Last week

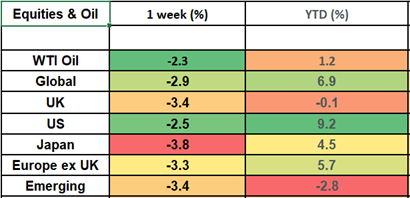

- Global equity markets lost -2.9% in Sterling terms in the week to 18th July; trimming gains in the year to date to 6.9%. A number of factors influenced the broad global sell off: but flat corporate earnings growth in the US and the perception that China’s economic growth is faltering both had an effect. Additionally, China’s Evergrande group filed for bankruptcy protection in the US as part of one of the world’s largest debt restructurings. This rattled markets over fears of contagion. Additionally, oil prices fell -2.3% over weaker demand, seen as a leading indicator for economic actvity that was not perceived as good news by equity markets.

- UK equities fell -3.4% in a “good news is bad news” scenario. Whilst July inflation data came in lower, significant wage growth and only a modest uptick in unemployment data raised the prospect of further interest rate increases from the Bank of England.

This week

- China may cut prime loan rates on Monday to support the property sector and try to shore up economic activity.

- Bank of Japan core CPI figures are due on Tuesday and this will feed through into interest rate and bond yield curve expectations.

- European Union Economic forecasts and flash PMI data are expected mid-week and will set the tone for the outlook for major economies such as Germany. Markets in Italy and France are closed on Tuesday for Assumption day.

- Quarterly earnings results for AI leader Nvidia will be released. The share price looks very frothy so it will be interesting to see these financials and whether a reality check is due.

- The week will round off with the Jackson Hole Economic Symposium where Federal Reserve Chairman, Jerome Powell’s speech will be scrutinised for clues of the direction US monetary policy will take.

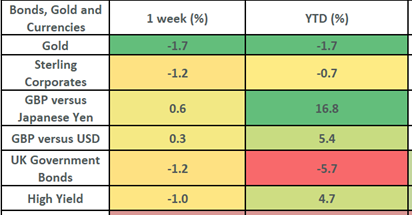

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- UK CPI inflation numbers were released on Wednesday, showing that year-on-year inflation figures fell to 6.8% in July. Crucially this was below the wage growth data released on Tuesday where basic wages, excluding bonuses, rose 7.8% on an annual basis. This can be interpreted two ways: on the one hand the fact wage growth is ahead of inflation means many will be better off and the cost of living crisis will ease for some. On the other hand, the wage growth number was the biggest jump since records began in 2001. UK unemployment has risen from 4% to 4.2%; showing interest rate increases have had some bite; but the employment market is still running fairly hot. All of which points to the possibility of further increases in interest rates.

- Unexpectedly strong US retail sales data, together with strong labour market data spooked US markets mid-week as fears of a resulting inflation uptick were priced in.

- Looking East: Asian stocks took a third week of losses. China unexpectedly lowered several key interest rates early in the week in a bid to jump start economic activity and provide support after a major trust fund defaulted on payments for a wealth management product linked to properties. China will possibly also cut prime loan rates on Monday. China is targeting 5% growth this year but a chorus of economists are warning this will not be achieved unless further support for the economy is announced.

- Evergrande filed for Chapter 15 bankruptcy protection in the US. This shields non-US companies undergoing restructurings from creditors that wish to sue them or seek to tie up assets in the US. While this is a typical step in the bankruptcy process it raised fears that other Chinese property developers would follow suit and default. There is also the sheer scale of Evergrande’s offshore debt to take into account: $31.7 billion. Evergrande is understood to be near the end of its restructuring process and is close to putting a proposal to creditors. We will continue to monitor how this plays out. It is important to understand that our carefully chosen Asia Pacific and emerging markets fund selections do not have exposure to the indebted Chinese property sector.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the particular investment objectives, financial situation or needs of any specific client, person, or entity.