Invesco Tactical Bond Fund (run by Stuart Edwards and Julian Eberhardt) has done a great job of playing the shift higher in bond yields. They had very low exposure to bond yield movements at the start of the year (and avoided the pain) and then ramped it up recently: hence doing so well this month – a great example of how active management can help benefit your clients.

- The bond markets are now pricing in 4 interest rate cuts (taking interest rates from 5.5% to 4.5%) from the US Federal Reserve over the course of the next year and 2 from the Bank of England (taking interest rates to 4.75%).

- In other economic data, UK retail sales continued to disappoint, but US retail sales continued to surprise to the upside. The US consumer continues to spend, with spending increasing significantly at bars, restaurants and online (and shifting away from home-related purchases). It’s worth remembering that the US is the world’s biggest economy, with the consumer making up c70% of its GDP. The US stock market itself makes up c70% of the global stock market, whilst the UK stock market constitutes a mere 4% – hence the US matters a lot more than the UK and we have a lot of exposure here within the Magnus portfolios. Our specialist US equity managers are having a great month so far, with Premier Miton up 6.5% and Threadneedle up 4.6%.

- China released some key economic data last week which was mixed. Retail sales and industrial production grew more than forecast, but fixed asset investment came in lower than expected. Concerns over the Chinese property market still rankle, but we are beginning to see signs of stronger intervention from the PBOC (People’s Bank of China). The PBOC made their largest liquidity injection into the market last week since December 2016 on the back of more disappointing data from the property market (which constitutes c25% of Chinese GDP).

- Finally, US corporate earnings continued to be pretty decent. Target (a big general merchandise / food discount store) rose by 17.8% last week on the back of much better-than-expected earnings numbers (cashing in on cut price reductions and cost cutting). The US earnings season has been mixed, but on balance, it has been a whole lot better than expected. With 94% of US companies (in the S&P 500) having reported, we are seeing earnings growth of 4.3% as compared to the -0.3% contraction that was expected at the start of the reporting season. A positive quarter of earnings’ growth would mark the first time we’ve seen that since Q3 2022.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.