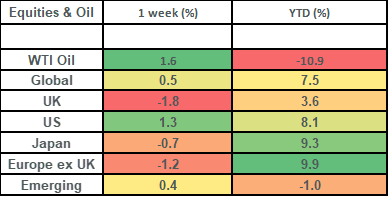

Global stock markets rose last week due largely to the US stock market and, in particular, the technology sector. Positive US markets helped to offset what was a pretty negative week for the UK, with both UK stocks and bonds coming under pressure due to inflation data which came in a lot higher than expected. It is pretty quiet this week. Markets should take some relief from there having been some progress over the weekend around the US debt ceiling and keen to see that progress through both houses in the US.

Last week

- Global stock markets rose (thanks largely to US technology companies: Nvidia in particular)

- UK stocks came under pressure in the face of higher-than-expected inflation

- Higher than expected UK inflation led to more rate hikes by the Bank of England being priced in by markets

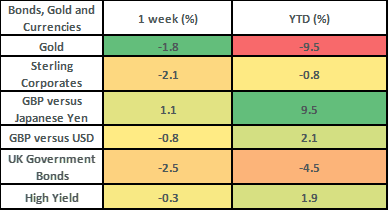

- The bond markets sold off, with UK Government bonds being hardest hit (on the back of higher interest rates being priced in)

- Finally(!), there was some progress around the US debt ceiling

This week

- The debt ceiling is likely to feature high this week, with a deal having been agreed between Biden and Republican House Speaker McCarthy over the weekend. It now has to pass through both houses by the June 5th

- The US also takes centre stage this week with jobs data (non farm payrolls) on Friday. Bloomberg economists are expecting to see 190,000 new jobs having been created in May.

- Alongside this, we have key economic survey data (PMIs) over the course of the week (the UK data is out on Thursday) as well as Eurozone inflation: due out on Friday.

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets rose by about 0.5% last week. This rise was due to the strength of the US market and in particular the technology sector, with Nvidia rising by 26% on the week (after its sales forecast came in 50% ahead of Wall Street estimates), which took returns to the year to 161%. Nvidia now has a market capitalization of $961m USD and is the 6th most highly valued public company in the world. This helped drive gains of 1.35% for the week in the US stock market which powered returns in global stock markets (owing to the US being a 68% weight in the index) even in the face of declining returns for pretty much every other region within the index.

- The UK stock market came under pressure last week due to the prospect of further interest rate hikes which got priced in off the back of a much higher than expected inflation number (more on that below). The FTSE All Share fell by 1.75% on the week, with domestic shares struggling the most; the FTSE 250 index fell by 2.5%, whilst the FTSE 100 index was down by just 1.6%.

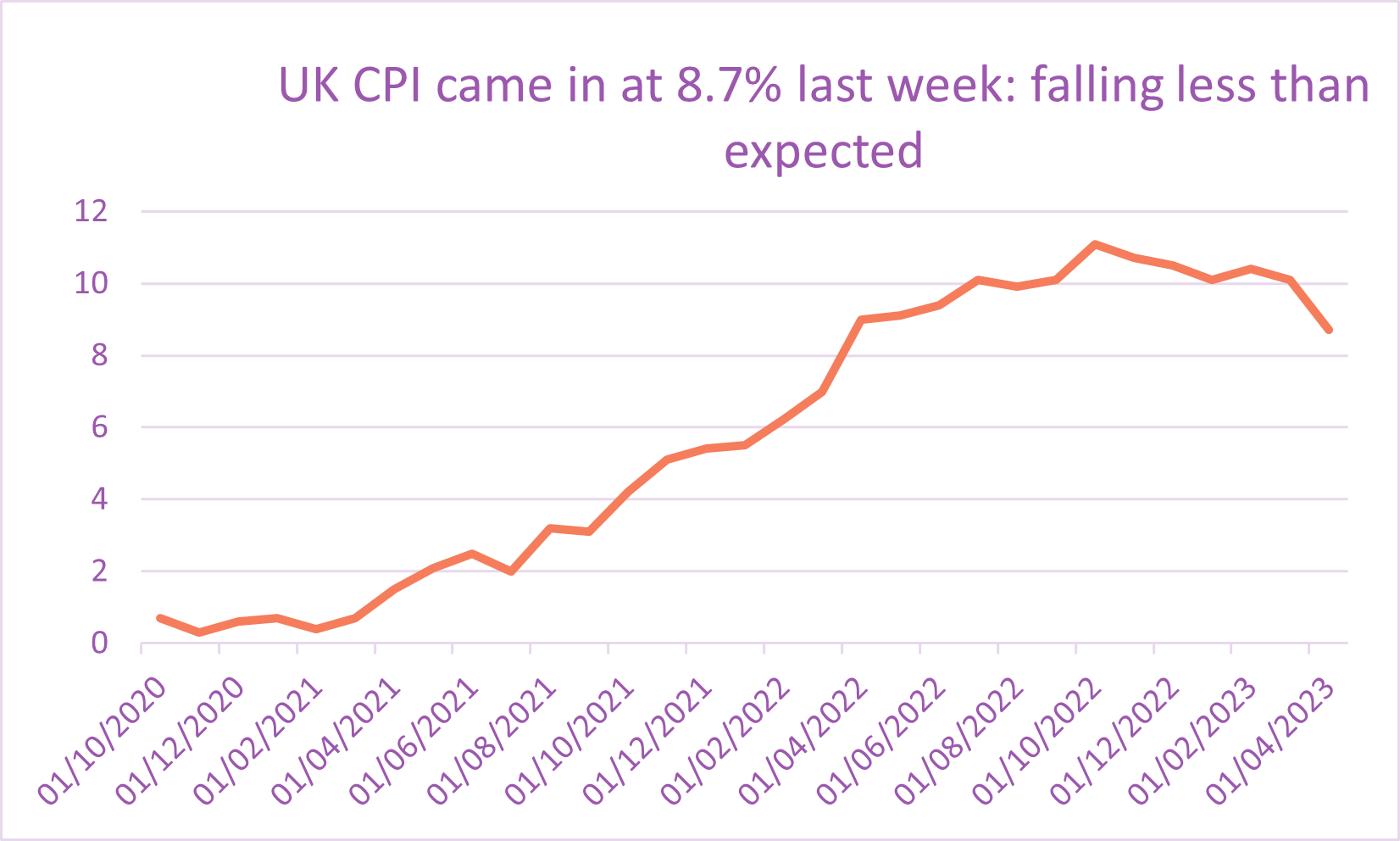

- UK CPI inflation came in last week at 8.7%. This was lower than the previous level of 10.1%. Sadly, that’s about the only positive we can say about the reading! It was a lot higher than the 8.2% number that had been expected by surveyed economists on Bloomberg and showed signs of stickiness, with food inflation continuing to run at 19% and services (driven by Restaurant prices) inflation continuing to run higher than expected. This month’s inflation print was always going to see the headline figure drop down (from 10.1%) due to the energy price spike of last year falling out of the 12-month series. However, the fact that most other components of the series continued to ride high made for higher interest rates in the UK being priced in. For instance, “core” inflation (which excludes food and energy) rose to a 21 year high of 6.8% from 6.2%; this was what really drove the bond markets into pricing more rate hikes.

- The higher-than-expected UK inflation number caused the UK bond market to sell-off as more rate hikes were priced in. Interest rates in the UK are currently 4.5%. At the start of last week, the bond markets were pricing in just 2 more rate hikes (i.e. a terminal rate of 5%). By the end of the week, they were pricing in a further 4 rate hikes, i.e. a terminal rate of 5.5%.

- UK government bond markets bore the brunt of the sell-off last week as bond yields rose to reflect the higher future interest rates being priced in. The UK 10-year bond yield closed out the week with a yield of 4.3%; this is back towards the highs that they reached in September last year, with the 10-year yield peaking at 4.5% post the Kwasi Kwarteng “mini” budget. This saw the UK government bond market sell off by 2.5% on the week, with the UK credit market selling off by 2.1%. US Treasury bonds were a little better, but still fell on the week; down by 0.7% as concerns around the US debt ceiling continued.

UK inflation fell less than expected last week, with services (like restaurants) and food prices remaining higher than expected

Source: Bloomberg

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the particular investment objectives, financial situation or needs of any specific client, person, or entity.