Last week saw global stock markets post their best week since February, whilst UK domestic shares rose by 6.7% on the week to post their best week since November last year! This welcome bounce came on the back of a pretty miserable month of returns in October, with the catalyst being interest rates being kept on hold by both the US and UK Central Banks. Bond markets joined in the rally, with the UK gilt market rising by 2% on the week to post its best week since March. This week the spotlight will shift to China where we’ve some key economic data and we also hear earnings reports from companies such as AstraZeneca in the UK and Disney in the US.

Last week

- Global stock markets had their best week since early February

- UK domestic stocks had their best week since last November

- UK and US interest rates were kept on hold

- US corporate earnings continued their strong trend

- Bonds bounced strongly, with UK gilts having their best week since March

This week

- It’s a pretty quiet week ahead in terms of scheduled data

- AstraZeneca (the 2ndbiggest company in the UK market) reports results on Thursday. We’ve also got results from eBay on Tuesday, Disney on Wednesday and Allianz on Friday

- Chinese trade data is released on Tuesday, with Chinese inflation numbers being released on Thursday

- Friday sees the release of the UK’s 3rdquarter growth number (preliminary reading)

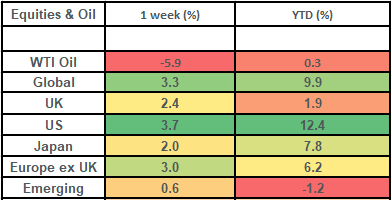

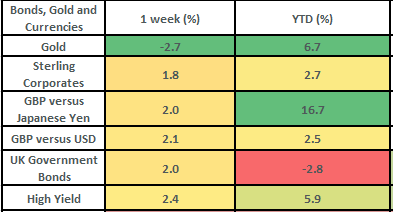

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets rose by 3.3% last week, which made for their best week since early February! This strong move came on the back of Central Banks (notably the US Federal Reserve) holding interest rates steady, strong corporate earnings and some weaker-than-expected US jobs data (which supports the narrative that policy doesn’t need to get any tighter).

- The equity rally last week was broad based, although it should be noted that strength in the Pound Sterling took some of the shine off of overseas’ returns. The Pound (having had a poor recent run) bounced by 2.1% vs the US Dollar and by 2% vs the Japanese Yen over the week.

- The UK FTSE All Share was up by 2.4% last week and for once it was the smaller companies in the index that drove the gains. The domestically focused FTSE 250 rose by 6.7% on the week – having its best week since November last year! It goes to show that the stock market does not equal the economy! UK economic data was not particularly good last week, but the key event for markets was the Bank of England’s rate setting meeting where they voted (6-3) to hold interest rates steady at 5.25%. This led the bond markets to price out the chances of any further rate hikes and equity markets rallied hard off the back of that. Of particular note last week would be Segro, Ocado and BT Group, which all rose by over 12% on the week. BP and Shell dragged on the index, with BP reporting less profit than had been forecast (by analysts according to Bloomberg) and writing down $540 million of wind power projects in the US.

- The US earnings season continues to progress pretty well. Corporate earnings haven’t been brilliant, but they have been a lot better than had been expected / had been feared! We are now just over 60% of the way through the reporting cycle and companies are showing an aggregate growth in earnings of 3.7% on this time last year. This is significantly better than the -0.3% decline that had been expected by analysts (according to Factset). A positive quarter of earnings’ growth would mark the first time we’ve seen that since Q3 2022.

- Bond markets joined in the rally too last week, with UK Government bonds rising by about 2% on the week and US Treasury bonds rising by about 1.5%. This came on the heels of a big fall in bond yields (bond yields move inversely to bond price moves), with UK 10-year gilt yields falling by 0.27% on the week and US 10-year treasury yields falling by 0.32% on the week. 10-year gilt yields were 4.28% on Friday’s close, with 10-year US Treasury yields at 4.57%.

- Last week saw Central Bank meetings in the US, the UK and Japan. Interest rates were held steady at 5.5% in the US and 5.25% in the UK. In Japan, the Bank of Japan (“BoJ”) kept interest rates at -0.1% and slightly loosened their yield curve control framework (they have been capping bond yields to stimulate growth). The BoJ will now regard 1% as a “reference” for where they want 10-year Japanese bond yields to be as opposed to a hard cap.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.