Last week

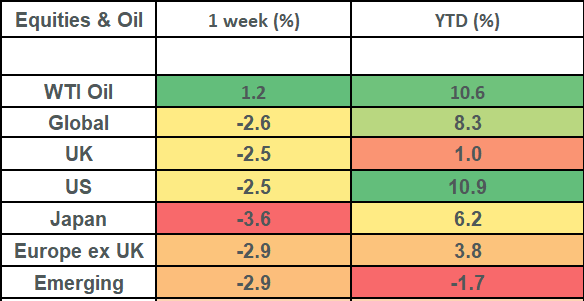

- It was a fairly dismal week for global equities last week, with a decline of -2.6% in Sterling terms. Fear of an escalation of the conflict in the Middle East, remarks perceived as “hawkish” by the Chair of the US Federal Bank and a resulting increase in US bond yields pushed broad equity indices worldwide into negative territory for the week ending 20th Additionally, the VIX index, which measures S&P 500 volatility, closed at its highest level in nearly 7 months indicating “risk off” sentiment.

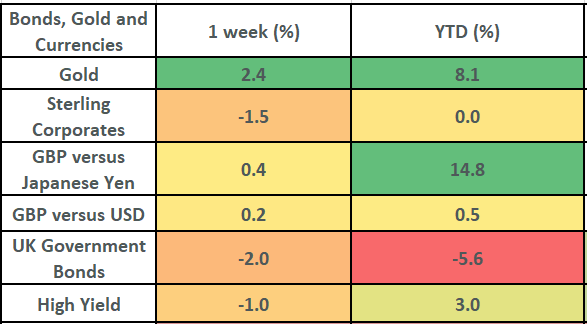

- Conversely gold and oil commodity prices surged over the week due to the uncertainty created by the conflict and the possibility of disruption to the oil supply.

- In a speech on Thursday, US Federal Reserve chair Jerome Powell said monetary policy wasn’t “too tight right now”. This was enough to create a reaction in US Treasury markets, with the 10-Year US Treasury Yield touching close to 5%, it’s highest level since July 2007. When yields rise, prices fall, so this wasn’t a good week for US Treasuries.

This week

- We will get an update on the strength of the U.S. economy this week with third-quarter GDP/economic growth, Purchasing Managers Index (PMI) data for manufacturing and services and the Fed’s favoured measure of inflation, the core personal consumer expenditures price index all being released.

- Thursday will see attention switch to the continent as the European Central Bank (ECB) will state whether interest rates will increase or be maintained. They are not expected to rise due to weakening economic data in the region, but we will see for sure on Thursday.

- PMI data will also be released for the UK and Continental Europe; this is seen as a leading indicator which gives a sense of whether an economy is expanding or contracting.

- It’s a bumper week for major US company earnings reports, including tech giants Alphabet, Microsoft, Meta and Amazon, pharmaceutical companies Merck, Bristol Myers Squibb and Abbvie and household names such as CocaCola, General Electric, 3M, Mastercard, Intel, UPS, Merck, Exxon Mobil, Chevron and Colgate-Palmolive.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- While China’s Q3 GDP and September retail sales exceeded market expectations, these positive data points failed to support markets. Ongoing property market concerns and the Biden administrations’ restrictions on AI chip imports weighted on Chinese equity markets. In turn this dragged on the overall Emerging Markets index which declined -2.9% over the week.

- Headline UK CPI inflation remained at 6.7%, although core inflation, which strips out the volatile food and energy sectors, did fall slightly from, 6.2% to 6.1%. A rise in petrol prices between August and September was the main factor in stubborn headline inflation. The one reason to be cheerful was that food prices saw their first monthly fall in more than two years. The news knocked UK bond markets with the broad UK bond indices falling 1.5% for corporates and 2% for government.

- To end on a positive note. I was impressed to read that Japan’s stock exchange is to introduce a radical “name and shame” regime to drive better corporate governance. The aim of this is to increase valuations and drive compliance. 2023 has been a breakthrough year for Japanese stocks. Japan has attracted international investors who seek Asian exposure and wish to avoid the political and regulatory risks inherent to China. The broad Japanese market is up 6.2% in Sterling terms year-to-date. The weak yen has boosted returns for UK investors via currency translation effects.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.