Stock markets were choppy last week and ended down by around 0.6%. Strength in the US labour market helped push bond yields to their highest level since the summer of 2007 which weighed on investors’ minds. Although such moves can feel unsettling, we’d highlight the observation that bond yields have been rising because of strength in the economy and that recent moves upwards in bond yields have tended to precede good periods of return for equity markets. This week, markets are again focused on inflation (with releases from the US and China) and also on corporate earnings; with some of the big US banks set to report on Friday.

Last week

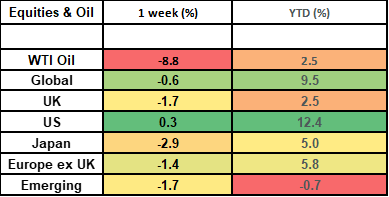

- Global stock markets had another choppy week, falling by about 0.6%

- US jobs data (released on Friday) showed a surprise increase in new workers, but the data showed that they weren’t being lured back to work by the prospect of higher wages

- US bond yields rose strongly over the week to finish at levels not seen since 2007

- The Oil price fell sharply (which should reduce inflationary pressures)

This week

- US inflation data is released on Thursday this week, which will likely be keenly watched. Not least since it comes the day after the release of the minutes of the most recent Federal Reserve meeting.

- UK growth data (GDP) is released on Thursday also.

- Chinese inflation and trade data is due out on Friday.

- The 3rd Quarter earnings’ season for US companies starts on Friday, with banks such as JP Morgan, Wells Fargo and Citigroup reporting.

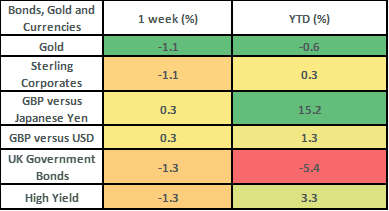

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets finished the week down by 0.6% in what was another choppy week for investment markets. Friday saw the biggest share price swing as it coincided with the release of the US jobs data. This data showed that 336,000 new workers had entered the labour force in September (roughly double what was expected). Initially, stock futures (the data was released before the US market opened) sold off very sharply. Stocks then rose strongly throughout the session as the detail behind the numbers revealed that although the jobs market was growing, people were not being lured by high wages (wage levels actually dropped a touch). This pointed to a more benign inflation environment, which, in turn, made the stock market less fearful of further interest rate rises.

- The UK stock market fell by 1.7% on the week. The fall in UK stocks was pretty broad based, but driven by the smaller, more domestic stocks in the FTSE 250, which fell by 2.9%. Positive performance over the week was driven by names such as British Airways’ owner IAG, up by 5.6%, Tesco (up by 5.4%) and Aviva (up by 4.9%).

- The bond market grabbed the headlines last week, with bond yields getting to their highest levels since the summer of 2007. The US 10-year treasury yield closed out the week yielding 4.8% and the UK 10-year gilt yield closed the week out at 4.57% (higher than in the “mini-budget” of last September). These moves have made for further losses in the bond market, with UK gilts down by 1.3% on the week and US treasuries down by 1% on the week. This takes UK gilts down by 5.4% for the year-to-date, with UK index linked bonds down by over 10%. We would note that we don’t have any direct exposure to UK gilts within the Magnus portfolios and prefer shorter-dated bonds which we view as being much more stable.

- Although the shift up in bond yields can be unsettling for investors, there are long-term positives to take from it. Firstly, higher bond yields represent a stronger economy and this in turn makes for a steeper yield curve. Indeed, the US yield curve (10-year bond yields minus 2-year bond yields) has steepened by about 0.5% over the last month and is now “only” inverted by 0.28%, having been inverted by 1.08% back in early July. An inverted yield curve (where 2-year bonds yield more than long-dated bonds) is generally a very good warning sign for investors. Secondly, whilst sharp rises in bond yields can unsettle markets in the short term, they can often be a harbinger of good times ahead for the equity market. This is due to their representing strength in the underlying economy and is shown in the table below.

- The Oil price fell by nearly 9% last week, with WTI oil closing out the week trading at $82.79/ barrel. This marks a decent walk back from the $93 price it traded at just a couple of weeks ago and should make for less pressure upwards on inflation figures.

|

Increasing Bond Yield Phase |

Change in US 10 Year Bond Yield |

Stock Market Return during phase |

Stock market return 1-month later |

Stock market return 3 months later |

|

1/3/22 to 14/6/22 |

1.8% |

-11.5% |

0.8% |

5.0% |

|

1/8/22 to 24/10/22 |

1.7% |

-7.4% |

6.4% |

7.4% |

|

2/2/23 to 2/3/23 |

0.7% |

-3.2% |

2.5% |

6.0% |

|

31/8/23 to 4/10/23 |

0.7% |

-5.0% |

? |

? |

Source: Bloomberg. Bond Yields are US 10-year bonds. Equities are global equities in local currency.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.