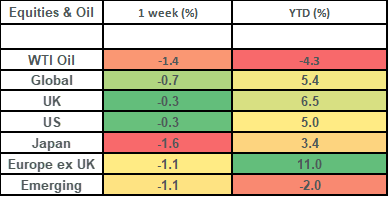

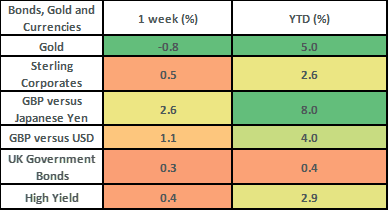

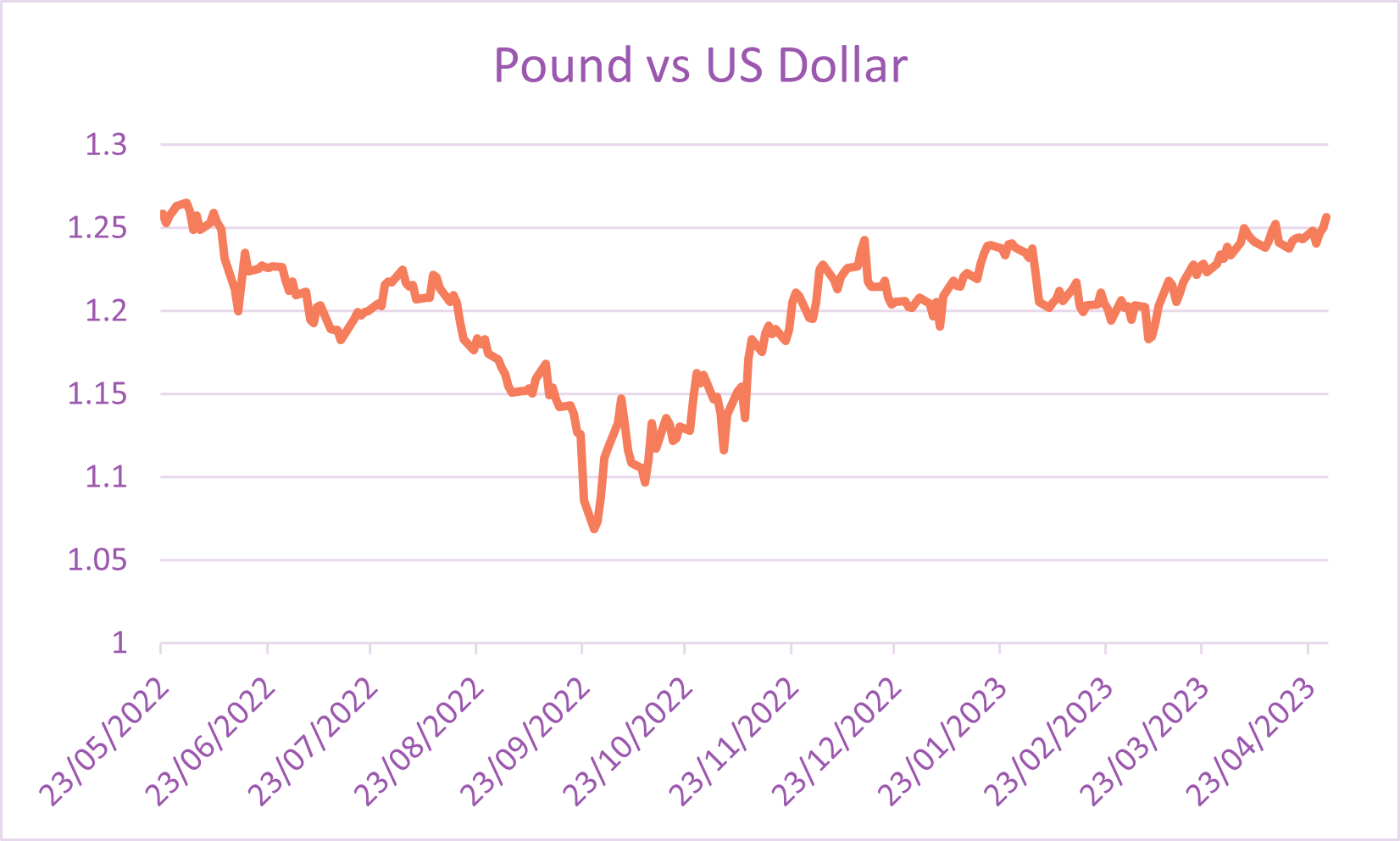

Global stock markets fell last week in GBP terms, which was driven by the strengh of the Pound. Global markets actually did OK in their own domestic currencies, but the key currencies (US Dollar and Japanese Yen) fell against the Pound which meant for returns being translated back as losses. The Pound strength was driven by some better-than-expected economic data (and the other currencies being generally weak!), which saw Sterling rally to its highest level vs the US Dollar since May last year. Corporate earnings were a mixed bag last week, with the general theme being fairly positive thanks to the big names in the index (notably Meta) doing much better than expected. This is another key week for corporate earnings, with Apple (the biggest company in the US S&P 500 index) reporting results. Alongside this, we have both the US and European Central Banks meeting, with both of them expected to raise interest rates by 0.25%.

Last week

- Global stock markets fell although this was largely due to Pound strength

- April saw stock markets flatline in Pound Sterling terms (as modest overseas gains were eroded by Pound strength)

- UK stocks dropped modestly last week but performed strongly in April

- Corporate results were mixed, with big tech doing well and cyclical companies struggling

- UK economic data was better than expected, whilst US data was on the weak side

This week

- It’s an action-packed short week!

- The US Federal Reserve meet on Wednesday night (where they’re expected to hike rates to 5.25%) and the European Central Bank meet on Thursday where they’re expected to hike rates to 3.25%

- It’s also a key week for corporate earnings. Tuesday sees results from BP and HSBC, Lloyds report on Wednesday and Shell and Apple publish their results on Thursday

- Friday sees the release of the much-watched US monthly jobs data (US non-farm payrolls) and also the release of business survey data (PMI) for the UK

Equity returns are in GBP, Oil is in USD. Gold is shown in GBP. Bond returns are all shown in GBP. Source Bloomberg.

Last week in more detail

- Last week saw global share markets (as measured by the FTSE World Index) fall by 0.7%. This fall was largely due to the strength of the Pound, which meant that overseas’ returns went from positive to negative when they were translated back to Pound Sterling. The Pound rose by 1.1% vs the US Dollar on the week (closing at 1.26) and by 2.6% vs the Japanese Yen.

- This was very much the theme for the month, with global stock markets finishing flat in GBP terms which was very much due to the Pound having risen by 1.9% vs the US Dollar and by 4.45% vs the Japanese Yen meaning that the positive returns of those markets were more than offset by the negative returns of their currencies.

- The UK market fell by 0.25% last week but was a strong performer over the month of April, rising by 3.35%; making it the best performer amongst the majors (when translated back into GBP). The UK market was boosted over the month by returns from companies such as Entain (+23.3%), Melrose (+18%) and also the big banks such as Barclays which rose by 16.6% on the month. Barclays followed the pattern of some of the big US banks (like JP Morgan and Citigroup) of reporting very strong corporate results. They reported last Thursday and came in with net profit numbers of £1.78 billion for the first quarter, with good growth coming from higher interest rates (net interest margin) and strong growth in their credit card division. This profit number was 19% higher than had been expected by analysts.

- Last week was a very busy week for corporate reporting in the US, with 35% of S&P 500 companies reporting results. Results were very mixed, with the mega-cap tech stocks generally doing very well and the more cyclical sectors performing poorly. Facebook parent Meta Platforms beat strongly on expected earnings (by 9.7%) and rose by 11.6% on the week. The big tech stocks have helped boost the blended earnings number for the first quarter to -3.7%. Whilst this is still negative, it is a lot better than the -6.7% that had been expected, with Amazon being the largest overall positive contributor (i.e., if we excluded Amazon, the “growth” number would drop from -3.7% to -5.1%).

- UK economic data showed some shards of light last week. The UK budget deficit grew to £139 billion in the year to March (5.5% of GDP) and although this is the highest level ever, it was smaller than had been forecast by the Office of Budget Responsibility and UK government borrowing came in below forecasts thanks to strong tax revenues. Further to this, a business confidence survey from Lloyds Bank said that business confidence rose to its highest level in more than a year, which helped boost Sterling (our currency) over the course of the week.

- US economic data was weaker last week, with the general tone being one of higher-than-expected inflation and a weaker underlying economy. This manifested in a core (excluding food and energy) PCE (Personal Consumption Expenditure) number which came in at 4.9% (vs expectations of 4.7%), a rise in retail inventories (i.e., consumers spending less than expected) and a lower than expected first quarter growth number (1.1% vs 1.9% expected).

- Bond markets responded positively to the weaker US economic data, with yields falling to reflect the reduced interest rate pressures. This saw US Treasuries rise by 0.9% on the week and UK Gilts rise by 0.3% on the week. UK Corporate bonds rose by 0.5%, benefiting from the double whammy of falling bond yields and slightly tighter credit spreads in the UK on account of the better-than-expected UK data.

A strong week for the Pound saw it claw its way back to its highest-level vs the US Dollar since May last year

Source: Bloomberg

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article should not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the particular investment objectives, financial situation or needs of any specific client, person, or entity.