Global stock markets made strong gains last week to repair some damage on a choppy, and ultimately down month in August. Markets rallied hard last week as economic data was mediocre. Mediocre economic data doesn’t sound great at face value, but it was well received by markets as they took it to mean that there’d be less interest rate rises, which is good news for stock markets. This week is very quiet in terms of scheduled economic data, with Chinese trade data (out on Thursday) likely the big news event for markets given the recent concerns there over the growth outlook and, in particular, the health of the property market.

Last week

- Global stock markets had a good week to round off a disappointing month

- Bond markets also rose last week, following a very choppy and slightly negative month of August

- US jobs data showed unemployment rising to its highest level since February 2022

- The Chinese authorities continued to ease policy in the face of concerns over some of the big property developers

This week

- It’s a very quiet week in terms of scheduled data. Starting with the US markets being closed today for Labor Day.

- UK PMI data is out tomorrow and Wednesday

- Chinese trade data is out on Thursday

- We’ve also got interest rate decisions from Central Banks in Australia (tomorrow) and Canada (on Wednesday). Both are likely to stay on hold.

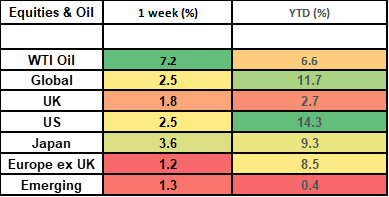

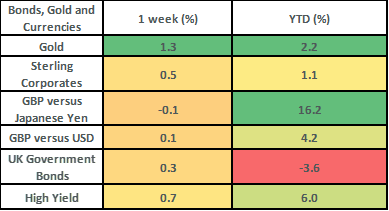

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets had a really strong week to help put some shine on a poor month of returns in August. The Global share market (as measured by the FTSE World) rose by 2.5% last week, with US shares (which makes up just shy of 70% of the global index) up by 2.5% and Japanese shares up by 3.6%. Technology and Consumer Discretionary stocks helped drive returns last week within the global index, with these sectors up by 4% and 3% respectively.

- Global stock markets finished down by 1% in August, with the UK stock market (as measured by the FTSE All Share) down by 2.6%. Whilst this isn’t a great result, it marked a big improvement on where things were mid-month, when global markets were down nearly 5% for the month, with Emerging markets down by over 6%. The month fell into 2 halves; the first half being driven by concerns over a “hard landing” (i.e. recession) coupled with concerns around China’s property markets and the second half being more in the camp of a “soft landing”; i.e. economic data was good, but not so good that it warranted dramatically higher interest rates.

- UK Government bonds rose by 0.3% last week. This made for returns for the month of August of -0.4%. Similar to the equity market, this is not a good result, but it could have been a lot worse! At mid-August, the UK Government bond market was down by over 3%, following a spate of much stronger-than-expected economic data which drove the bond market into pricing in more interest rate rises. This was dialled back (as the data softened) in the second half of the month. Although yields are a lot higher now than they were a couple of years ago (UK 10-year bond yields are roughly 4.4% today as compared to 0.7% 2 years ago), the returns from these instruments are still very choppy – hence why we at Magnus prefer using shorter-dated bonds in our Clients’ portfolios, where the returns are much more stable and predictable.

- US jobs data was the big economic news last week. It was in keeping with the “bad news for the economy equals good news for stock prices” narrative that has boosted stock returns in the last couple of weeks. The jobs data showed that less jobs were being advertised, less people were leaving jobs (to find another one with a higher wage which is inflationary) and that unemployment was ticking up. Whilst this might not all sound great, it signals to the stock markets that there is less need for higher interest rates and that rate cuts might be coming (to support the economy).

- Specifically, 187,000 news jobs were created by the US economy in August (a bit more than forecast, but prior month’s numbers were revised downwards), the unemployment rate rose more than expected (to 3.8% vs expectations of 3.5%), to reach its highest level since February 2022 and the labour force participation rate reached its highest level (62.8%) since the start of the pandemic in February 2020. This suggests that higher interest rates are working: inflation is coming down and more people are being dragged back into work (due to higher costs of living), which boosts the supply of workers and reduces the demand for higher wages (due to there being more workers available).

- Emerging market stocks continued to recover and get a boost from China, following a raft of policy easing announcements by the Chinese authorities. The Chinese Central Bank has now cut reserve requirements at Banks (so more money is available to buy Chinese assets) and cut mortgage rates and down payment levels, in order to ease the housing market. This comes on the back of concerns over Country Garden Holdings (China’s largest property developer by sales), with it being revealed that this company might default on its debt it its financial performance didn’t improve.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the particular investment objectives, financial situation or needs of any specific client, person, or entity.