Last week saw global stock markets round off the month of May (where they rose by 0.7%) and bounce hard into June, with a 2% rise on Friday. Markets took relief from the resolution of the US debt ceiling and also some encouraging US jobs data. With the debt ceiling now in the rear view mirror, attention will now turn to the next US inflation numbers (13th June) and the next decision on interest rates (14th June), with the bond markets currently pricing in no change to US interest rates; i.e. that they remain steady at 5.25%.

Last week

- Global stock markets rose, with most of the gains coming on Friday

- UK stock markets lagged but still posted positive numbers (just!)

- The US debt ceiling agreement was signed into law by President Joe Biden

- US jobs data was mixed: signs of a strong labour market but also that higher interest rates were doing their job (unemployment ticked up)

- Government bond markets posted good gains last week

This week

- It is a very quiet week in terms of scheduled data!

- Tuesday sees retail sales data being released for the Eurozone and construction PMI data for the UK.

- Friday sees the release of Chinese inflation data

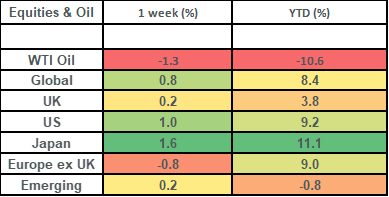

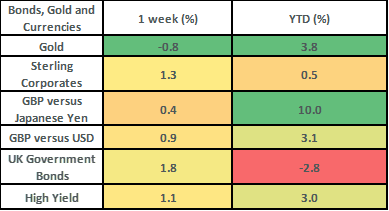

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets rose by about 0.8% last week. US and Japanese markets helped to drive gains, with the Japanese stock market rising by 1.6% for the week to take gains for the year to 11.1%. Ultra-low interest rates in Japan combined with easing travel restrictions have helped boost tourism and investment in Japan. Investor sentiment has been buoyed by news that Warren Buffet has invested in the country’s leading trading groups.

- The UK FTSE All Share posted very modest gains (of 0.16% last week), which was due entirely to the 1.6% bounce that it enjoyed on Friday. Friday’s bounce (which came in the afternoon post the US jobs numbers), saw the big mining and materials firms in the UK index perform very strongly, with firms like Rio Tinto up by 3.8% on the day and Anglo American up by 5.2% on the day.

- Friday saw US President Joe Biden sign the debt ceiling agreement into law. This was after it had passed through the House of Representatives on Wednesday and the Senate on Thursday. Although it had caused markets much consternation in the run up to its agreement, the signing of it didn’t really impact market movement too much.

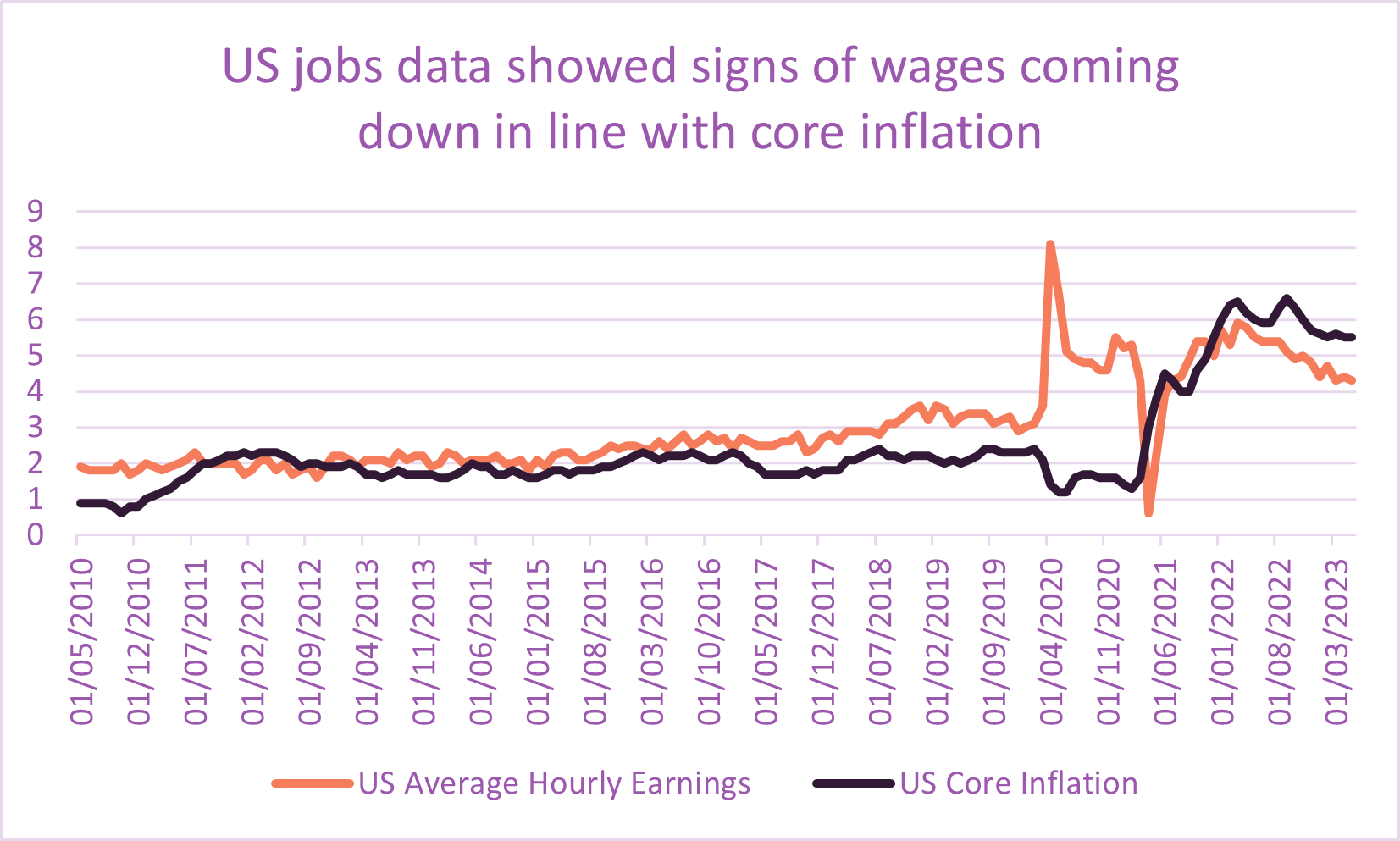

- The key push higher for markets last week came after the US jobs data on Friday lunchtime, which contained signs that the labour market might be cooling (and that higher interest rates are doing their job!). In particular, the unemployment rate rose to 3.7% (from 3.4%) and wages grew at 4.3% in May (less than in April and less than had been expected by Bloomberg economists). Both of these numbers were less than had been expected and this gave the stock markets confidence that the Federal Reserve would not need to keep hiking interest rates. Although 4.3% is still a big gain for wages, it is the slowest pace since June 2021 and hence spurred confidence. The other elements of the jobs data were very strong, with 339,000 new jobs shown to have been created in May (vs forecasts of 195,000).

- Government bond markets did well last week. The UK gilt market rose by about 1.8% and US Treasuries rose by 0.7%. UK 10-year gilt yields closed out the week at 4.15%. Government bond markets responded well to slowing economic data (such as Eurozone inflation which came in lower than expected and US and Chinese manufacturing PMI numbers which came in less than expected), which led them to price in less interest rate rises. Credit markets also got a boost too (following Friday’s rally), with UK investment grade bonds up 1.3% on the week.

US jobs data gave markets a boost on Friday as it evidenced that rate hikes are working! Wage inflation showed signs of coming down, along with core inflation..

Source: Bloomberg

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the particular investment objectives, financial situation or needs of any specific client, person, or entity.