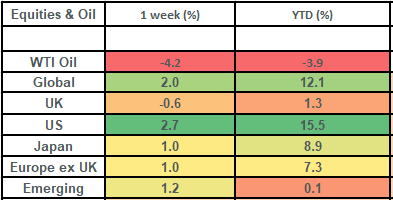

Global stock markets put in another good showing last week, with the global share market rising by 2% on the week, which takes gains for the month to 4%. Much of this move was down to the strength in the US stock market, which continued to benefit from good earnings’ reports from its companies. Most other equity markets posted decent gains too, apart from the UK which was dragged lower by Diageo (disappointing results) which has a big weight in the Index. This week is action packed, with lots of key economic data being released, including the all-important inflation numbers for the UK and the US.

Last week

- Global stock markets had another strong week: rising by 2%

- US companies continued to report strong corporate earnings (we’re on track for our 1st quarter of positive earnings growth since Q3 2022!)

- Emerging market stocks rose by 1.2%

- UK equities fell back on the week: dragged down by energy stocks and Diageo

- UK growth came in a 0% for Q3. Not a good number, but actually, this was better than had been expected!

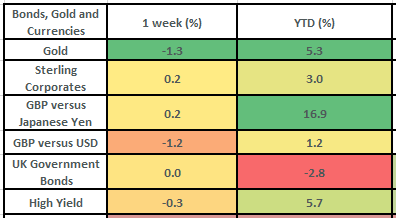

- Bond markets struggled to make ground: largely trading sideways.

This week

- This is a busy and important data week!

- UK inflation is out on Wednesday (Bloomberg economists expect it to drop to 4.7% from 6.7%) and UK retail sales is out on Friday.

- US inflation is out tomorrow, US retail sales are out on Wednesday and US housing data is out on Friday

- China releases a lot of big economic data tomorrow: retail sales, industrial production and fixed asset investment.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets put in another strong showing, rising by 2% on the week. This takes gains for the month to over 4% and puts them up 12% now for the year-to-date. US stocks helped to power gains last week, with technology shares doing particularly well (the tech sector was up over 5.5% alone on the week).

- Gains in US equities last week came on the back of some strong earnings reports (particularly from firms in the tech sector). We are now pretty much done with 3rd quarter earnings in the US and the numbers have been strong. Just over 90% of companies (in the US S&P 500) have reported earnings and the blended growth rate is 4.1%. This is much better than the modest contraction (-0.3%) that was expected and we are on track for the first quarter of earnings growth since Q3 2022: i.e. we are coming out of an earnings recession on the back of 3 consecutive quarters of negative earnings growth!

- Emerging market equities also had a decent week, rising by 1.2%. Within emerging markets, there were some very good gains for Brazilian equities; rising by 3% on the week, which takes their gains for the month to 8.6%. This is a key benefit to the Emerging markets manager that we have within the Magnus portfolios (Pacific North of South) that have a near 10% allocation to Brazil and are up strongly for the year.

- UK equities were a bit soggy last week; down by 0.6%. The index was dragged down by a pull-back in the oil price (energy accounts for c13.5% of the FTSE 100 due to BP and Shell’s high index weightings) and also a 10.7% decline in Diageo (which makes up 3.8% of the index). Diageo (a drinks producer, making drinks such as Johnnie Walker whisky) issued negative guidance, citing “materially weaker performance” in Latin America and the Caribbean (with consumers trading down to cheaper brands).

- UK growth (if we can call it that!) data came out last week showing a reading of 0% for the 3rd Clearly this isn’t great, but it is worth noting that it was better than the -0.1% that had been expected (by Bloomberg economists). It is also worth remembering that the UK is only a small part of the global jigsaw and that the US economy has just posted a 3rd quarter growth number (annualized) of 4.9%, which is the strongest reading since 2021!

- Bond markets struggled to make ground last week. UK Gilts returned 0% for the week, UK corporate bonds returned 0.25% for the week and US Treasuries lost 0.3%. Bond yields continued to be choppy; falling at the start of the week and then rising again in the second half on the back of some weak auctions. In fact, Thursday’s $24 billion of 30 year US Treasury bonds was met with the weakest demand in 2 years.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.