Stock markets had a bit of a “re-set” last week after a really strong run. The downgrade in credit rating of US Government debt was the key catalyst and the noise around this drowned out some good earnings’ reports from US corporates. The other big news last week was the rate rise (14th consecutive one) to 5.25% from the Bank of England. This was in line with expectations and bond markets are now pricing just 1 or 2 more hikes from hereon. This week the spotlight shifts back to inflation, with US and Chinese numbers out on Wednesday which are likely to be the highlight of a quiet summer week.

Last week

- Stocks fell back after a very strong run

- The Bank of England raised rates to 5.25%

- Bond markets sold off a touch, with Sterling Credit markets holding up best

- US corporates continued to report earnings which were ahead of analyst expectations

This week

- US inflation is due out on Wednesday, it is currently running at 3% but is expected to tick up slightly this month on the back of rising energy prices

- Chinese inflation numbers are also due out on Wednesday

- UK growth numbers for the 2nd quarter are due out on Friday

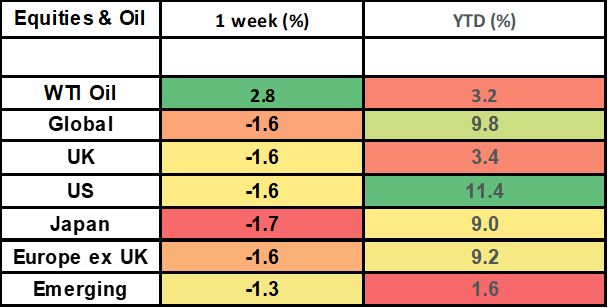

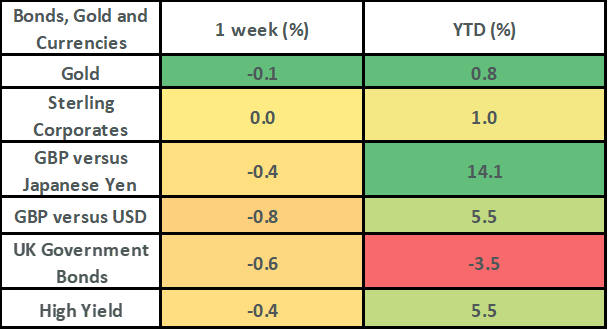

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Stock markets have taken a bit of a re-set after a very strong July and year-to-date. The key catalyst for the pull-back last week was the downgrade in credit rating of US Government debt. Whilst this is “headline grabbing”, it doesn’t represent any new information for markets and likely coincides with a pull-back in stock markets after a 10% rise since mid-March when the spotlight was on Silicon Valley Bank and Credit Suisse.

- Global stock markets fell on the week by 1.6% and pretty much all the major regional markets fell in line with this. Emerging market stocks were a bit “less bad”, falling by just 1.3% as the resurgence in Chinese stocks (up by 0.8% on the week) continued following the recent announcement (at the July Politburo meeting) that the authorities would shift to a more supportive stance on the economy.

- Within the UK market, it was the domestic shares which held up better; with the FTSE 250 index falling by 1%, in contrast to the FTSE 100 index which fell by 1.5%. This likely the reflects the improving outlook for domestic companies following a ratchet down in interest rate hike expectations on the back of the Bank of England’s meeting last week. Domino’s Pizza group was one of the brighter spots in the FTSE 250 index, rising by 15.7% on news that the company had raised earnings expectations reported strong sales growth.

- Corporate earnings season in the US is now 84% of the way through (as of Friday’s close) and the general tone has been decent, although the impact has been muted. Companies have reported an earnings decline in the 2nd quarter of 5.2%. Whilst a negative earnings number is never good (it’s on track for the largest quarterly earnings decline by the index since Q3 2020), it is better than the -7% decline that analysts’ had been forecasting before the reporting season started. The muted reaction in stock prices has come from the fact that valuations are pretty high (the US index trades on 19.2 times forward earnings) and certain big stocks in the index have already run very hard. A good example here would Tesla, which has fallen by 20% since its earnings numbers: the earnings were actually pretty good, but the stock was already up over 100% for the year and trades on 70 times earnings and the decent earnings numbers weren’t enough to offset some technical selling and profit taking.

- The US debt downgrade was the big news story from last week. Fitch (who are one of the big credit rating agencies) downgraded the US debt rating from AAA to AA+. This is big news as it’s only the 2nd time that US debt has been downgraded (the first time being in 2011 by Standard & Poors: a decision which has not been reversed). This reflects the fact that the US debt-to-GDP has jumped from 60% in 2008 to 118% today (it was 130% at the height of the pandemic in 2020). High debt burdens weigh on growth, but they are not new news, hence the announcement from Fitch is likely one of a number of catalysts causing markets to take a breather after a very strong recent run.

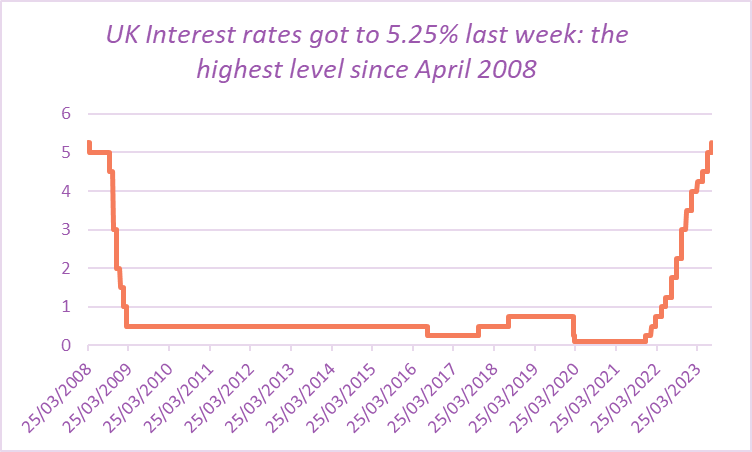

- The other big news last week was the interest rate rise from the Bank of England. UK interest rates are now at 5.25% following the 14th consecutive interest rate rise which takes them to their highest level since April 2008. The accompanying statement said that policy would be “sufficiently restrictive for sufficiently long to return inflation to the 2% target”. Bond markets are now pricing in just 1 to 2 more hikes from the BoE (significantly less than they were in May) following a drop down in inflation.

- Bond markets generally sold off last week, with bond yields rising as borrowing costs rose. UK investment grade bonds fared relatively better due to the improving outlook for UK corporates (i.e. borrowing costs are likely to be less high than was once feared in the future).

The Bank of England hiked interest rates last week for the 14th consecutive time: taking interest rates to 5.25%.

Source: Bloomberg

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the particular investment objectives, financial situation or needs of any specific client, person, or entity.