Turning the corner – looking ahead to 2023

It’s January, so that means it is time for a brief re-cap of 2022 and a look ahead to what 2023 might bring. We’ve tried to break this out into “bite-sized” chunks so that the messages are easier to relay to your Clients. These messages will be further fleshed out with some more charts and data at the meeting next week.

The 2022 hangover

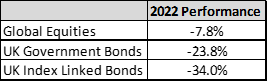

“Ukraine” grabs the mantle for most searched news item on Google in 2022, with “Queen Elizabeth passing” a close second. We’d borrow from our late Queen in describing 2022 as an “annus horribilis”, at least from the perspective of investment markets. 2022 saw bond markets have their worst year on record, equities have their worst year since the Global Financial Crisis (“GFC”) as inflation surged to a 40-year high, and interest rates reach their highest level since the GFC.

Global Equities as per the FTSE World Index, Total Return in GBP, UK Government Bonds as per FTSE Actuaries UK Conventional Gilts All Stocks Total Return Index in GBP, UK Index Linked bonds as per FTSE Actuaries UK Index Linked All Stocks in GBP.

The dawn of a New Year does not in itself allow us to bid goodbye to these issues, but it makes for a good time to pause and contemplate what lies ahead. 2023 likely brings more pain for the economy, but the good news for us as investors is that the stock market does not equal the economy! Investment markets are forward looking and have already priced in much of the pain that we are all dealing with today. Although very cautious on the outlook for the economy, we are very constructive on investment markets which will start to factor in a recovery long before it is reflected in everyday life.

Before we get too carried away with what lies ahead once we’ve “turned the corner”, it’s important to consider the key risks that caused investors to slam the breaks on in the first place. These are myriad but we’d summarise the key ones as:

3 key risks for ‘23

- Recessionary fears

- Rocketing inflation and rocketing interest rates

- China choking off global growth by pursuing a zero covid policy

We consider these key risks in the context of our investment framework which focuses on 3 key building blocks; the Business Cycle, Valuations and Investor Sentiment; “CVS” as we call it.

The Business Cycle considers economic growth, economic policy and corporate earnings. The slew of negative headlines and daily reminders (every time we check our electricity meters) of the cost-of-living crisis should be evidence enough that economic growth is not going gangbusters. However, the question for markets is not whether stalling growth triggers a global recession, but whether the recession that we’re expecting is deep or shallow.

“The Business Cycle”– Recession Risk: Low growth for sure, deep recession unlikely

Recession itself is already very much priced in by markets. Recessionary indicators – without getting overly technical – are all screaming recession. The scream becomes much louder and higher pitched as we move across the Atlantic to the Eurozone and is positively glass shattering as we get back to the UK.

The US, being the world’s biggest economy, is the one we should focus on and whilst recession seems more likely than not, it is also likely a shallow one; this is our base case. We foresee low and sluggish global growth this year: much more in keeping with the “Turbulent 20s” rather than the “Roaring 20s” that were much talked about as the covid cash piles were amassed. We’d note that the US consumer (who drives much of US and Global growth) is still spending and has the benefit of having refinanced their mortgages back in 2020 when rates were close to zero.

“The Business Cycle”– Inflation to come down with the US to lead

Similar to growth rates, the picture looks a lot more positive in the US than it does in the UK. US inflation likely peaked in June last year and should continue to fall back, with the bulk of the fall coming in the second half of the year. The UK is likely a year behind on that journey.

2024 is a crunch year. Whilst the US consumer might be protected from higher interest rates (through locking in their mortgages) the US corporate is not, with many having refinanced for 3- and 4-year periods back in the near zero-rate days of 2020. The situation is similar for UK corporates and less rosy for UK consumers, with 25% of consumer fixed rate mortgages coming up for renewal in 2024. In short, if rates aren’t coming down by 2024 then things begin to look very ugly!

“The Business Cycle”– Economic policy

Based on what we know today, we see the hard work of rate rises as being mainly done, with just 2 more expected in the US (i.e. a further 0.5% rise in interest rates) and 4 more in the UK (i.e. a further 1% of rate hikes). This would take interest rates to 5% in the US and 4.5% in the UK and allow them to cut rates towards the end of the year to ignite growth.

After a year of tight restrictions and a zero-covid policy that saw much of China in lockdown, signs are emerging of China “turning the corner” itself. We’ve seen credit growth start to accelerate and the last 2 months have seen an incremental shift and relaxation of the zero covid policy.

In essence, we see the worst being behind us as we assess these key risks. The question then turns to what has been priced in by corporates; both on the equity and the bond side and why we believe the investment regime has changed.

“The Business Cycle”– Corporate Earnings

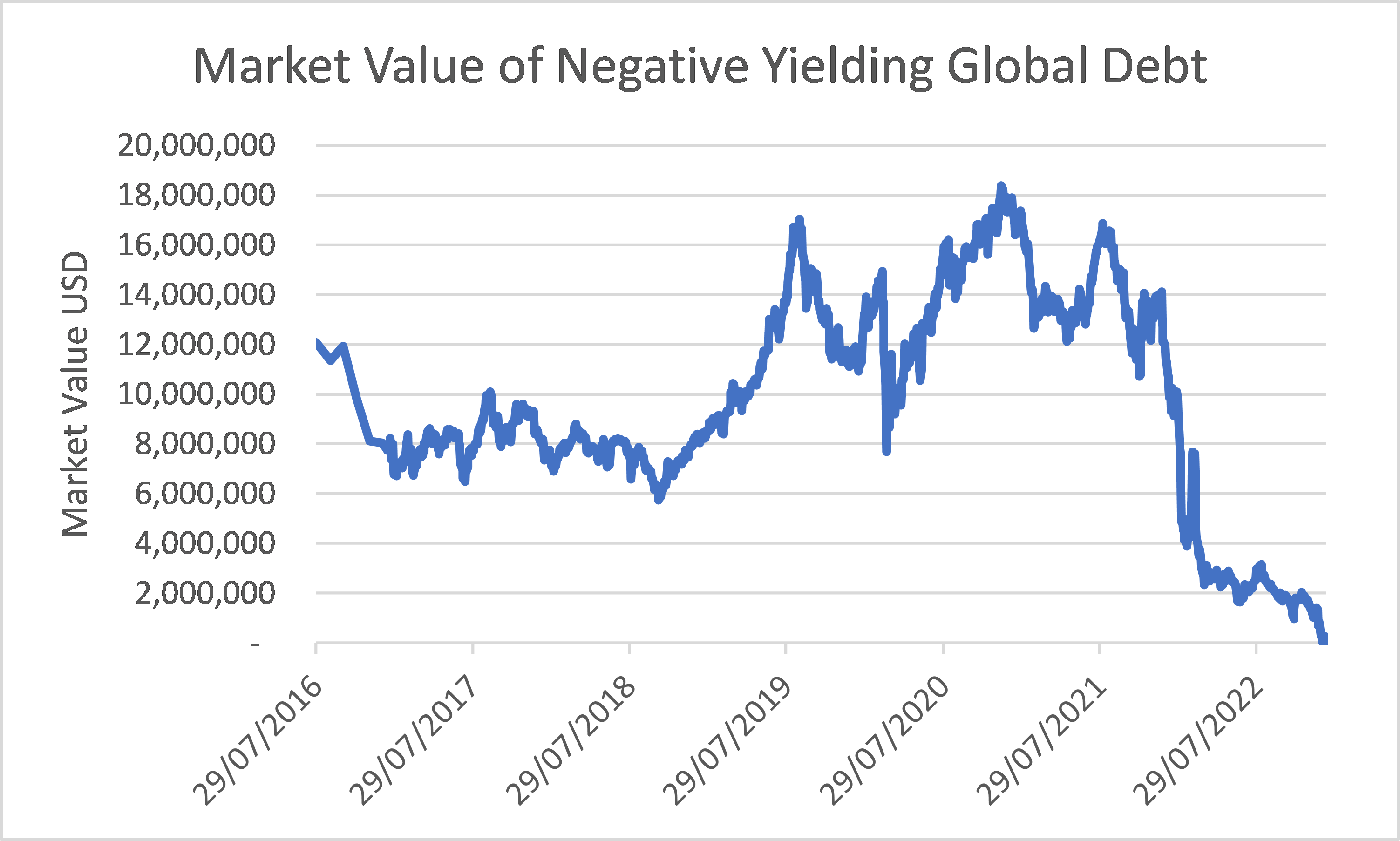

The previous decade, where interest rates began with a zero, represented a different regime for judging companies. The promise (or hope) of profits tomorrow was more richly rewarded than delivering cashflows today. This made sense in a world where companies could borrow for next to nothing and even be paid to borrow in some cases. This breathed life into the “growth” style of investing and allowed expensively valued companies to trade on very high multiples. This style of investing has fallen from grace, with high profile names such as Peloton, Zoom and Tesla all falling by over 60% last year. We expect the return of higher interest rates and structurally higher inflation to make the market much more discerning in judging a companies’ success and believe the outlook for corporate profits is vital.

Regime Change: the days of borrowing cheaply (or even being paid to borrow!) are behind us:

Why earnings matter? For 2023, global earnings are expected to grow at c3%, with US earnings expected to grow at c5%. We think both these expectations seem overly optimistic. We have question marks over companies’ ability to generate higher earnings in the face of rising wages and higher input costs, with a consumer that is not game to swallow big price increases. Our glass is not quite as full as the equity analysts’, and it is this caution that prevents us from being more “overweight” this asset class.

Valuations

Valuations within equity markets are much more attractive than they were a year ago, but the US market is still dear relative to other markets and its long-term history. Fortunately though, there are excellent pockets of value at a regional and sector level. We’d cite markets such as Asia and Japan where valuations are cheap, and the cycle is supportive and would also note the cheap valuation of our own domestic market in the UK. At a sector level, we are excited about the anticipated spend directed towards themes such as clean energy and infrastructure and would also note the attractiveness of healthcare which provides resilient earnings in a world of ageing populations.

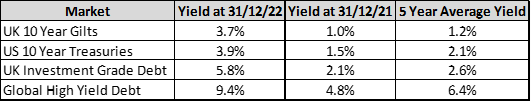

Goodbye TINA. TAPAS anyone?

The regime of low interest rates made bonds unappetizing. TINA (There Is No Alternative) was a popular refrain of market commentators in defence of investors piling into ever more expensive equities. TINA has long since departed and the first global bond bear market in over 70 years has left us with many alternatives to stocks. In fact, nowadays There Are Plenty of AlternativeS ; hence the new penchant for TAPAS!

Valuations in bond markets now look very attractive; notably in the Government and Corporate bond markets; those hardest hit in 2022. Having been shunned for much of the last decade, many of these investments now pay a yield over and above expected inflation and, in our view, are pricing in a more serious economic crisis than that priced by the equity market. We would note, the attractiveness of short-dated corporate debt where the yields (of circa 6%) are compelling and the credit quality top-rated.

UK and US 10 Year Yields are “Generic Government Yields” as per Bloomberg. UK Investment Grade Yields are as per the Bloomberg Sterling Aggregate Corporate Yield to Worst Index and Global High Yield Debt Yields are as per the Bloomberg Global High Yield Corporate Bond Index. Source: Bloomberg.

Sentiment

This brings us to the final leg of our framework, Investor Sentiment. We’ll save you from wading through our chart pack (available on demand for anyone struggling with sleepless nights) and simply say that investors are currently full of fear and bearishness. This creates excellent contrarian investment opportunities and is often where the best returns get made.

Conclusion

Events will happen and markets don’t fall neatly into calendar years. We can’t tell you what the next 12 months in markets will be like in much the same way as we can’t tell you what the most googled news item will be in 2023. We can however look at the path of policy and remind ourselves of the forward-looking nature of markets that we believe are “turning the corner”. Turning away from high inflation and low growth and peering towards lower inflation and higher growth. As for 2023’s top google news search, your guess is as good as mine. Personally, I’m hoping that “England Rugby World Cup Win” and “Magnus best new DFM” fight to the wire for a joint first!