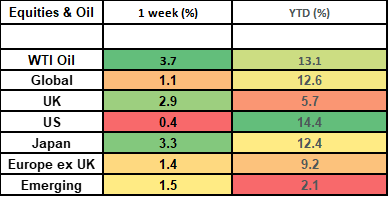

Last week was a solid one for global equities and an excellent week for UK and Japanese equities. The FTSE All Share rose by 2.9% last week, whilst the larger companies in the FTSE 100 rose by 3.1% over the week; making for its strongest weekly return since January. This week the focus is firmly on the 2 I’s: Interest rates and Inflation. The US Federal Reserve meet on Wednesday (where they’re expected to keep interest rates steady at 5.5%) and the Bank of England meet on Thursday (where they’re expected to hike rates to 5.5%). The UK inflation number (out on Wednesday) will be a factor in the BoE’s decision.

Last week

- Stock markets had a good week, with UK and Japanese markets faring best

- The European Central Bank hiked interest rates to 4%

- UK economic data was a bit weak, but this helped UK assets as the market priced in less aggressive rate hikes (although we still expect one to come this week!)

- China continued to gently stimulate the economy

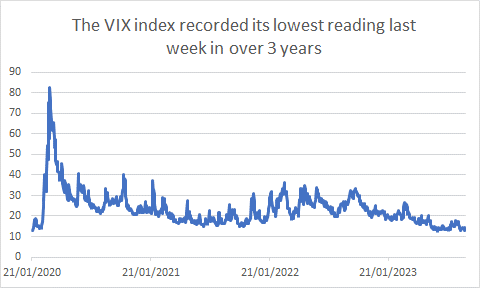

- The VIX index (or “fear gauge”) recorded its lowest reading in over 3 years

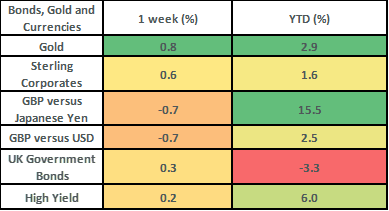

- Bond markets posted modest gains

This week

- The focus is on interest rates and inflation this week!

- The US Federal Reserve meet on Wednesday, the Bank of England meet on Thursday and the Bank of Japan meet on Friday.

- UK inflation numbers are out on Wednesday

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets performed well last week, with the global index of shares rising by 1.1%. From a style perspective, “value” outperformed “growth” by just over 1%, with the banking sector being the best performer (up over 4%), whilst the technology sector was the worst performer; down by 1.1% on the week. This fall in the tech sector was driven by Apple which is the biggest holding in both the Global market and the US market (which forms c70% of the Global Index). Apple fell on the back of mixed reviews of its new iPhone 15.

- UK and Japanese share markets were amongst the best performers of the major equity indices. The FTSE All Share rose by 2.9% on the week, whilst the Japanese share market rose by 3.3% on the week. Within the UK share market, it was the larger companies (i.e., the FTSE 100 ones) which fared best. This was driven by the materials sector (up 7.8% on the week) and the banking sector (up by 6.9% on the week). Within the FTSE 100, the 3 best performing stocks on the week were Airtel Africa (+15.2%), Anglo American (+13.8%) and Rio Tinto (+9.4%).

- The European Central Bank hiked interest rates to 4% last week. This marked the 10th consecutive rate hike and takes interest rates to their highest levels on record. It is worth remembering that interest rates in the Eurozone were negative in July last year, with the deposit rate in July 2022 being -0.5%. Interest rates have risen to combat high inflation and the bond futures market is not expecting any further interest rate hikes from this region now. This view was reinforced by President Christine Lagarde’s speech which hinted that interest rates would now be “maintained” at these levels.

- UK economic data was a tad on the weak side last week, but this was taken as good news by the stock and bond markets as it is in keeping with the view that that interest rates might not go as high as once feared. The UK economy was shown to have shrunk by 0.5% in July (a worse number than expected which was attributed to worker strikes and wet weather). UK unemployment also rose last week to 4.3% (from 4.2%), which was in line with expectations.

- China continued to tap on the accelerator last week, with the People’s Bank of China (PBOC) cutting the reserve requirement ratio for banks for the 2nd time this year. The cut was 0.25%. They also made a cash injection into the banking system. This is in an attempt to shore up the property market and boost growth in the economy.

- The VIX index (often referred to as the “fear gauge”) hit a level of 10.3 on Thursday of last week. This is the lowest level we have seen since before the onset of the pandemic in early 2020. This suggests that investors are showing increased confidence in the US equity market and are not so concerned with protecting their portfolios (by using option strategies).

- Bond markets were fairly flat on the week. UK gilts rose by about 0.3% whilst high yield corporate bonds rose by about 0.2%. Sterling corporate bonds were amongst the best performing area of the bond market, rising by 0.6%. This was due to a combination of UK yields falling (due to UK economic data being mediocre and not warranting ever higher interest rates) and UK credit spreads tightening based on this improved outlook for borrowing.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the particular investment objectives, financial situation or needs of any specific client, person, or entity.