Stock markets had a poor week, with concerns about the Israel-Hamas war dominating market sentiment. This fall came in the face of some quite solid corporate earnings figures and also a very strong 3rd quarter growth number for the US economy. This week is packed with Central Bank meetings which will help give the market an updated view on interest rates and we’ve also got a decent number of companies reporting their results too, with Apple (Thursday) being the key one.

Last week

- Global stock markets fell for the second straight week

- Corporate earnings data was pretty solid, but this was overshadowed by negative market sentiment

- The European Central Bank maintained interest rates at 4%

- Bond markets rallied

- China showed signs of stabilisation

This week

- It’s a busy week for Central Bank meetings! The Bank of Japan conclude their meeting tomorrow, the US Federal Reserve conclude theirs on Wednesday evening and the Bank of England meet on Thursday lunchtime.

- US monthly payrolls (jobs) data is due out on Friday lunchtime. This is generally a key watchpoint for markets.

- There’s also a busy earnings release schedule. Samsung, BP and Caterpillar report tomorrow, Apple and Shell report on Thursday and BMW report on Friday.

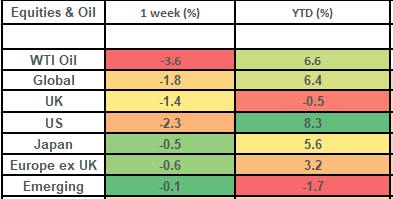

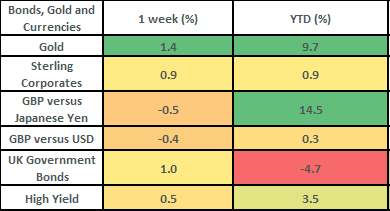

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets fell by 1.8% last week, which takes returns for the month to -3.5%. Negative sentiment stemming from the Israel-Hamas war continued to dominate market direction. This was in the face of some quite strong corporate earnings data in the US as well as a strong 3rd quarter growth number for the US economy. The US economy grew at an annualized pace of 4.9% in the 3rd quarter which was better than the 4.5% that had been expected (by Bloomberg economists), more than double the level in the 2nd quarter and represented the best growth rate since the end of 2021.

- Corporate earnings last week in the US were pretty good despite the negative market! 54 companies in the US stock market (S&P 500) reported Q3 earnings last week and 38 of them beat consensus estimates. Big companies (members of the so called “magnificent seven”) such as Amazon, Alphabet, Meta and Microsoft reported generally good numbers, which beat consensus expectations, but the market honed in on negative guidance around rising expenses.

- We are now about halfway through the US earning season and the blended growth rate is 2.7% (from this time last year) and this compares to an estimate of a 0.3% contraction. If earnings’ growth remains in positive territory, it will mark the first quarter of year-over-year earnings’ growth since Q3 2022.

- The UK market had a tough ride last week, following some weak economic data. The unemployment rate rose to 4.2% (from 4%) and key survey data (PMIs) all remained in “contractionary” territory, although they were broadly in line with expectations. This made for heavy going for the FTSE All Share, which fell by 1.4%.

- The European Central Bank left interest rates unchanged at 4%. This helped provide some respite for bond markets and potentially marks a “pausing” of rate hikes from Central Banks. To that end, there are no rate hikes expected from either the US Federal Reserve or the Bank of England when they meet this week.

- Bond markets rallied on the back of the negative sentiment, weaker economic data and hopes that there won’t be interest rate rises at the meetings this week. UK gilts rose by 1% on the week, with UK corporate bonds rising by 0.9%. UK 10-year gilts closed out the week yielding 4.54%, with US 10-year Treasury bonds yielding 4.84%. This represented quite a big rally over the week, with the US 10-year Treasury yield briefly getting past 5% on Monday – which is the first time it has breached this level in 16 years!!

- Although overshadowed by the tragic events in Gaza, there was some encouraging data last week from China. This helped stabilize emerging market returns (Chinese equities actually rose on the week) and came on the back of improving industrial profits at Chinese firms. Furthermore, there was an announcement about more fiscal stimulus to help support the economy.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.