Global stock markets took a bit of a breather last week – falling back by 0.5% – but still remain up strongly for the month (up by 1.6% in June). The drop back last week was entirely due to the strength in the Pound which meant that overseas’ gains got translated back as losses. This minor pull-back didn’t thwart the Japanese stock market which continued its march higher and also Emerging market shares which picked up last week. This week is a big one for markets. We have Central Bank meetings in the US and the Eurozone and inflation numbers out of these 2 regions. Stock markets will be looking for signs that the US (in particular) is nearing a pause in its hiking cycle.

Last week

- Global stock markets fell back, due to the strength in the Pound

- Japanese stocks continued their march higher

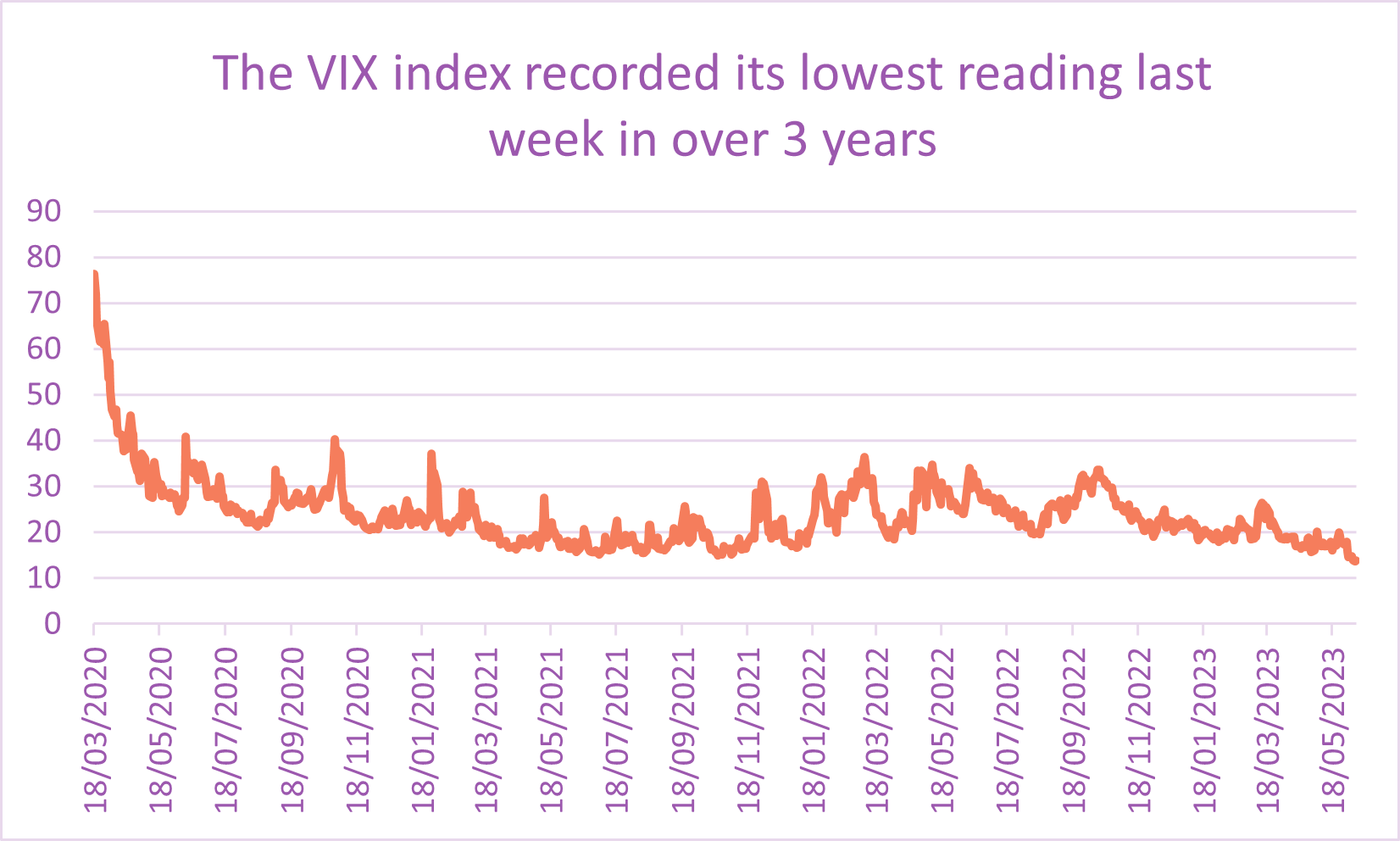

- The VIX index (often referred to as the fear gauge) came in at its lowest level in over 3 years

- Bond markets were mixed ahead of the Central Bank meetings in the US and Eurozone coming up this week

This week

- There are some key events this week, with the focus on inflation and interest rates

- US inflation data (CPI) is out on Tuesday. It is currently running at 4.9% and is expected (by surveyed economists on Bloomberg) to fall to 4.1%

- The US Federal Reserve conclude their meeting on Wednesday night. They are expected to hold interest rates steady at 5.25%

- The European Central Bank meet on Thursday. They are expected to hike interest rates to 3.5%. Inflation readings for the Eurozone are due out on Friday

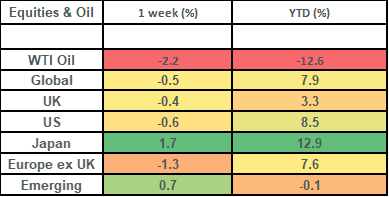

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets fell by about 0.5% last week, which was driven by the strength in the Pound. The Pound rose by about 1% vs the US Dollar over the week, to close out Friday at a level of 1.26 GBPUSD. This meant that gains in the US market (which makes up nearly 70% of the global index) were translated back as negative returns once currency had been accounted for. Last week actually saw the US stock market enter bull market territory in Dollar terms; it is up more than 20% from its mid-October lows.

- Japanese stocks rose by 1.7% on the week which saw them reach fresh 33-year highs! Enthusiasm towards the market was boosted by an upward revision to Japan’s first quarter economic growth. This follows recent positive enhancements around corporate governance (with the Tokyo Stock Exchange actively encouraging lowly valued companies to improve their returns to shareholders) and positive press around Warren Buffett having bought sizeable stakes in 5 of the big trading houses in Japan.

- Emerging market shares picked up last week – providing a nice foil to global stock markets. Gains were powered by the Brazilian stock market which rose by 4.8% on the week, taking gains for the month to just over 11%.

- The VIX index (often referred to as the fear gauge) fell to its lowest level in over 3 years (since the 2020 covid pandemic). This shows the relative calm that has returned to stock markets now that the US debt ceiling is in the rear-view mirror.

- The bond markets were mixed last week. Government bonds sold off (as yields pushed higher), whilst higher yielding bonds posted positive returns (as credit spreads contracted on increased confidence in the outlook). UK gilts fell by about 0.3% on the week (to take returns for the year to -3.1%). This saw UK 10-year yields close out the week with a yield of 4.2%. High Yield markets had a good week, rising by 0.65%. These markets benefited from a tightening in credit spreads.

The VIX index (often referred to as the “fear gauge”) recorded its lowest reading in over 3 years last week.

Source: Bloomberg

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the particular investment objectives, financial situation or needs of any specific client, person, or entity.