Last week was a very gentle ease into the month. There was very little in the way of important data and both stock and bond markets were largely unchanged. This week will be much more instructive for markets, with inflation data out of the US, jobs data out of the UK and key economic data out of China. These will be keenly watched by markets as they will inform the Central Bank meetings which follow next week both in the US and the UK.

Last week

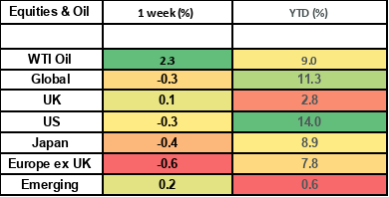

- Global stock markets fell modestly on the week

- Bond markets were also flat, with government bonds outperforming credit

- Oil prices continued to rise, with WTI oil getting to its highest level since November last year

This week

- US inflation numbers are due out on Wednesday. Expectations are for a small increase from the current rate of 3.2%. Thursday then sees the release of US retail sales.

- UK jobs data is out on Tuesday and growth numbers are due out on Wednesday

- China releases a bulk of key economic data (retail sales, fixed asset investment and industrial production) on Friday.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets fell by about 0.3% last week, with US (-0.3%) and Continental European markets (-0.6%) weighing on gains. Within the US markets, Apple (which is the biggest stock in the S&P 500 at a 7% weighting) dragged as it fell by 5% on the week. The fall in Apple came after news that Chinese government employees would no longer be able to use iPhones and also on reports that the new iPhone 15 was going to be significantly more expensive than current models.

- UK stocks were in modest positive territory for the week; with the FTSE All Share index up by 0.1%. Relx, Centrica and the Sage Group were all over 5% on the week. UK stocks also responded well to comments from Bank Governor Andrew Bailey. Bailey told a parliamentary committee that “we are much nearer now to the top of the (interest rate) cycle”.

- Emerging market stocks also held up fairly well last week, with the index rising by 0.2%. This was thanks largely to a strong bounce in the Indian share market, whilst Chinese shares continued their recent drag on returns. Chinese economic data was mixed last week but did show signs of bottoming. Key survey data (PMI) came in lower than expected, but still in “expansionary” territory, whilst trade data (exports and imports) came in better than expected, albeit still in contraction.

- Bond markets were pretty flat on the week. UK government bonds returned to zero, whilst UK corporate bonds were down by 0.1%. US bonds were a little weaker due to high issuance last week in the corporate market and also some strong data from the labour market (jobless claims came in lower than expected) which (at the margins) made for bond yields to rise a touch.

- Oil prices continued to rise last week, with WTI oil closing the week trading at $87.5 / barrel. This is the highest level it has been at since November last year. Part of the reason for the increase in price is due to recent supply cuts by Saudi Arabia and Russia.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the particular investment objectives, financial situation or needs of any specific client, person, or entity.