It was a poor week for stock markets to round off the month of September. Markets were held back over concerns around a US Government shutdown. This was avoided, but not until the weekend and hence weighed on markets throughout the week. This week is pretty quiet as we ease our way into the new Quarter, with US jobs data on Friday likely the highlight. Although there are a smattering of companies reporting, it doesn’t really get going until next week which will likely set the tone for markets in the short-term.

Last week

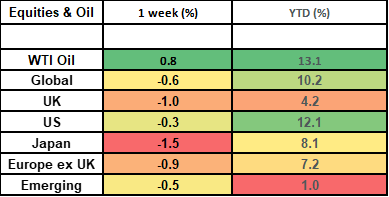

- Global stock markets sold off last week to round off a negative month

- The UK stock market had a negative week, but was up quite strongly for the month of September

- Oil prices continued to push higher

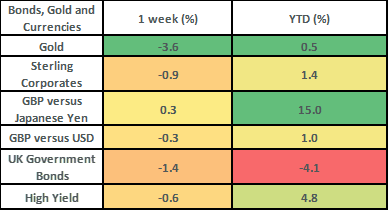

- Bond markets sold off as yields rose

This week

- US jobs data (payrolls) is likely the key event for this week. These numbers are released on Friday.

- UK business survey data (S&P Global PMIs) is out on Wednesday

- Corporate earnings’ reports are pretty thin on the ground (it starts to ramp up next week with the US banks), but we do have results from Tesco and JD Wetherspoon in the UK and Pepsi Co in the US

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets fell by roughly 0.6% last week. Coincidentally, this mirrored the fall that they had in the month of September as a whole, with the bulk of the falls coming after the US Federal Reserve’s meeting on 20th September where they suggested that interest rates would remain “higher for longer”. On a global equity basis, most of the fall came from the consumer discretionary and the technology sector. Sentiment around consumer discretionary took a further knock last week with a much-watched measure of US consumer confidence coming in lower than expected (the US Conference Board Consumer Confidence reading came in at 103.0 from a prior level of 106.1 and against an expected level of 105.5). Corporate results from Nike (on Thursday night) did, however, give some hope for the consumer, as earnings came in better than expected and the stock rallied over 6% (on Friday) off the back of this.

- The UK stock market was down by about 1% last week but was actually one of the stronger performing markets over the month of September, when it rose by 1.8%. The UK share market has been a beneficiary of its big weighting to the commodity sector (the FTSE 100 has a 14% weighting to Energy and a 9% weighting to Materials), with the best performers over the month being names like BP (up by 9.4%), Shell (up by 8.3%) and mining companies such as Anglo American (up by 8.2%).

- UK economic data was mixed last week. On the plus side, economic growth for the first quarter of the year was revised upwards (to 0.3% vs the prior estimate of 0.1%). On the negative side, the property market continued to show signs of weakness. Mortgage approvals fell by more than expected and showed a slowdown from the prior month (despite mortgage rates having started to moderate).

- Recent inflation data has been conflicting and this is one of the reasons that markets have been jumpy over the month of September. Key measures of US and Eurozone inflation showed signs of falling back last week: clearly this is good news. However, countering this has been the persistent recent rise in oil prices which continued last week. On the inflation side, US core PCE came in a touch lower than expected (based on the monthly figure) and Eurozone inflation came in at 4.3%. This was the slowest pace for Eurozone inflation in about 2 years and a big improvement on the 5.2% August reading. Despite the lower inflation prints, oil prices continued to rise last week, with WTI oil closing the week at a price of $90.8/ barrel, which is roughly the highest level we have seen in a year.

- Bond markets continued to sell-off last week, with UK gilts falling by 1.4% on the week and UK index linked bonds falling by 2.2% on the week. This takes the year-to-date figures for UK gilts to -4.1%, with UK index linked bonds down just over 7.5% for the year-to-date. Bond prices have fallen as yields have risen aggressively over the past week, with the yield on UK 10-year gilts closing out the week at 4.44% and 4.57% for their US counterparts (Treasury bonds). The recent sell-off in bond yields has seen UK gilt yields get to the levels we saw last year during the infamous “mini-budget” and, looking past this, has seen UK and US government bond yields get to levels not seen since prior to the Global Financial Crisis.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.