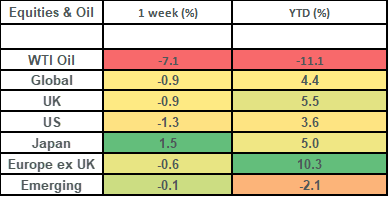

Global stock markets fell back last week, with the US market dragging the Global index lower. US shares continued to wrestle with concerns over regional banks, pressure from rising interest rates and worries about breaching their debt ceiling. UK shares also gave back some ground too last week, but are up a healthy 5.5% for the year-to-date still. The UK is very much in the focus this week, with the Bank of England meeting on Thursday (where they’re expected to hike rates to 4.5%) and growth data out on Friday. Alongside this, US inflation data (out tomorrow) will also be keenly watched.

Last week

- Stock markets fell last week with the US market dragging the most

- UK stocks slid back last week despite some decent numbers (and strong share price gains) from HSBC

- Interest rate rises weighed on stocks last week, with the US Federal Reserve, European Central Bank and Reserve Bank of Australia all raising rates

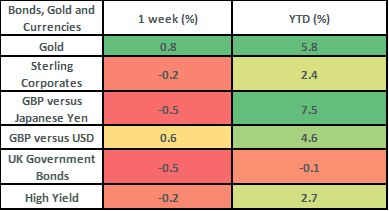

- Bond markets were mixed last week. UK government bonds gave up ground whilst US Treasury bonds rallied

This week

- The focus is on the UK this week, with the Bank of England meeting on Thursday. It is expected that they will hike interest rates by 0.25% to 4.5%

- UK first quarter economic growth numbers are out on Friday, with survey data (as per Bloomberg) expecting an expansion of 0.1% in the first quarter

- US inflation (CPI) data is out tomorrow. It is expected that CPI will remain steady at 5%

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Global equity markets fell by about 0.9% last week as cyclical sectors such as banks and energy dragged the market lower, whilst higher quality sectors such as healthcare provided some ballast. Looking across the regions, it was the US market which fared worst over the week, falling by about 1.3%. The US market was held back by ongoing concerns with its regional banks, a 10th consecutive rate rise from the US Federal Reserve and concerns about breaching their debt ceiling.

- Japanese markets were a bright spot, with the domestic stock market rising by about 1.5%. This was due in part to it only being open for the first 2 days of the week (due to the Golden Week national holidays), but the market has also been boosted by the Bank of Japan’s commitment to accommodative monetary policy and also the government’s more relaxed stance on Covid. The Japanese government have said that they will reclassify Covid to being on a par with seasonal flu from 8th May and have now dispensed with their covid border control measures.

- The UK FTSE All Share fell by 0.9% on the week, with energy shares lagging as the oil price dropped by about 7% on the week. HSBC (a 6% weighting in the UK FTSE 100 index) helped shore up returns (and offset the drag of the big energy names) as it rose by 4.5% on the back of some strong earnings numbers. HSBC’s earnings came in 28% greater than analysts had been expecting as they announced a $2bn share buyback program and restored their pre-covid dividend of 10 cents a share.

- US regional banks continued to be a concern for markets last week, following JP Morgan’s acquisition of First Republic Bank. PacWest Bancorp was the latest regional bank to be in the firing line after they announced last Wednesday that they were “reviewing strategic options”.

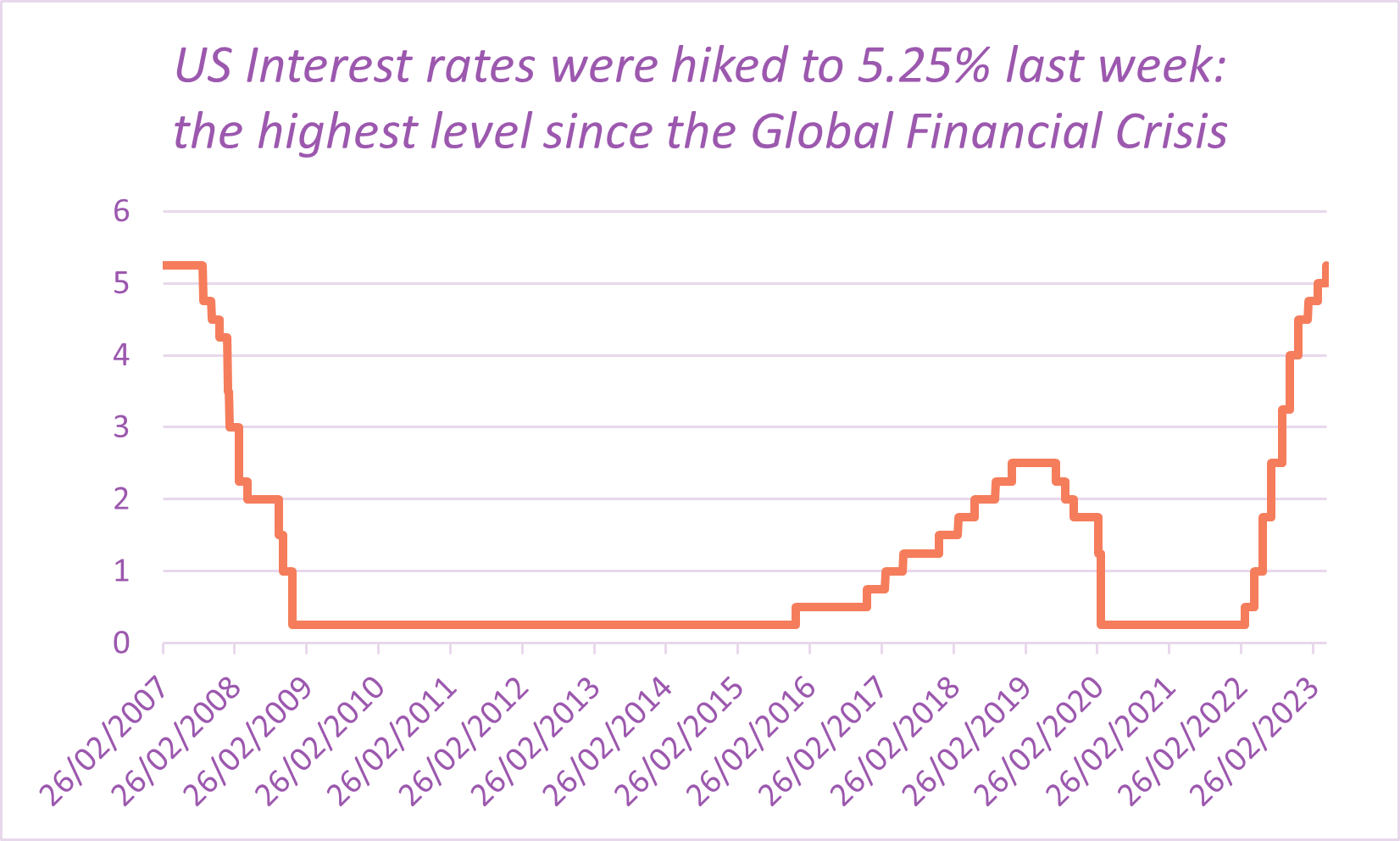

- Last week saw 3 major Central Banks hike interest rates, with the US Federal Reserve hiking rates (for the 10th consecutive time) to 5.25%, the European Central Bank hiking rates to 3.25% and the Reserve Bank of Australia hiking to 3.85%. Although Fed Chair Powell pushed back on the notion that rate cuts would be coming shortly (to stimulate growth), the market does not agree, with rate cuts being priced in (by the bond futures markets) as early as the September meeting.

- Concerns about the imminent need to raise the US debt ceiling rose last week, with US Treasury Secretary Janet Yellen notifying congressional leaders that the agency might not be able to meet its debt obligations “potentially as early as June 1”. Reaching the debt ceiling is not a new issue for the US government (it has been raised, extended, or revised 78 times since 1960) but it tends to bring choppiness to the markets as the date draws near, with rival parties lobbying policies and proposals in exchange for the assurance of their votes.

- Bond markets were mixed and choppy last week. UK government bonds sold off to the tune of 0.5% (as yields rose), whilst US treasury bonds rose modestly on the week as treasury yields fell. UK bond yields have risen a fair bit over the last few weeks, with the UK 10-year bond yield closing out last week at 3.78%. This rise higher in UK gilt yields has come with a strengthening of the UK currency as UK economic data has been a touch better than expected, with mortgage data in particular surprising to the upside (approvals for home purchases rose for a second consecutive month).

The US Federal Reserve hiked interest rates last week by 0.25%. This was the 10th consecutive interest rate hike.

Source: Bloomberg

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the particular investment objectives, financial situation or needs of any specific client, person, or entity.