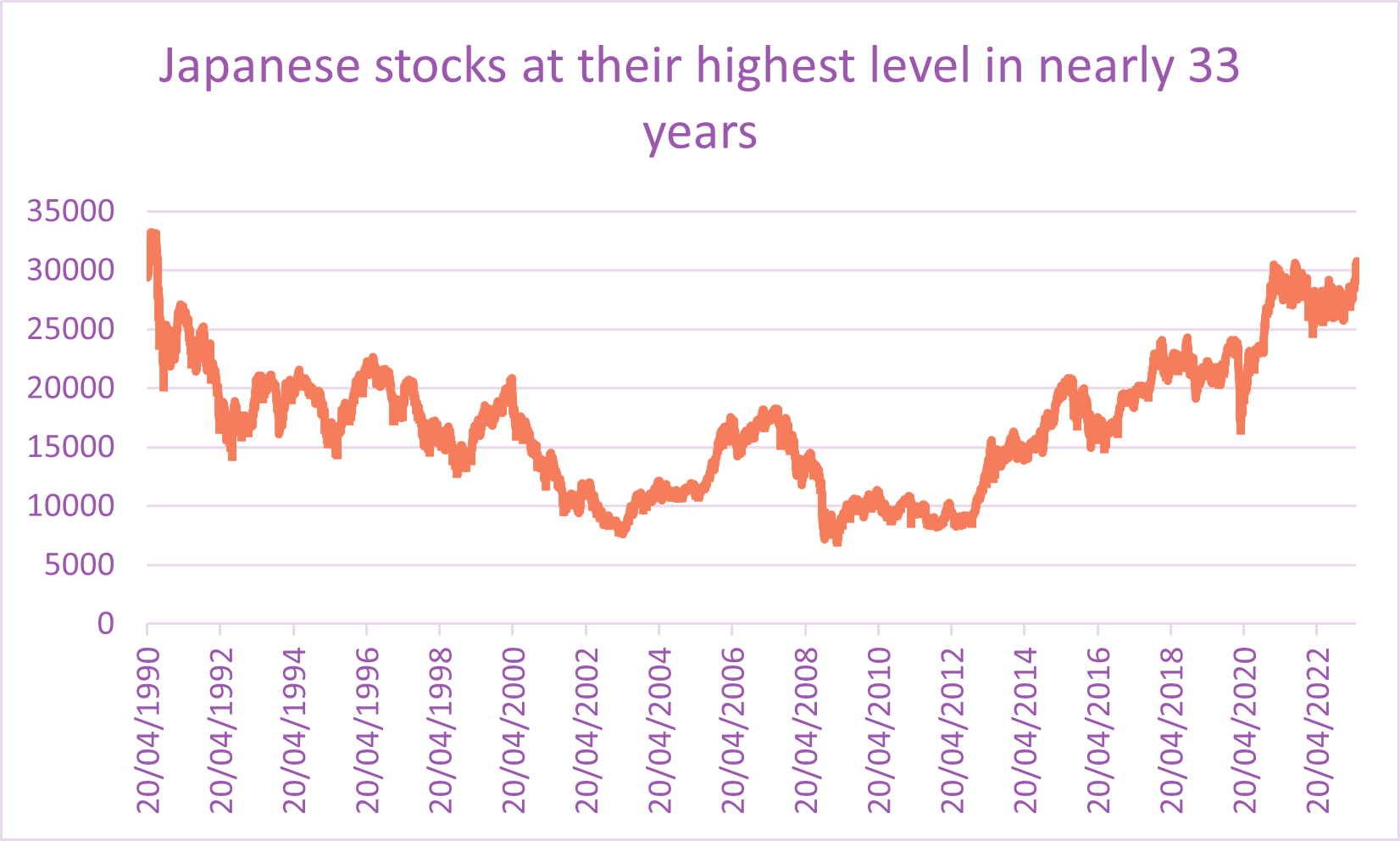

Global stock markets rose again last week, with the US and Japanese markets driving gains. This has followed a really strong run for Japanese shares which has seen them get to their highest level in almost 33 years! The key area of focus for this week is likely to be around the US debt ceiling, with meeting scheduled for this week. Alongside this, there are key inflation numbers from the UK (Wednesday) and the US (Friday) and also the earnings report of Nvidia; which will be closely watched given all the excitement around artificial intelligence.

Last week

- Stock markets had another good week (thanks to the big stocks in the US market)

- Japanese stocks continued their strong recent-run

- Bonds pulled back as data suggested rates might need to stay higher for longer

- Concerns about the US debt ceiling were eased by positive comments from President Biden

This week

- UK inflation data is out on Wednesday. It is expected that the rate will drop to 8.2% from the current level of 10.1%.

- Retail sales data for the UK is out on Friday.

- Tuesday sees the release of key global survey data (PMIs) and Friday sees the release of US Personal Consumption Expenditure (PCE) data which is the Federal Reserve’s preferred gauge of inflation. Also, Nvidia reports its earnings this Wednesday.

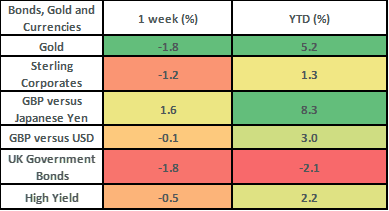

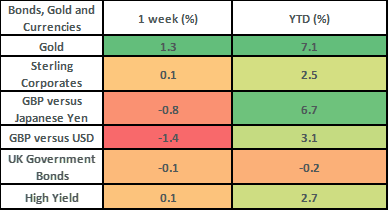

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global stock markets rose by about 1.2% last week, which saw the global market push back up towards the highs it reached in early February this year. The US stock market (given its 68% weight in the index) drove the bulk of the returns, but it was Japan (just a 6% weight in the global index) that was the best performing region. The Japanese stock market rose by 3.1% on the week and is now up over 6% so far this month. The Japanese stock market is now at the highest level it has been at since summer 1990 but is still a good way below the peak it reached in December 1989 (a period over which global stock markets have risen by over 5 times!).

- Technology and Banks were the 2 best performing sectors last week in the global stock market. Tech shares continued to rise on the excitement about Artificial Intelligence, with Nvidia up by 10.2% last week and Alphabet (Google’s parent) and Meta (Facebook’s parent) both up over 4%. Within the banking sector, it was the regional banks which did best. Generally, there seemed to be something of a “relief rally” in the markets as concerns about the debt ceiling abated (more on that below).

- The UK stock market took a back seat last week, with the FTSE All Share up just 0.25%. Within the UK market, it was the smaller, more domestic shares which did best, with the FTSE 250 up by 0.6% on the week. It was a mixed week for UK economic data. The unemployment rate came in a touch higher than expected at 3.9% (vs expectations of 3.8%) and average weekly earnings grew at 5.8%. This data caused the UK bond market to price in one further interest rate hike to the UK market, which came on the back of a speech by Bank of England Governor Andrew Bailey which said that policymakers “still judged the risks to inflation to be skewed significantly to the upside”. This makes this week’s inflation number (due out on Wednesday) one to watch closely. We would expect it to fall back from the current level of 10.1% to just over 8% as there is a large number (2.5%) in the 12-month series that falls out over this period.

- UK government bonds fell by 1.8% on the week (on the back of higher UK interest rates being priced in), whilst US Treasuries fell by 1.4%. All areas of the bond markets were under-water last week (as bond yields rose), but credit markets held up relatively better, with high yield markets down by about 0.5% (they are shorter-dated and less driven by movements in bond yields) and investment grade credit (as per the UK index) down by about 1.2%.

- Although inflation data is the big driver of UK markets at the moment, the US debt ceiling has been the big driver of global markets over the course of the last few weeks. Sentiment around this improved last week, with President Biden saying he was confident that there would be no default. This has come to the front of mind for markets of late, following comments from Treasury Secretary Janet Yellen (a former Federal Reserve Chair) where she warned that the deadline could come as soon as 1st

- The other big news for markets last week involved US retail sales data. This is key since around 70% of US economic growth comes from personal consumption. Last week’s US retail sales report showed a slower pace of growth than expected (0.4% vs 0.8% expected). Picking through the detail, there was evidence that the consumer is becoming more discerning with their spending; focussing on buying what they need rather than what they want. This manifested in lower demand for discretionary goods such as sporting equipment and more demand for the basics, which was confirmed by some strong earnings numbers last week from some of the core retailers in the US such as Walmart and Home Depot.

The Japanese stock market recorded its 6th consecutive weekly gain and is now at the highest level in nearly 33 years…

Source: Bloomberg

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the particular investment objectives, financial situation or needs of any specific client, person, or entity.