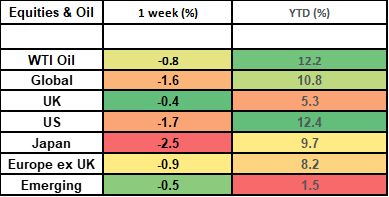

Stock markets sold off last week against the backdrop of rising US bond yields. US stocks were the biggest drag on the global index, with the US index having a particularly tough day on Thursday (the day after the US Federal Reserve meeting) on the view that interest rates would not be coming down as quickly as previously thought. This week is quiet in terms of scheduled data as we get towards the end of the month, with US inflation (Friday) and growth numbers (for the UK and US) – also out on Friday – likely the key data points in a low news week.

Last week

- Stock markets had a tough week, with US and Japanese markets hardest hit

- Both the US and UK Central Banks made no changes to interest rates, but the US Federal Reserve signalled that they’d not be coming down as fast as previously expected

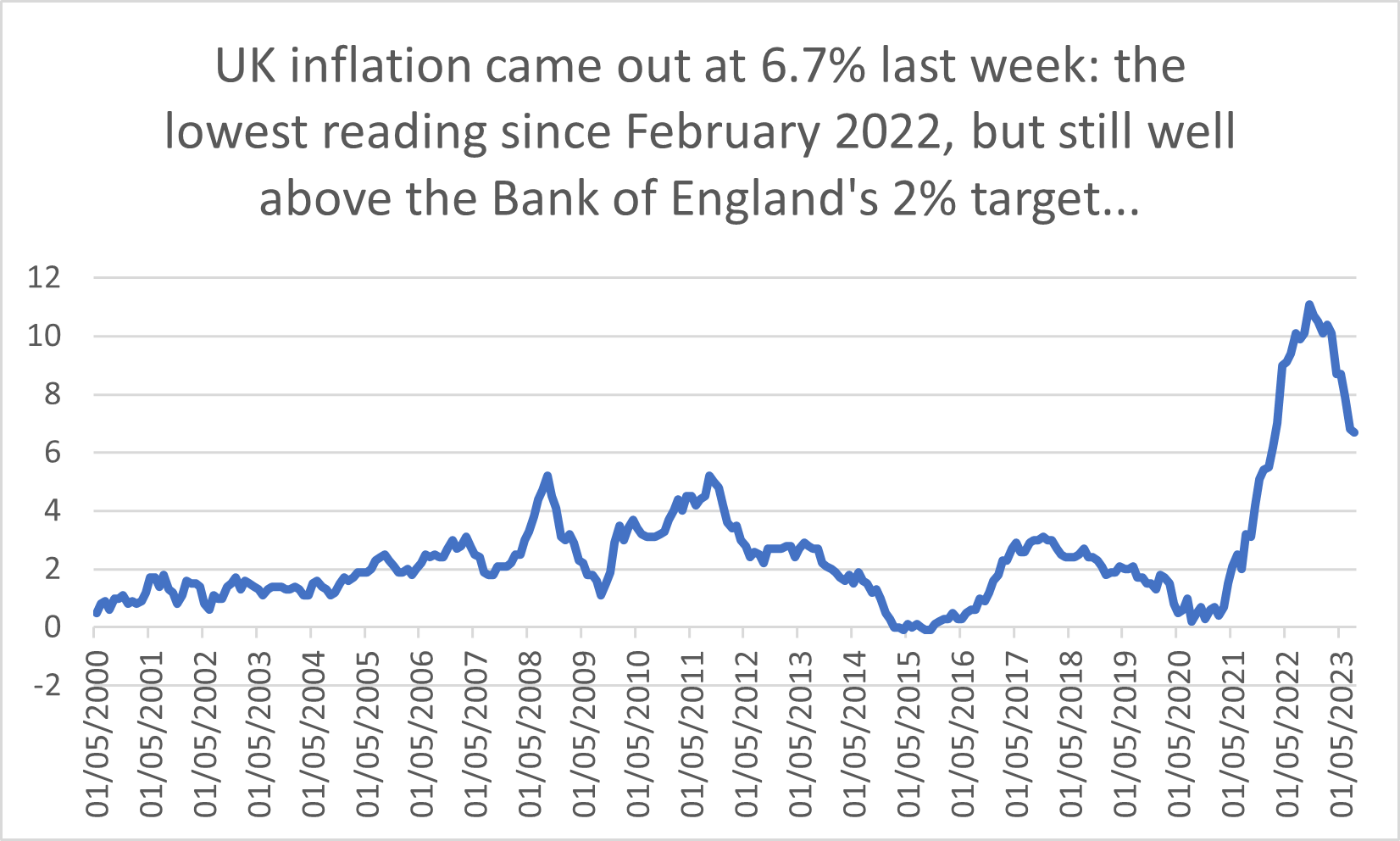

- UK inflation came in lower than expected (which helped cushion the UK market)

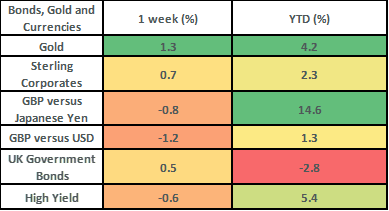

- UK bonds did well: benefiting from the lower-than-expected inflation number

This week

- It’s a quiet week after the Central Bank heavy one just gone!

- There’s a fair amount of US data out, starting with Home sales on Tuesday, Growth numbers (GDP) on Thursday and PCE inflation (the Fed’s preferred measure) on Friday.

- Eurozone inflation is also out on Friday

- Growth data for the UK (GDP) is out on Friday

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets sold off by about 1.6% last week. The fall was driven by the US stock market (which has a c70% weighting within the global index), which fell quite sharply towards the end of the week, on the back of the US Federal Reserve’s meeting. US stocks recorded their biggest 1-day loss in 6 months on Thursday; the day after the Fed meeting.

- The US Federal Reserve made no change to interest rates at their meeting on Wednesday night – holding them steady at 5.5%. The part that unsettled the stock market was a slight change in tone as to when they would be cutting rates. The message from the Fed was that rates would stay higher for longer and that interest rate cuts would not come as fast as previously expected. This was confirmed by the release of the “dot plot” which showed that Fed officials are now forecasting 2 interest rate cuts next year as opposed to the 4 they had penciled in previously. This in turn led the bond futures’ market to price out some of the rate cuts they’d been pricing for next year (they are now pricing 2 cuts as opposed to the 3 they were pricing previously), which in turn caused US bond yields to rise.

- The UK share market was a relative out-performer. It finished down by 0.4% on the week but was going along very strongly until it got caught up in the wider change in sentiment driven by the US market. Wednesday’s lower-than-expected inflation print saw the UK market rise strongly. Consumer Price Inflation (CPI) came in at 6.7% (down from 6.8%), which was a lower number than expected. 6.7% is still a very high number, but it was cause for cheer for the markets as it marked the lowest level of UK inflation since February 2022! Key winners over the week within the UK stock market were companies which generally benefit from a stronger consumer, with Marks and Spencer up by 7.8% on the week, Hargreaves Lansdown up by 6.2% on the week and JD Sports Fashion up by 5.3%.

- The Bank of England surprised markets by keeping interest rates on hold at 5.25%. This move was likely driven in part by the lower-than-expected inflation number which came out the day before the Bank meeting. The Monetary Policy Committee voted 5-4 in favour of keeping interest rates on hold and Andrew Bailey was quick to stress that the “job isn’t done yet” as regards getting inflation back down to 2%. However, the softening in tone – and first pause in rate rises since December 2021 – was welcome news for the bond market, with bond yields falling (and mortgage rates too) to reflect a more accommodative long-term outlook.

- Bond markets were mixed last week. UK bonds did best, whilst US and global bonds sold off. The driver behind this was the different stances from the Bank of England and the US Federal Reserve. UK gilts rose by 0.5% on the week, with UK corporate bonds rising by 0.7%, whilst US Treasuries fell by 0.5% on the week. High Yield markets also fell (by about 0.6%), with most of that market being weighted towards the US.

- It was a week of Central Bank meetings, and the Bank of Japan also kept their interest rates on hold – at -0.1%. They maintained their 0.5% allowance set on either side of the yield target for 10-year Japanese government bonds and maintained their pledge to add stimulus without hesitation if needed.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.