Stock markets had a good bounce last week, with Japanese shares leading the way. Investment markets took the tragic news of the war between Israel and Hamas in their stride, with safe-haven assets such as government bonds benefiting strongly. Lower bond yields, in turn, gave equity markets a boost (as it meant lower borrowing costs), which helped the broad market rise. There were also some good earnings’ beats from some of the US banks on Friday. This week is shaping up to be a very busy one, with lots of key economic data being released and also some key earnings data from the likes of Tesla and Netflix.

Last week

- Global stock markets had a good week, with Japanese shares leading the way

- Earnings season in the US got off to a good start, with some good numbers from the Banks

- The UK economy returned to growth

- Safe-haven assets rallied following the tragic events in the Middle East.

This week

- UK inflation data is out on Wednesday, with Retail Sales out on Friday.

- It’s a busy week for US corporate earnings. Goldman Sachs and Bank of America report on Tuesday, Netflix, and Tesla report on Wednesday and then we have American Express and Schlumberger reporting on Friday.

- US Retail Sales data is released tomorrow

- China releases its monthly data dump tomorrow, which includes growth data, retail sales, fixed asset investment and industrial production numbers.

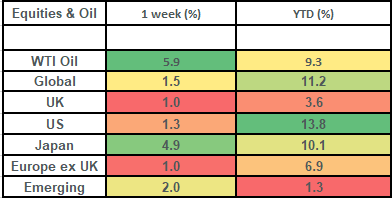

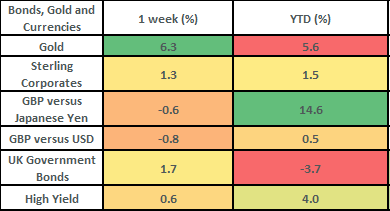

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets bounced well last week, rising by about 1.5%, with the biggest gains coming from the Japanese market which rose by 4.9%. The rise in Japanese shares came on the back of a poor prior week and also news that the International Monetary Fund (IMF) had revised up its forecast for Japan’s growth in 2023 to 2.0% from 1.4% previously. Japanese stock market gains were boosted one bit further by the strengthening of the Japanese Yen over the week. The Yen often acts as a “safe haven” currency, and it rose following the conflict between Israel and Hamas.

- Energy was (unsurprisingly) the best performing global sector last week, given the near 6% rise in the oil price. There was also some strong performance from the defensive sectors such as Utilities; which rose nearly 4% on the week.

- The US third quarter earnings season kicked off last week and there were some decent results from the Banks. Wells Fargo, JP Morgan and Citigroup all delivered better numbers than had been expected and rose by 3.6%, 2% and 0.3% on Friday respectively (when the numbers were released).

- The UK FTSE All Share rose by 1% last week. BAE Systems (defence company) was the best performer in the FTSE 100 in the week, rising by 10.1%, with Endeavour mining up by 9.4% and BP up by 8.3%. St James’s Place was the biggest faller on the week in the FTSE 100, dropping by 20.7%. The fall came on Friday amidst reports that they were under pressure from the regulator to overhaul their fee structure to comply with consumer duty.

- There was some good news last week for the UK economy, with data showing that it returned to growth in August (growing by 0.2%), following a contraction in July.

- Safe-haven assets rose last week, following news of the war between Israel and Hamas. This saw Gold rise by 6% on the week and Government bonds rally (as yields fell). UK Government bonds rose by 1.7% on the week and US Treasury bonds rose by 1% on the week. This saw the UK 10-year government bond yield close out the week at 4.39% and the US 10-year treasury yield close out the week at 4.6%.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.